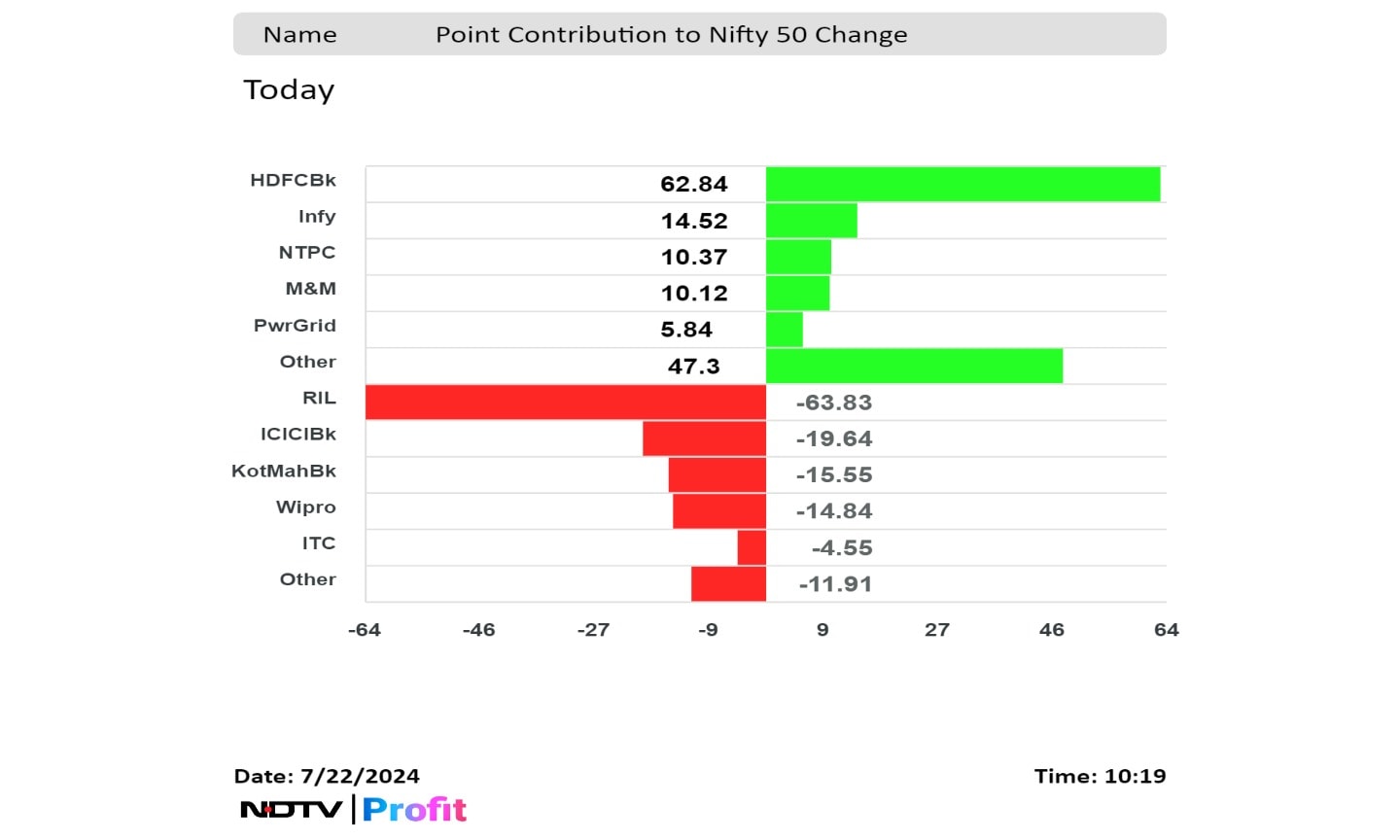

Shares of HDFC Bank Ltd. gained over 2.7% on Monday to contribute the most in Nifty's recovery even as Reliance Industries Ltd. lost nearly 3%. The private lender came out of its four-day losing streak, in which it had fallen nearly 1%.

The stock rose after it reported first-quarter net profit in line with analysts expectations.

HDFC Bank Q1 Results: Key Highlights (Standalone)

Net interest income rose 2% to Rs 29,837 crore. (YoY)

Net profit falls 2% to Rs 16,174.75 crore. (Bloomberg estimate: Rs 15,652 crore). (YoY)

Gross NPA rose 9 basis points to 1.33%. (QoQ)

Net NPA 6 basis points to 0.39%. (QoQ)

"The deposit growth, while lower than full-year expectations, appears to be a result of a system-wide slowdown in deposit growth rather than a sharp drop in market share," said Bernstein in a note.

HDFC Bank's standalone net profit dropped 2% quarter-on-quarter to Rs 16,174.75 crore due to lower core income growth and higher tax expenses. The bank's net interest income, or core income, rose 2% sequentially to Rs 29,837 crore.

In addition, the company announced that it has provided an in-principle approval to initiate the process of listing HDB Financial Services Ltd. on the exchanges via an initial public offering.

The company's board has delegated the powers to a committee of directors to undertake various steps in this regard, it said in an exchange filing on Saturday.

The stock contributed 73 points compared to the 211.4 point-recovery in the Nifty from day's low at 10:35 a.m.

Shares of the lender rose as much as 2.72% to Rs 1,651 apiece, the highest level since July 8. It pared gains to trade 2.65% higher at Rs 1,649.20 apiece as of 10:37 a.m. This compares to a 0.13% advance in the NSE Nifty 50 Index.

The stock has fallen 3.76% on a year-to-date basis and 0.37% in the last 12 months. Total traded volume so far in the day stood at 0.41 times its 30-day average. The relative strength index was at 53.93.

Out of the 47 analysts tracking the company, 39 maintain a 'buy' rating and eight recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 13.9%.

.png)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.