Shares of HDFC Bank Ltd. rose on Wednesday after they declined on Tuesday after its weightage fell in MSCI India Domestic Index by 0.20% to 8.31%.

Nomura maintained a 'neutral' outlook on the lender, keeping the target price unchanged at Rs 1,720 per share, implying an upside of 7.3% from the previous close.

HDFC Bank will need to meet higher priority sector lending requirements starting from the second quarter, the brokerage said. This will slightly reduce its net interest margin by about 3-5 basis points in FY25. The impact will lessen in future years as their asset base grows, it said.

HDFC Banks' annual disclosures indicate overall priority sector lending compliance is in excess of the regulatory threshold of 40% of loans. However, the organic shortfall in the small and marginal farmer sub-segment, could rise to Rs 1.1 lakh crore in the current financial year (approximately 3% of assets this fiscal) due to the merger, Nomura noted.

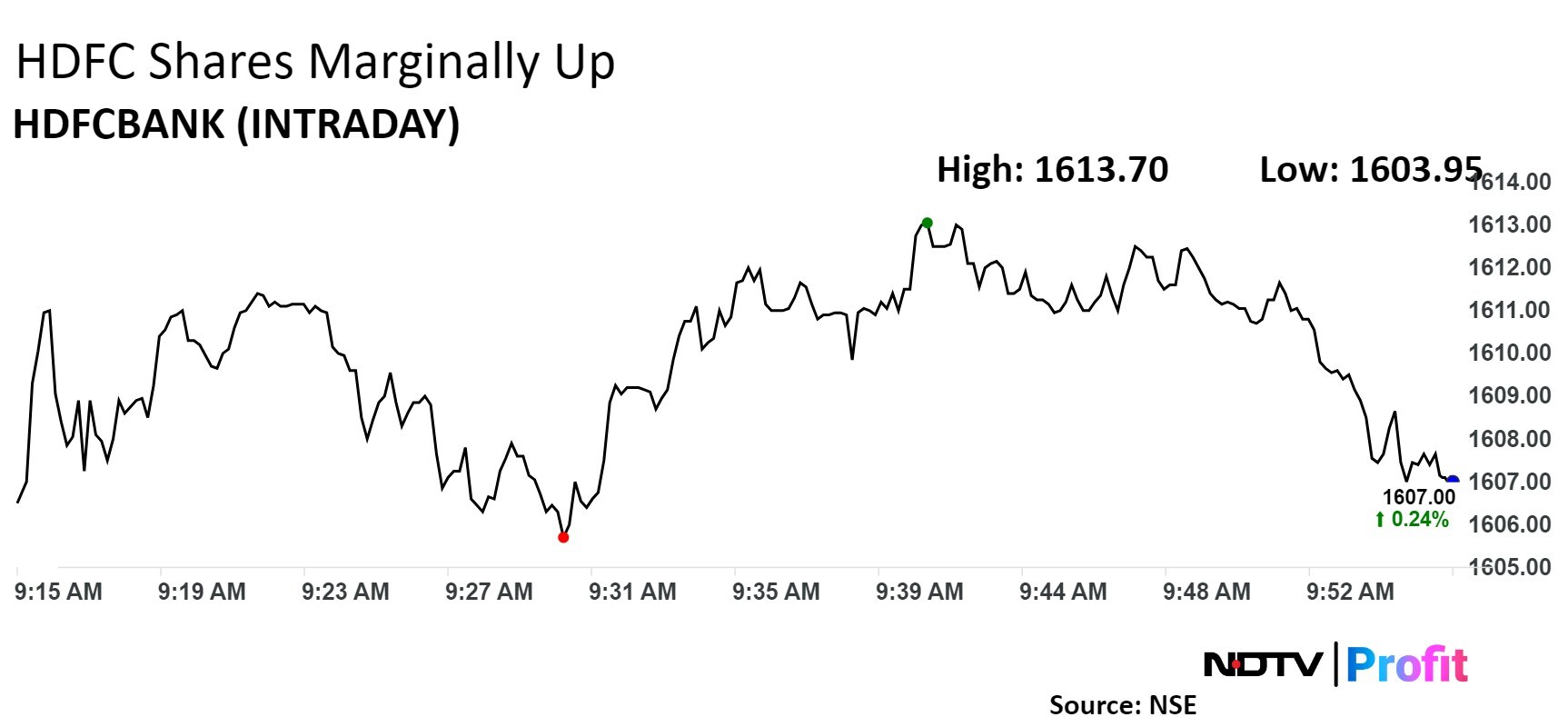

Shares of the company rose as much as 0.65% before paring gains to trade 0.40% higher at Rs 1,610 apiece, as of 09:52 a.m. This compares to a 0.11% advance in the NSE Nifty 50.

The stock has risen 2.4% in the last 12 months, but fallen 5.87% year-to-date. On NSE, total traded volume so far in the day stood at 0.20 times its 30-day average. The relative strength index was at 45.89.

Out of 55 analysts tracking the company, 38 maintain a 'buy' rating, nine recommend a 'hold' and eight suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 16.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.