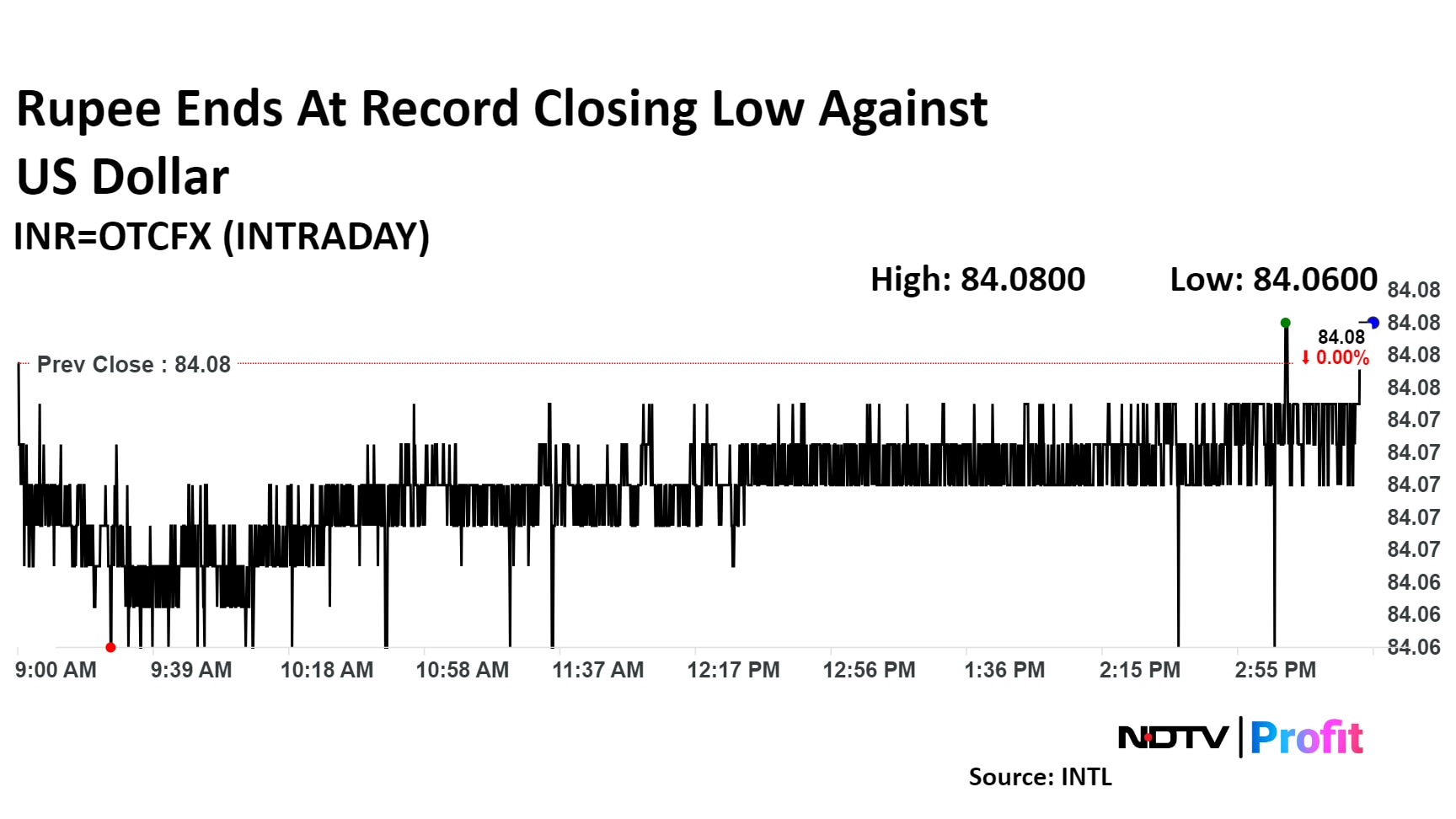

The Indian rupee closed at a record closing low against the US dollar on Wednesday as the greenback strengthened globally.

The local currency ended at Rs 84.082 as compared to the previous day's close of Rs 84.076. Intraday, it weakened to an all-time low of Rs 84.085.

The rupee faced strong resistance in the range of 84.10–84.20, with a potential to drift toward the 83.80 level, according to Amit Pabari, managing director of CR Forex Advisors.

The currency market is likely to remain jittery over US presidential elections and the Federal Reserve's rate cut path ahead.

The US dollar index, which measures the strength of the greenback against a basket of six currencies, advanced 0.27% to 104.36, while the US 10-year bond yields moved 2 basis points higher to 4.23%.

"The rupee's potential for appreciation appears modest, though the dollar Index is expected to ease from its recent highs," Pabari said. In the medium term, the dollar index is anticipated to decline to the 100–102 range, as the Fed is expected to reduce rates by another 100 basis points in 2025.

This scenario limits the rupee's potential for depreciation, particularly as the Reserve Bank of India actively manages its value around the 84.10 mark. As a result, the local currency is likely to remain range-bound in the near term, he said.

Brent crude oil declined 1% to $75.17 after data showed a bigger-than-expected draw in American stockpiles, even as worries about Middle East supply persisted, Bloomberg reported.

The dollar has been riding on several bullish factors, such as higher yields, safe haven flows, geopolitical tensions and resilient economy, according to Anil Bhansali, executive director of Finrex Treasury Advisors LLP. "The range for the dollar tomorrow could be the same 83.90 to 84.15. Importers need to keep the stop loss of 84.10 for unhedged near-term positions," he said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.