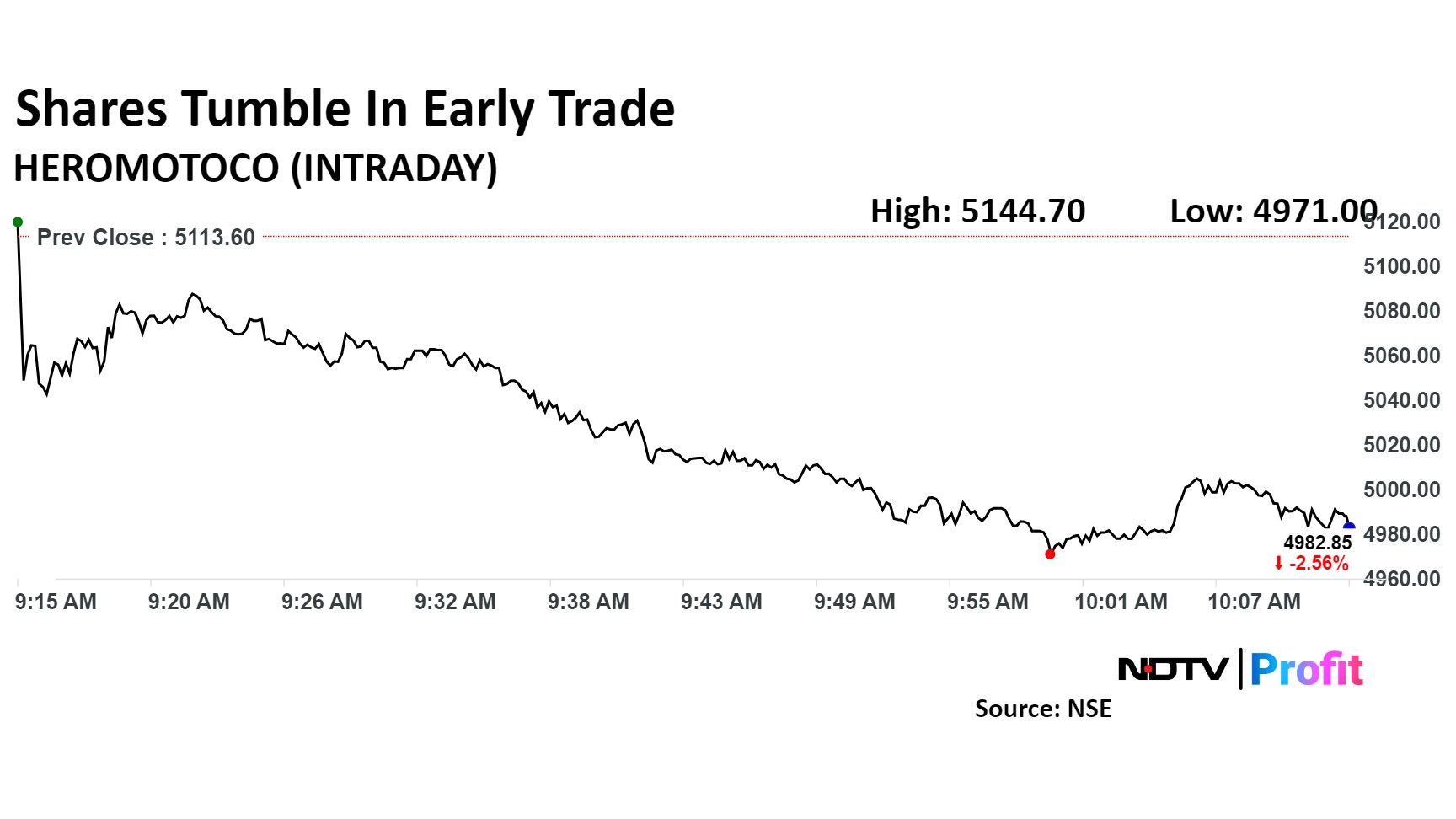

Hero MotoCorp Ltd.'s share price has come under pressure following a downgrade from UBS, which reiterated a "Sell" rating on the stock, citing significant challenges ahead for the automotive giant. The stock was down more than 2% in early trade on Friday.

In its analysis, UBS emphasised that the market's optimistic view of Hero MotoCorp as a rural proxy is misplaced. While there are expectations of a revival in demand for commuter motorcycles, the brokerage pointed out rising competition and a shift towards electrification, premiumisation, and scooters as looming threats. UBS forecasts Hero MotoCorp's FY27 net profit to be 18% below consensus estimates, further compounding concerns over the company's long-term growth prospects.

Key highlights from UBS's report indicate that a staggering 77% of Hero's volume stems from domestic commuter motorcycles (100-110cc), predominantly concentrated in just five states. This narrow focus leaves the company vulnerable, especially as it faces market share erosion in a rapidly evolving landscape dominated by competitors like TVS and Honda, as well as the rising popularity of electric vehicles (EVs).

Moreover, UBS noted that the assumption of a rural recovery driving demand for commuter motorcycles has been a significant factor behind Hero's recent valuation re-ratings. However, as the market shifts towards EVs and scooters, Hero's market share has already fallen by 320 basis points this year, with expectations of further decline.

Despite being a market leader in motorcycles in India, Hero's share in two-wheeler exports remains at a mere 6%, raising questions about its ability to diversify its portfolio effectively. Recent launches, including the Vida, HD X440, and Xoom scooter, have not met sales expectations, with low single-digit market shares in their respective categories, the brokerage noted.

UBS's analysis indicates that the market is currently pricing in an unlikely recovery in Hero's commuter motorcycle segment, a turnaround in its overall market share, and a successful foray into the EV market. As a result, the investment bank has lowered its FY26 and FY27 profit estimates by 14% and 18% below consensus, respectively, signaling further downside risks for the stock.

The scrip fell as much as 2.79% to 4,971 apiece. It pared losses to trade 2.25% lower at Rs 4,998.75 apiece, as of 10:07 a.m. This compares to a 0.62% decline in the NSE Nifty 50 Index.

It has risen 59.15% in the last 12 months. Total traded volume so far in the day stood at 1.0 times its 30-day average. The relative strength index was at 24.

Out of 42 analysts tracking the company, 27 maintain a 'buy' rating, seven recommend a 'hold,' and eight suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of 9.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.