(Bloomberg) --

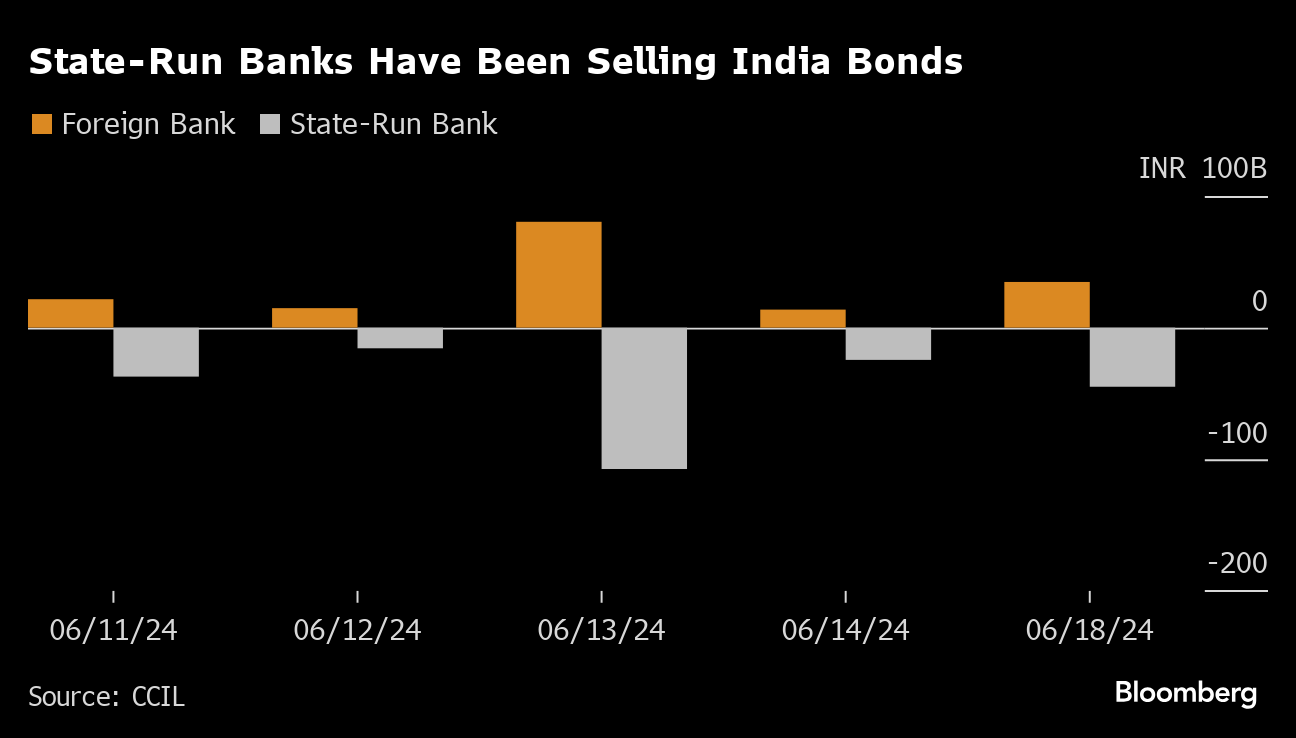

India's state-owned lenders have turned aggressive sellers of government bonds while foreign banks are piling in ahead of the global index inclusion.

Public lenders, the biggest holders of debt, sold 230 billion rupees ($2.8 billion) of sovereign bonds in the past five sessions, the most in over a year, according to data from the Clearing Corp. of India. Foreign banks, investing on behalf of their overseas clients, bought 165.2 billion rupees of the notes, absorbing the bulk of the supply.

“The foreign buying is likely for clients and position taking ahead of the bond inclusion and given the fact that the most of the negatives in the market are already priced,” said Rajeev Pawar, head of treasury at Ujjivan Small Finance Bank. State-run banks are using this demand to book profit as yields near 7%, he said.

Most foreign portfolio investors use foreign banks based in India as custodians for their investment operations.

READ: JPMorgan Index Listing Fuels $40 Billion Rush Into Indian Bonds

India's inclusion in the JPMorgan emerging-markets bond index is nearing, with the first 1% weight on the index to be added on June 28. The country will eventually have a 10% weighting, similar to China.

Yield on the benchmark 10-year bond is down 20 basis points this year to 6.97%, versus a 35-basis point rise in US Treasury yields.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.