The rupee closed weaker against the U.S. dollar on Wednesday after the greenback rose as a higher-than-expected U.S. inflation print prompted investors to pull back their bets on the Federal Reserve easing monetary conditions anytime soon, according to forex traders.

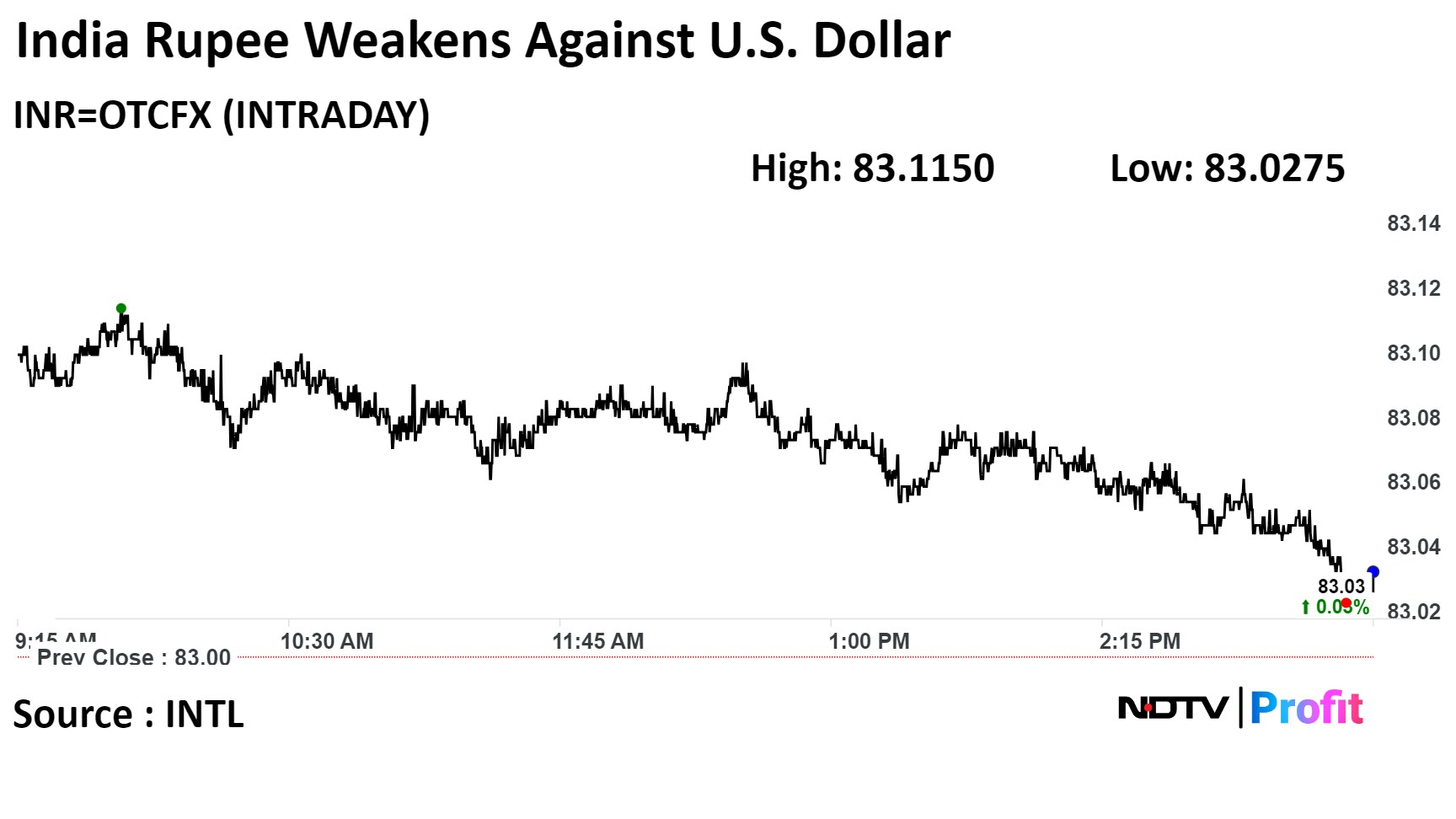

On Wednesday, the local currency depreciated 2 paise to settle at Rs 83.03 against the U.S. dollar, compared to Rs 83.01 at close on Tuesday. Intraday, the currency hit a low of 83.12 against the U.S. dollar.

"The rupee weakened to Rs 83.1150, which looked like a god-send opportunity for exporters who sold dollars to hedge their exports. The dollar index was stronger at 104.93, the US 10-year index at 4.2970%, and Asians were also weaker, but this did not have any effect on the dollar-rupee pair, which was sold off at higher levels. This indicates the amount of inflows into the country," said Anil Kumar Bhansali, head of Treasury and executive director at Finrex Treasury Advisors LLP.

"The US dollar has surged by more than 0.65%, and US 10-year yields have spiked by almost 17 basis points, reaching 4.33%. This significant movement followed the release of stronger-than-expected US Consumer Price Index (CPI) data, which came in at 3.1%," said Amit Pabari, managing director of CR Forex Advisors.

The U.S. CPI rose 0.3% month-on-month in January and 3.1% year-on-year, higher than the 0.2% sequential rise and 2.9% annual rise estimated by economists and analysts in Bloomberg's survey.

Fed fund futures traders have priced in an 8% chance of a rate cut in the March policy meeting, unlike the 76.9% possibility a month ago, according to the CME FedWatch Tool.

"Money markets' expectations of rate cuts from the Fed got knocked back as US inflation proved stickier than investors were hoping for, pushing dollar index and US 10-year Treasury yields higher towards 105.00 and 4.33%, respectively," said Kunal Sodhani, vice president of Shinhan Bank.

The dollar index, which gauges the strength of the greenback against a basket of major currencies, jumped to 104.98, the highest level since Nov. 14, according to data on Cogencis. As of 3:45 p.m., the dollar index was at 104.92.

"The rupee is expected to remain broadly in the range of Rs 82.90–83.20 on Thursday, with good upticks on the dollar to be sold and good downticks to be bought. The RBI may keep absorbing the inflows to keep the rupee range bound," Bhanshali said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.