Hindustan Zinc Ltd.'s share price was down as much as 8.14% after the Ministry of Mines announced on Tuesday that it planned to offload up to 2.5% stake in the company via offer for sale.

The offer will open on Nov. 6 for non-retail investors and on Nov. 7 for retail investors. The floor price for the OFS is set at Rs 505 per share, representing a 9.8% discount to Tuesday's close, as per an exchange filing.

As the promoter of Hindustan Zinc, the government aims to sell up to 5.28 crore equity shares with a face value of Rs 2 each, comprising a base offer of 1.25%, according to the company's filing. The OFS includes an initial 1.25% stake, with an option for an additional 1.25% if oversubscribed.

If the oversubscription option is not utilised, the shares in the base offer will be offered through a designated window on BSE Ltd. and NSE Ltd. The sale will be conducted exclusively through seller brokers—Axis Capital Ltd., IIFL Securities Ltd., HDFC Securities Ltd., and ICICI Securities Ltd.—with IIFL Securities Ltd. also acting as the settlement broker.

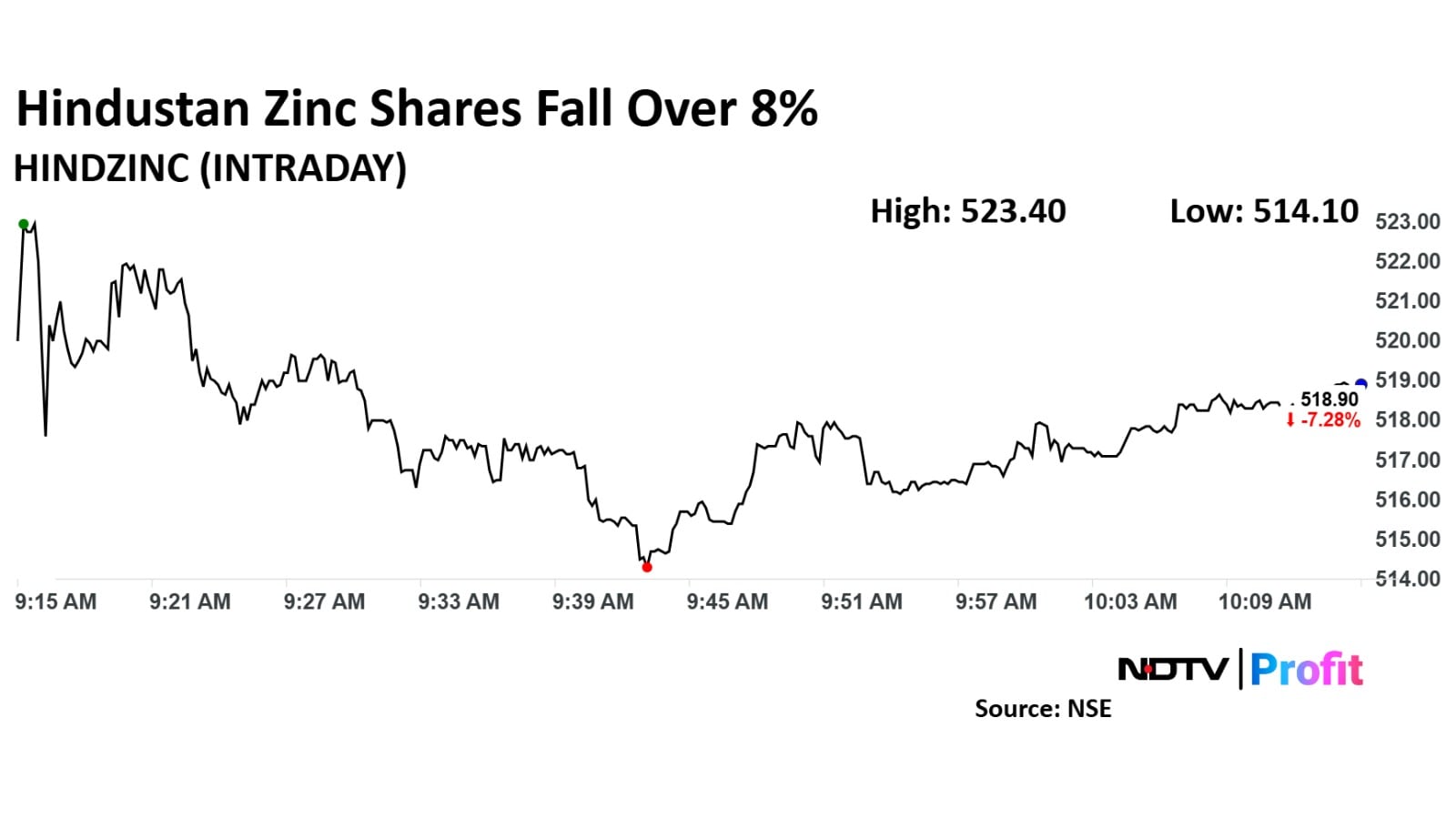

Hindustan Zinc Share Price Today

Hindustan Zinc stock fell as much as 8.14% during the day to Rs 514.10 apiece on the NSE. It was trading 7.35% lower at Rs 518.50 apiece, compared to an 0.70% advance in the benchmark Nifty 50 as of 10:13 a.m.

It has risen 75.07% in the last 12 months and 63.02% on a year-to-date basis. Total traded volume so far in the day stood at 5.3 times its 30-day average. The relative strength index was at 42.12.

One out of the 12 analysts tracking Hindustan Zinc has a 'buy' rating on the stock, two recommend a 'hold' and nine suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price target implies a potential downside of 19%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.