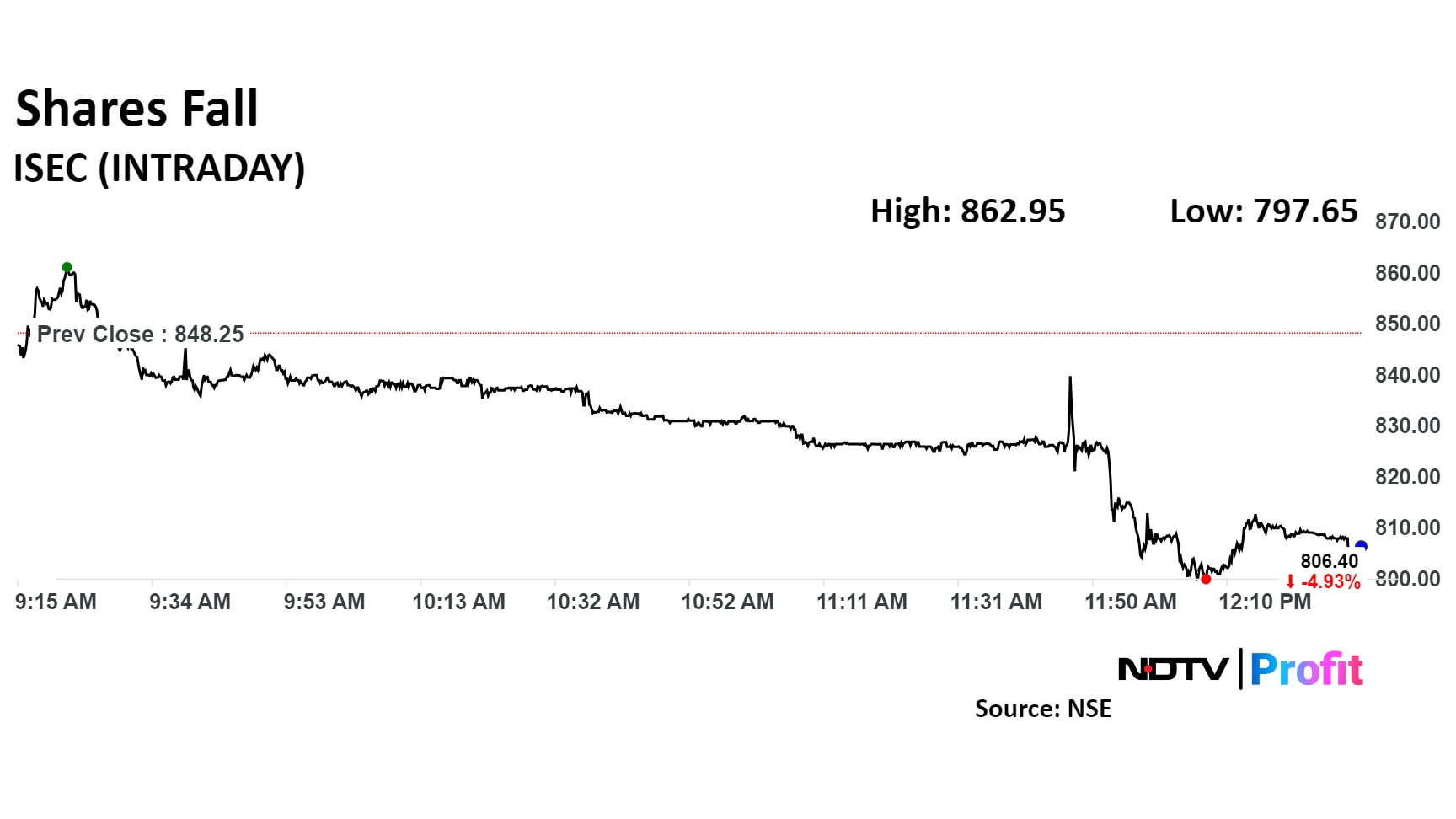

Shares of ICICI Securities fell nearly 6% on Wednesday after the Mumbai bench of the National Company Law Tribunal approved the delisting scheme of the company.

Under the approved scheme, ICICI Securities shareholders will receive 67 ICICI Bank Ltd. shares for every 100 shares they hold. The scheme had earlier secured approval from 93.8% of ICICI Securities' equity shareholders.

Quantum Mutual Fund and Manu Rishi Gupta, who held 0.08% and 0.002% of ICICI Securities shares, respectively, had opposed the scheme. They had alleged undue influence by ICICI Bank employees on the voting process. However, they have now dismissed their objections.

The case revolves around allegations that ICICI Bank pressured shareholders into supporting its proposal to delist ICICI Securities, its broking subsidiary, from Indian stock exchanges.

Earlier, ICICI Securities argued that the objections were against shareholder democracy principles and that the objectors lacked proper standing.

Shares of the company fell as much as 5.97% to Rs 797.65 apiece, the lowest level since Aug. 16. It pared losses to trade 4.92% lower at Rs 806.50 apiece as of 12:20 p.m. This compares to a 0.22% advance in the NSE Nifty 50 Index.

The stock has risen 29.88% in the last 12 months. Total traded volume so far in the day stood at 8.1 times its 30-day average. The relative strength index was at 59.

Out of three analysts tracking the company, one maintains a 'buy' rating and two recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 9.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.