The equity markets will continue to witness elevated liquidity till the end of the year and investors should be selective while picking up stocks as valuations are high, according to Chola Securites' Dharmesh Kant.

"The liquidity in equities will remain for another 5–6 months. In that backdrop, investors have to be specific about stocks," Kant, head of equity research at the brokerage, told NDTV Profit. "There has to be a balance between consistent compounding on an earnings basis, even if valuations look high."

Opportunities in themes like railways, infrastructure and power will continue to be there as political leadership in the government hasn't changed, he said. Moreover, the government is in a better position in terms of cash, given the record RBI surplus, buoyant tax revenue and tepid spending so far this fiscal due to the elections.

In terms of sugar stocks, all of which were trading higher, Kant said if there is better production this year and inventory levels are high, it can be negative for these companies.

Short covering can set in once the Nifty 50 crosses 23,500 and it will take the index to 23,700, according to Rajesh Palviya, senior vice president of technical and derivatives research at Axis Securities. The major call concentration is in the 23,400–23,500 range.

"Broader markets are showing a different picture. There is stock-specific action happening. The index may remain in consolidation for a couple of more days," he said.

"For Bank Nifty, the major support zone is placed at the 50,000 mark. It may remain in consolidation until it takes out that level," Palviya said.

The benchmark equity indices extended their rally for a third consecutive day on Thursday to close at their highest levels as macro data uplifted the sentiment. Various data points, including a one-year low retail inflation in May, as well as the index of industrial production and the softer-than-expected US inflation, also added to the positive sentiment.

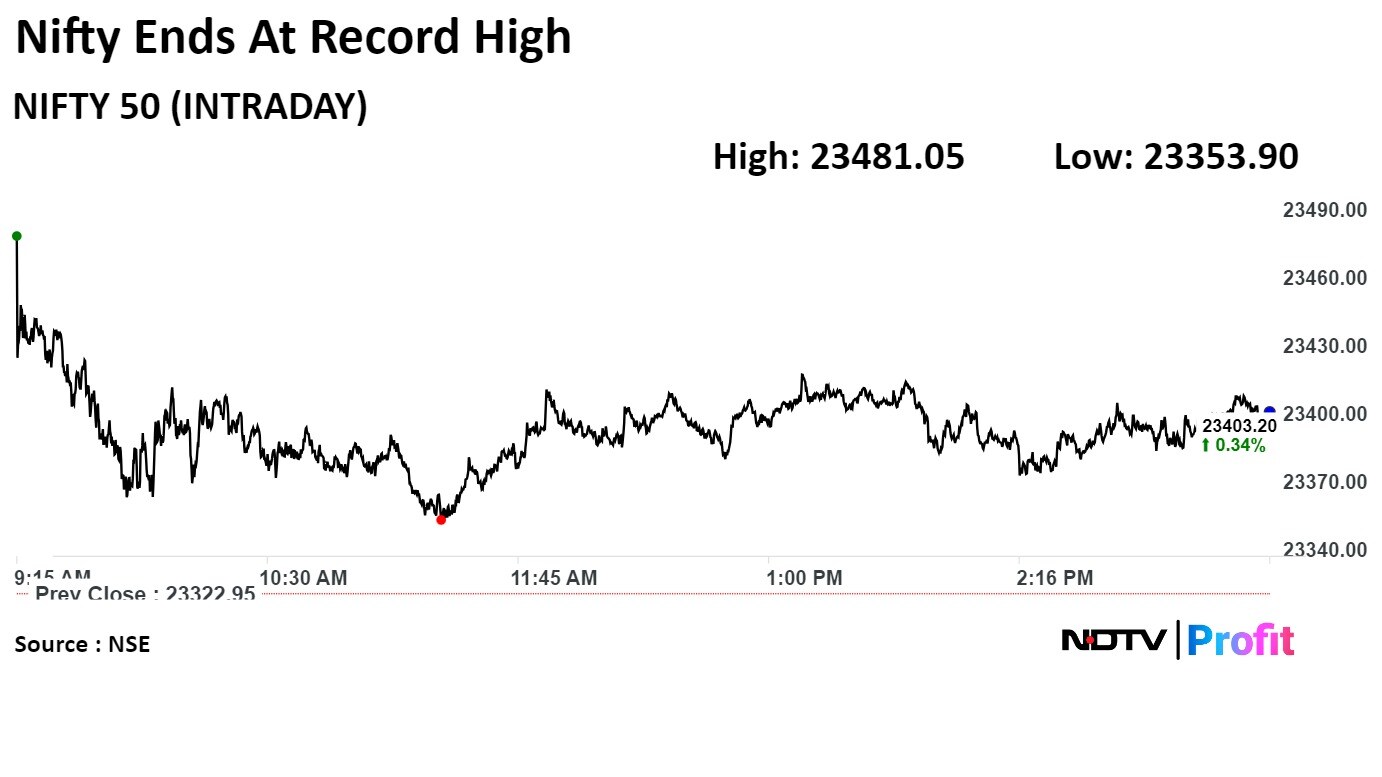

The NSE Nifty 50 closed 75.95 points, or 0.33%, up at 23,398.90, while the S&P BSE Sensex ended 204.33 points, or 0.27%, higher at 76,810.90.

During the day, the Nifty recorded a new intraday high of 23,481.05 points and the Sensex also hit a record high of 23,481.05.

Watch the full conversation here:

The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.