(Bloomberg) -- India's foreign exchange reserves posted their biggest weekly rise in four months as investors bought the nation's stocks and bonds following the country's inclusion in the JPMorgan Chase & Co.'s emerging markets bond index.

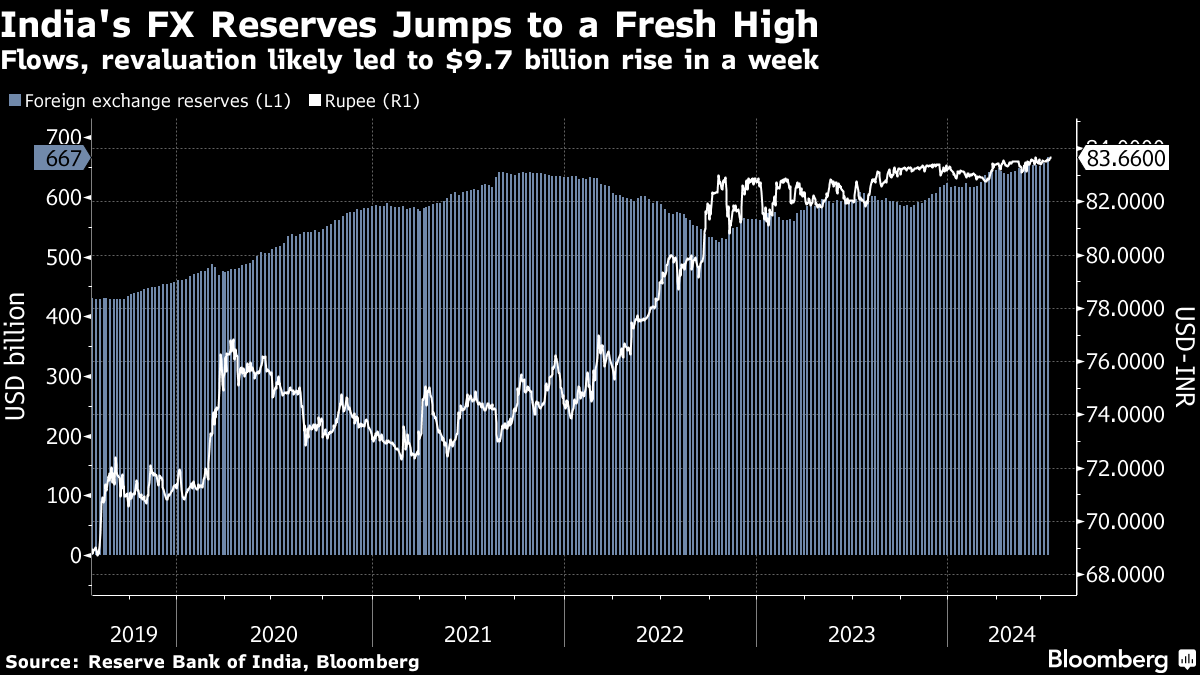

The stockpile rose $9.7 billion to $666.9 billion as of July 12, data from the Reserve Bank of India showed Friday. It was the sharpest weekly rise since early March.

Foreign investors have poured money into India's markets this year as they look for alternatives to Chinese equities and after JPMorgan announced the inclusion of India's bonds into its key index. So far this month, foreign investors bought $2.9 billion in equities and over $1 billion in bonds.

“The increase in foreign exchange reserves was a function of both revaluation effect and foreign portfolio investors flows in July, led more by equities than debt” despite the JPMorgan index inclusion, said Madhavi Arora, lead economist of Emkay Global Financial Services Ltd.

The rupee weakened further this week and is hovering near its record low of 83.67 against the dollar amid broader strength in the US currency. Rising reserves gives the central bank more ammunition to prevent a rapid slide in the rupee. By absorbing the foreign inflows, the RBI has kept the rupee relatively stable compared with other currencies in the region.

The RBI plans to use reserves as its first line of defense to stabilize the currency and manage the additional inflows coming from the bond index inclusions, Bloomberg reported earlier.

--With assistance from Subhadip Sircar.

(adds size and scope of the jump in first paragraph.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.