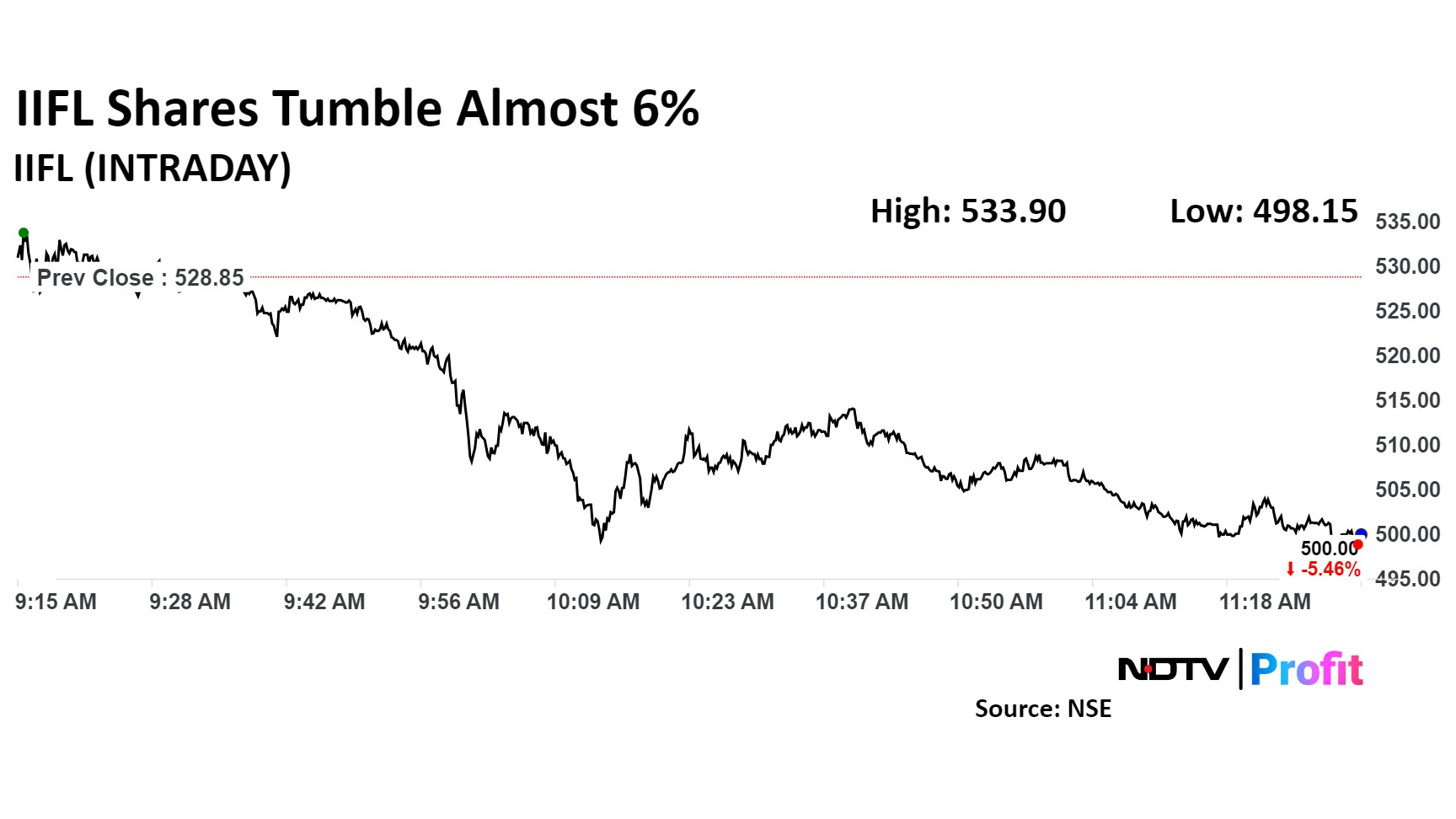

Shares of IIFL Finance Ltd., a non-bank lender, fell almost 6%, amid speculations of a potential ratings action due to a ban imposed by the Reserve Bank of India earlier this year.

NDTV Profit had reported that the non-bank lender might see a rating downgrade owing to a ban by the Reserve Bank of India from March, citing people familiar with the matter. Delays in removal of RBI restrictions on its gold loan business will likely lead to the company's rating being brought down by a notch, the people said.

The RBI issued a ban on IIFL Finance's gold lending on March 4, citing compliance issues such as serious deviations in assaying and certifying the purity and weight of gold, breaches in loan-to-value ratios, and excessive cash disbursal and collection beyond statutory limits.

Although IIFL Finance has reportedly addressed the RBI's concerns and submitted a compliance report last month, it is still awaiting feedback from the regulator.

Shares of the company fell as much as 5.81% before paring some loss to trade 5.17% lower at Rs 501.50 apiece, as of 11:29 a.m., compared to a 0.36 advance in the NSE Nifty 50.

The stock has fallen 13.76% year-to-date. Total traded volume so far in the day stood at 2.21 times its 30-day average. The relative strength index was at 57.70.

Out of six analysts tracking the company, three maintain a 'buy' rating, two recommend a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 8.0%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.