The Indian rupee fell to a record low closing level against the dollar on Wednesday after the greenback surged as the latest economic data in the US trimmed expectations of a rate cut by the Federal Reserve.

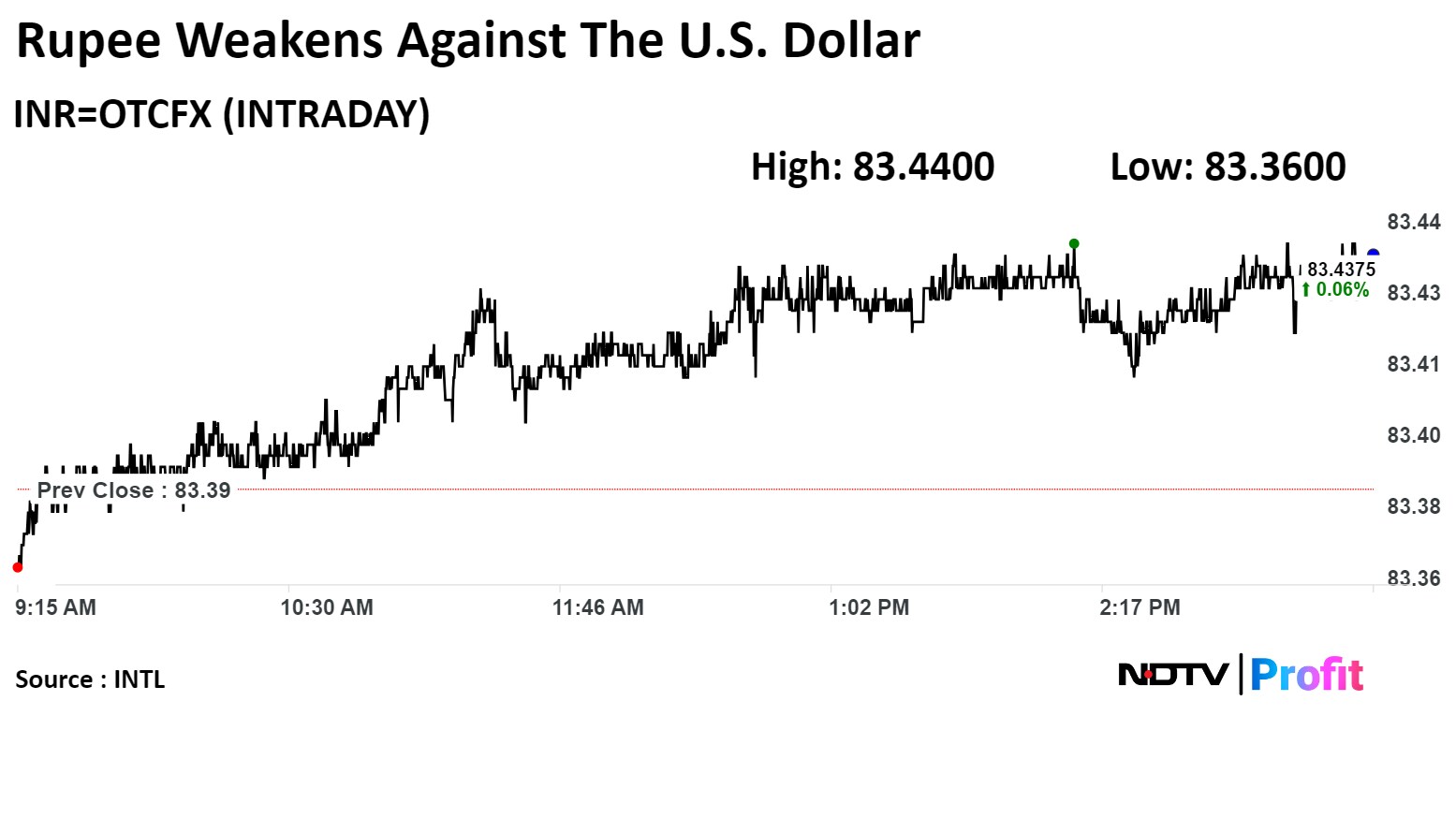

The local currency weakened five paise to close at Rs 83.43 against the US dollar. It had opened at Rs 83.37, according to Bloomberg data.

The rupee had closed at Rs 83.38 a dollar on Tuesday. On a year-to-date basis, it has depreciated 0.14%.

The rupee tracked a decline in the emerging market currencies amid a weakening of the yuan.

The dollar index retreated from close to a four-month high as markets assessed a rebound in factory orders and slightly stronger-than-expected employment data.

New orders for US manufactured goods rose 1.4% after a drop of 3.8% previously. The US job openings increased by 8,000 to 8.76 million in February against expectations of 8.75 million.

The markets also await Fed Chair Jerome Powell's remarks later in the day.

On March 22, the rupee had plunged in offshore trade against the US dollar on account of increased demand for dollars by corporates to make payments at the end of the financial year, according to currency traders.

"This weakening was attributed to the strength of the dollar index and higher crude oil prices, both of which pressured the rupee," Jateen Trivedi, research analyst at LKP Securities, said. "Market focus is now on Friday's RBI policy, particularly after the decision to maintain currency norms as a hedging tool only on exchanges."

The comments from the RBI will be closely monitored for insights into its stance on this regulation and its potential impact on market participation. The rupee's range is anticipated to remain between 83.30 and 83.55, according to Trivedi.

Despite the recent challenges encountered by the rupee at the end of previous financial year, the overall outlook appears promising, according to Amit Pabari, managing director at CR Forex Advisors.

Bolstered by robust fundamentals, impressive PMI figures and a surge in foreign investment, coupled with the narrowing of the current account deficit, there are clear signs of the rupee gradually gaining strength. Short-term projections suggest a potential for the rupee to reach levels of approximately 82.80 against the dollar, with long-term expectations hovering around 82.50–82.20, according to Pabari.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.