Hindalco Industries Ltd. saw its share price rise nearly 3% on Monday following the company's strong second-quarter earnings, which exceeded analysts' estimates.

The aluminium producer reported a 78% year-on-year increase in net profit, reaching Rs 3,909 crore for the quarter ended Sept. 30, 2024. This was higher than the consensus estimate of Rs 3,297.7 crore, as polled by Bloomberg.

The company also posted revenue growth of 7.4%, totalling Rs 58,203 crore, up from Rs 54,169 crore a year ago, and surpassing analysts' forecast of Rs 55,132.1 crore.

Hindalco's Ebitda soared 40%, coming in at Rs 7,883 crore compared to Rs 5,612 crore in the same quarter last year. The Ebitda margin also improved to 13.5% from 10.4% in Q2 FY24, driven by a decline in power and fuel costs, along with a Rs 1,171-crore reversal of finished goods inventory changes.

The robust performance was largely attributed to strong revenue growth across all of Hindalco's major segments—Novelis, copper, and aluminium upstream and downstream. Notably, the aluminium segments saw the highest uptick, with revenue increasing 20% in the downstream segment and 15% in the upstream segment.

Despite a Rs 514-crore exceptional expense, the company's profit growth remained strong, signalling solid operational performance and a favourable market environment.

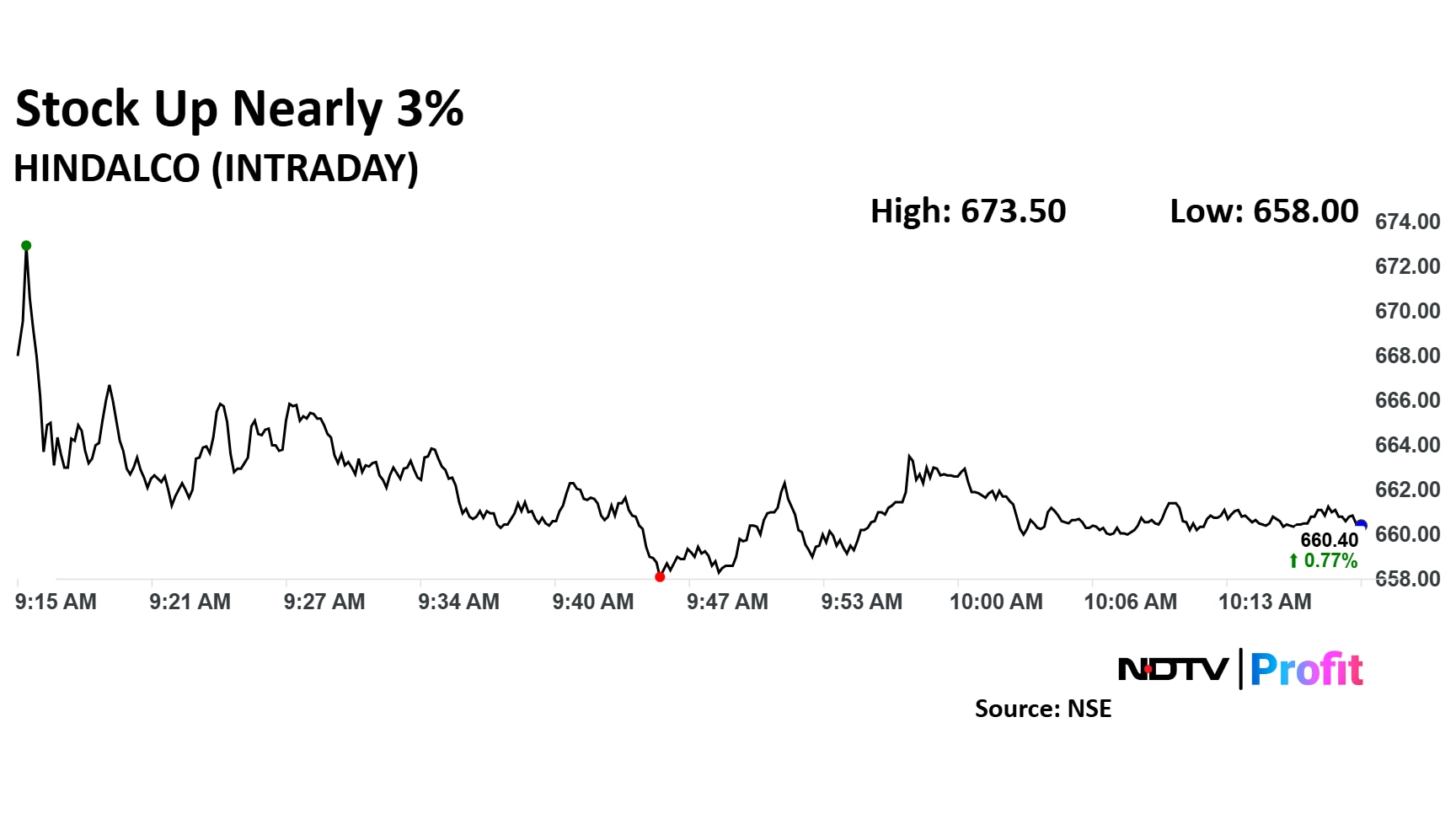

The scrip rose as much as 2.77% to Rs 673.50 apiece. It pared gains to trade 0.80% higher at Rs 660.60 apiece, as of 10:25 a.m. This compares to a 0.21 advance in the NSE Nifty 50 Index.

It has risen 36.93% in the last 12 months. Total traded volume so far in the day stood at 2.9 times its 30-day average. The relative strength index was at 39.7.

Out of 29 analysts tracking the company, 23 maintain a 'buy' rating, one recommend a 'hold,' and five suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 14.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.