Indian markets lost steam after posting a record winning streak on valuation concerns, while global stocks were traded cautiously ahead of payroll data in the US.

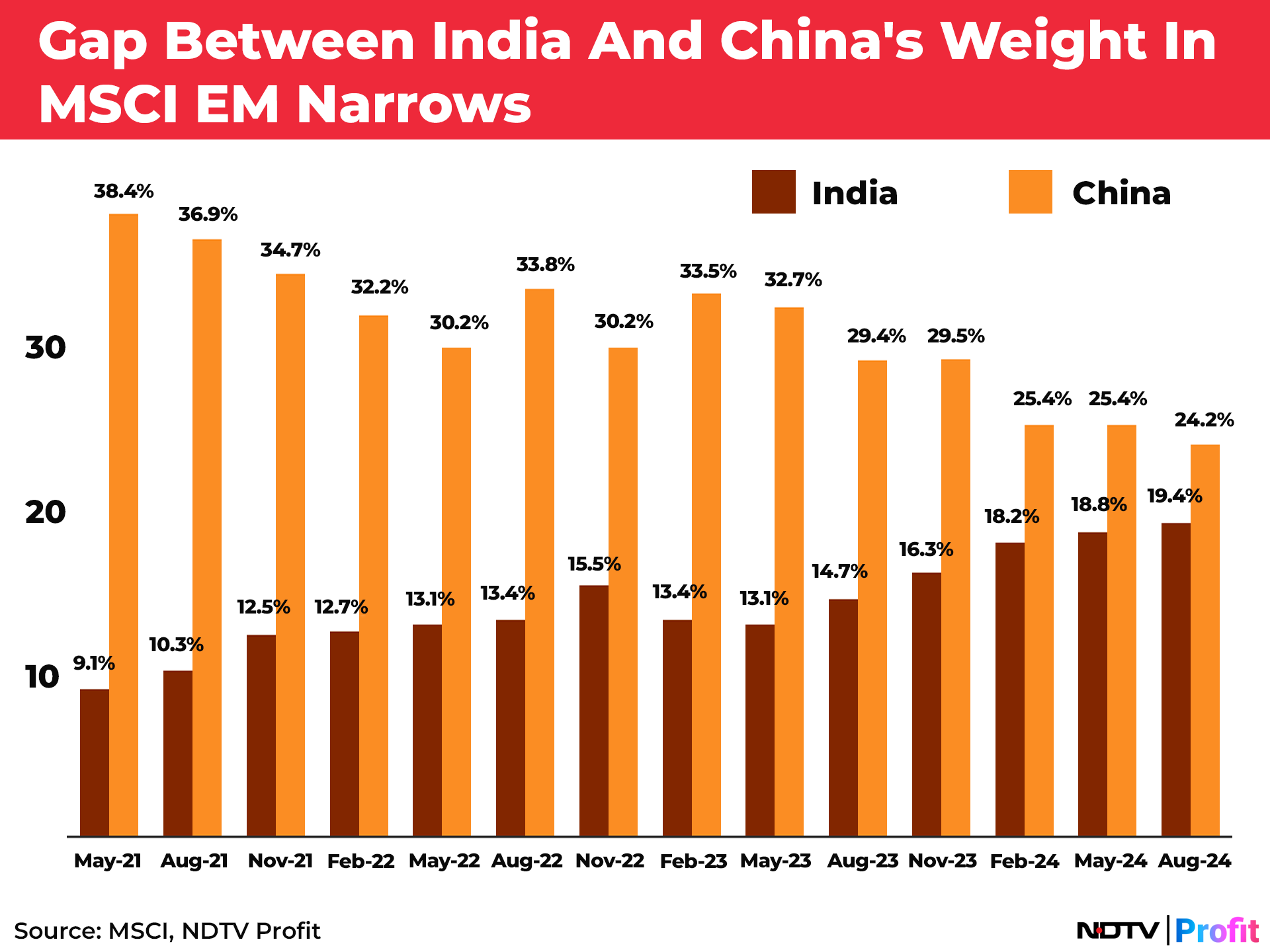

On a positive note, India overtook rival China to become the largest weighting in the MSCI EM investable market index this week.

The Indian government approved 10 capital acquisition proposals amounting to Rs 1.44 lakh crore spread across the Army and Coast Guard. The State Bank of India will focus on improving customer service and engaging with depositors rather than raising deposit rates, according to its new chairman.

NDTV Profit, in its weekly news wrap every Friday, brings you the mega events across businesses, industries and countries that have impacted investors' wealth.

India Pips China In MSCI EM Investable Market Index

India overtook its rival China to become the largest weighting in the MSCI EM investable market index this week and is on the way to ace its neighbour in the EM index.

Rising weight in a key emerging market index would draw more absolute foreign flows in the country's financial markets, Morgan Stanley said earlier this week.

The firm noted that foreign portfolio flows are being challenged by domestic market participants who are outbidding them. "This is why a growing issuance pipeline is crucial for increasing foreign participation, which we expect to see in the coming months," it said.

India's weightage in the EM gauge jumped to a record of 19.8% from 18.8% in May, while that of table topper China slipped to 24.2% from 24.7%, as per the index aggregator's quarterly review for August.

(Source: Chinmay Vasdev / NDTV Profit)

Analysts at the investment firm said that India's bull run is only past the halfway mark, but a mix of fundamental and technical factors have Asia's third-largest market poised for a temporary correction.

The ongoing record rally will likely see some profit booking in the short run, Ridham Desai, equity strategist at Morgan Stanley, said. "A correction will test money in the market and possibly excite money on the sidelines."

Stocks Hit Amid Caution Ahead Of Key US Jobs Data

Global stocks were hit on Thursday and Friday as traders remained cautious in the run-up to US payroll data, which could set the tone for the September rate cut.

Japanese Nikkei 225 closed 0.72% lower at 36,391, and South Korea's Kospi ended lower by 1.21% at 2,544 on Friday.

India's benchmark indices extended losses on Friday to record their worst week in over three months. Nifty ended 1.1% or 275.75 points lower at 24,869.3 while Sensex closed 1.24% or 1,017.23 points down at 81,183.93.

All eyes will be on the upcoming US jobs data for August due Friday, a key indicator of whether the Federal Reserve will initiate a half-point interest cut in September. The monthly economic report is expected to show payrolls increased by about 1,65,000, based on the median estimate in a Bloomberg survey of economists.

While the payroll data is expected to show a pickup in hiring and wage growth, caution remained as the US added the fewest jobs since early 2021. Traders are still pricing in over 100 basis points of easing this year, implying a potential super-sized reduction, according to Bloomberg.

The next Federal Open Market Committee meeting will be held on Sept. 17–18.

A lower-than-anticipated cut in interest rate by the US Federal Reserve in September will have markets on edge and put Jerome Powell's wording in focus to understand the dovish trajectory, according to Andrew Holland, chief executive officer of Avendus Capital Pvt.

Government Clears Mega Defence Acquisitions

India approved 10 capital acquisition proposals amounting to Rs 1.44 lakh crore spread across the Army and Coast Guard. Shares of all defence companies surged after the announcement.

The Defence Acquisition Council, chaired by Defence Minister Rajnath Singh, on Tuesday accorded the acceptance of necessity, or AoN, for proposals that include modernisation of the tank fleet of the Indian Army, procurement of air defence fire control radars, procurement of Dornier-228 aircraft, and next-generation patrol vessels with advanced technology.

The materials will be acquired domestically under the Buy (Indian) and Buy (Indian-Indigenously Designed, Developed, and Manufactured) categories.

The total share of domestic procurement has seen a phenomenal improvement from 54% in fiscal 2019 to 75% five years later and is expected to improve further, Antique Stock Broking Ltd. said in a note.

The new proposal is a tremendous opportunity for local defence manufacturers like HAL, BEL, Mazagon Dock, GRSE and other defence players, it said.

Companies like Bharat Forge Ltd., Mahindra Defence Ltd., and Tata Advanced Systems Ltd. are likely to benefit from the planned procurement of future-ready combat vehicles, while Bharat Electronics Ltd. stands to gain from air defence fire control radars.

Editor's Pick For The Week

Raymond Lifestyle Will Not Venture Into Women's Wear Business, Says Gautam Singhania.

SEBI To Release Consultation Paper On SME Listing Process Soon.

FAME-III Rollout In A Couple Of Months Time, Says Minister HD Kumaraswamy.

Raising Deposit Rates Not Core Focus: SBI's New Chairman

The State Bank of India will focus on improving customer service and engaging with depositors rather than raising deposit rates, said the bank's new chairman, CS Setty.

In an exclusive interview with NDTV Profit, Setty, who took over as chairman on Aug. 28, said that the bank will not look at growth at any cost.

"If I compete on deposits, I would compete on the non-rate contest, not the rate war," he said.

Banks need to focus on product innovation, the new SBI chairman said. It is probably good to focus on creating a new product for customers that combines the benefits of fixed deposits, systematic investment plans and insurance. Such product design innovation within the bounds of regulatory norms is what is needed.

"We do not need rate innovation. It is very easy to offer 50 basis points higher," he said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.