Shares of The Indian Hotels Co. have surged nearly 6% after its first-quarter profit rose 10%, beating analysts' estimates. This prompted Emkay Global to initiate coverage on the stock with an 'add' and a target price of Rs 615 apiece, implying a potential upside of 6.4% from the previous close.

The hotel group, which operates the Taj brand, reported a net profit of Rs 260 crore in the June quarter, according to an exchange filing on Friday. Bloomberg analysts estimated a profit of Rs 255 crore.

The new business vertical, which includes Ginger, Qmin, and amã Stays & Trails, generated Rs 162 crore in revenue, up 37% from the previous year. The Reimagined Businesses of TajSATS and The Chambers (membership fee) recorded a revenue of Rs 274 crore, up 17% from the previous year. Management fee income amounted to Rs 114 crore, representing 17% growth over the previous year.

Emkay Initiates Coverage On Indian Hotels

Initiates coverage on the Indian Hotels Co. with 'add' rating and a target price of Rs 615 apiece, implying a potential upside of 6.4% from the previous close.

Slower revenue growth than previous quarters due to multiple headwinds.

Management maintains double-digit revenue growth in FY25 despite a weak start.

Cuts FY25/26 Ebitda by 0-3% factoring in Q1 performance.

Believes valuations are rich which limits upside.

Nuvama On Indian Hotels

Maintains a 'hold' rating on the stock and a target price of Rs 568 apiece, implying a potential downside of 1.7% from the previous close.

Elections and extreme heatwave led to weak revenue growth in Q1.

Management sees 20% growth in the first 17 days of July.

Expects second quarter of FY25 likely to surpass the first by a fair distance.

Revised revenue estimates for FY25E/26E by 12%/20%.

Believes valuations remain rich with strong growth priced in.

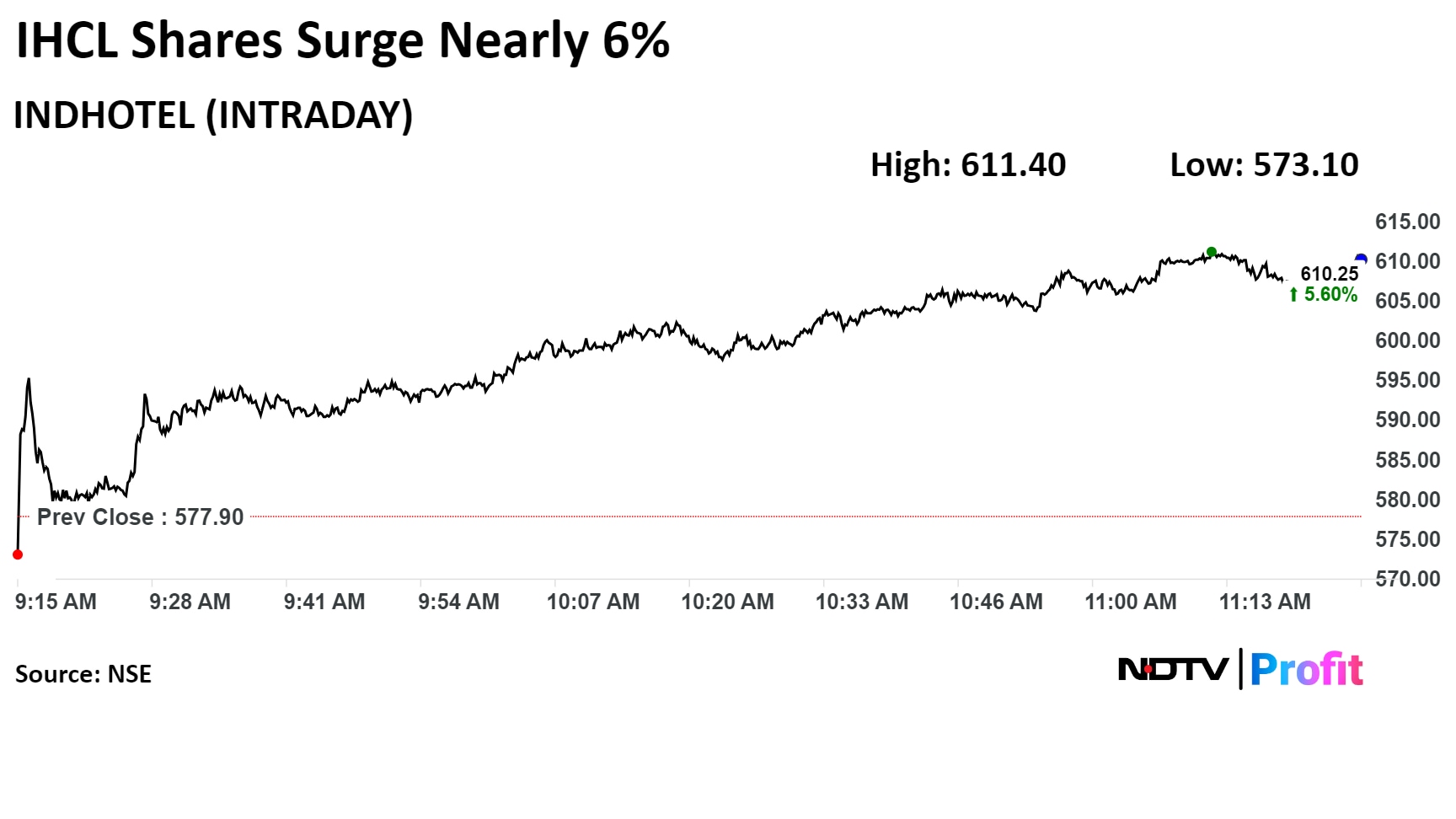

Shares of The Indian Hotels Co. rose as much as 5.68% during the day to Rs 610.75 apiece on the NSE. It was trading 5.09% higher at Rs 607.50 apiece, compared to a 0.03% decline in the benchmark NSE Nifty 50 as of 11:24 a.m.

The stock has risen 55.73% in the last 12 months and 39.3% on a year-to-date basis. The relative strength index was at 54.21.

Eleven out of the 19 analysts tracking The Indian Hotels Co. Ltd. have a 'buy' rating on the stock, five recommend a 'hold' and three suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 1.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.