(Bloomberg) --

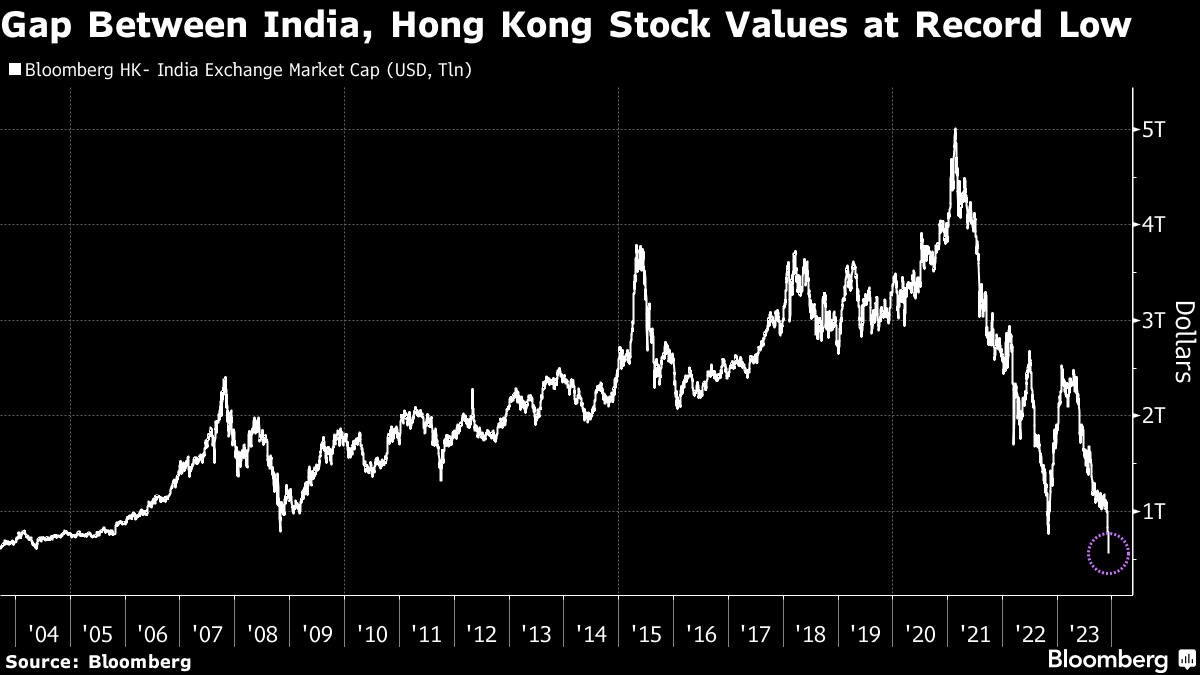

India's stock market value reached more than $4 trillion Tuesday for the first time, marking a key milestone for the world's fifth-biggest equity market as it rapidly narrows the gap with slumping Hong Kong.

The market capitalization of companies listed on India's exchanges has risen by $1 trillion in less than three years, as the South Asian market emerges as one of the best performers in the region as well as the emerging world.

Already trading at all-time high levels, India's key stocks benchmarks have risen more than 13% this year and are headed for an unprecedented eighth-straight year of gains. In contrast, the key Hong Kong equity measure has fallen 17%, with the market's total value dropping to less than $4.7 trillion.

India toppled China to become the worlds' most populous nation earlier this year and has emerged as the fastest-growing major economy. Touting political stability and strong domestic growth potential, India has been making efforts to increase global investment in its capital markets as well as industrial production.

Foreign investors have bought more than $15 billion of the nation's stocks this year on a net basis, while domestic funds have poured in more than $20 billion. This institutional support has been supplemented by a boom in retail trading since the pandemic.

India has been moving from being a consumption-oriented economy to an economy led by consumption as well as investment, and “markets have reacted positively and rightly to this potential strength of the country,” Ashish Gupta, chief investment officer at Axis Mutual Fund, wrote in a note.

The nation's economic growth stands out against a slowing global macro backdrop, with its gross domestic product jumping 7.6% in the three months to September from a year ago. That's seen bolstering the prospects for Prime Minister Narendra Modi to retain power in elections next year.

Some experts caution that the vote still poses risks for the stock market, while others note the high valuations of Indian shares as a reason for concern. The S&P BSE Sensex Index is trading at 20 times forward earnings estimates, slightly above its five-year average and higher than the 16 times for a gauge of global stocks. And volatility has risen along with stock benchmarks, a sign that some investors may be starting to hedge more aggressively given the extent of the rally.

Others are still optimistic, like Goldman Sachs Group Inc. which upgraded India to overweight last month as “the best structural growth prospects in the region”. Nomura Holdings Inc. maintained its overweight recommendation on India in its latest Asia ex-Japan strategy report.

“Structurally, we would be buyers on dips assuming political/policy continuity,” Nomura strategists led by Chetan Seth wrote in a note dated Tuesday.

--With assistance from Alex Gabriel Simon.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.