Hitachi Energy share price increased by more than 3% on Monday after the company announced plans to invest approximately Rs 2,000 crore in expanding its capacity, portfolio, and talent base to promote a sustainable energy future in India.

The investment was announced as the firm celebrates 75 years of operations in India. Hitachi Energy is hosting a two-day experiential technology symposium, "Energy & Digital World 75" (EDW75), on October 7 and 8 in New Delhi.

The planned investment aims to support India's trajectory toward becoming the third-largest economy globally. CEO Andreas Schierenbeck stated, “The energy challenge before us is bigger than one company, one team, and one individual. As the energy transition gathers pace with increased electrification and integration of renewables, power grids are becoming increasingly significant.”

Key components of the investment will focus on significant capacity expansions, including enhancements to the large power transformers factory and upgraded testing capabilities for specialty transformers. Additionally, the capacity of the traction transformers factory will be boosted to aid in modernising India's railway network.

Hitachi Energy will also expand its network control solutions and introduce new products, including the REF650 medium voltage offering, aimed at bolstering the company's manufacturing capabilities in India. The initiative aligns with the company's strategic growth plan for 2030, which emphasises digitalisation and supply chain strengthening.

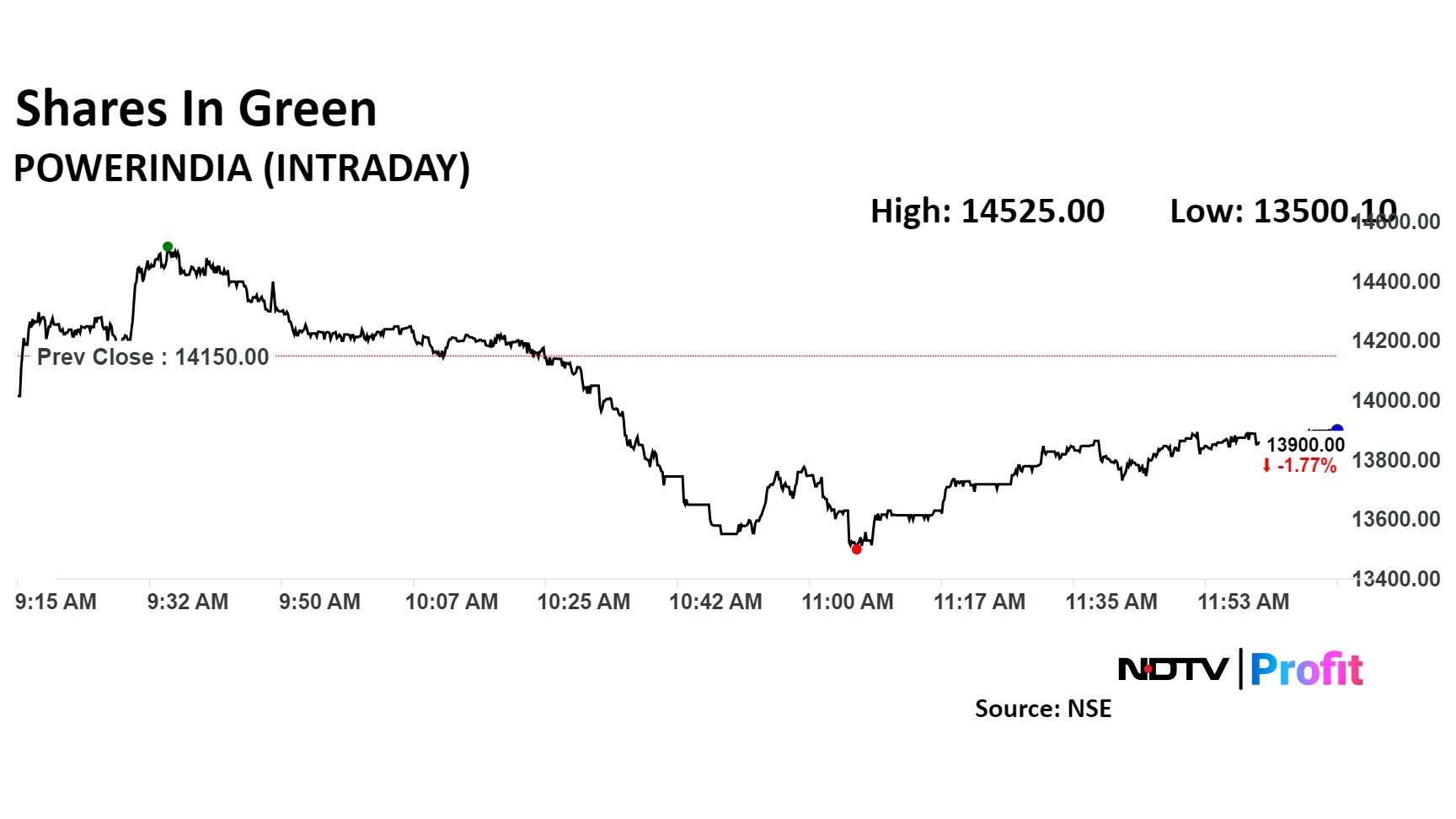

The scrip rose as much as 3.64% to 14,525.00 apiece. However, it gave up the gains to trade 1% lower at Rs 13,875.00 apiece, as of 12:08 p.m. This compares to a 0.45% decline in the NSE Nifty 50 Index.

It has risen 252.32% in the last 12 months. Total traded volume so far in the day stood at 1.8 times its 30-day average. The relative strength index was at 63.

Out of eight analysts tracking the company, five maintain a 'buy' rating, one recommends a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 9.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.