HDFC AMC's share price gained over 5% to hit record high for a second consecutive session on Wednesday as brokerages are positive on HDFC Asset Management Co. after its profit rose in the second quarter of fiscal 2025.

CLSA upgraded the stock to an 'outperform' rating from 'hold', while Nuvama and Citi raised their target prices.

The asset management company reported 32% year-on-year growth in profit after tax to Rs 576.61 crore for the three months ended Sept. 30, 2024, on a 38% rise in total income to Rs 1,058.19 crore. Analysts had estimated the net profit to be at Rs 606 crore.

Morgan Stanley, in its initial reaction to the results, said the net profit missed expectations because the tax rate was higher at 33%, as against 20% in the previous quarter and 26% in the same quarter last year—likely due to changes in the Union Budget.

The brokerage has an 'equal weight' rating on the stock, with a target price of Rs 4,120 per share, implying a downside of 9.6%. "We will follow up with a more detailed note following management commentary on the conference call at 1730 IST today," it said.

The higher tax rate was a one off and will be steady state from next quarter on, according to CLSA. The brokerage has raised its target price from Rs 4,450 apiece to Rs 4,920 per share, implying an 8% upside.

Profit excluding tax was 11% ahead of CLSA estimates and the brokerage attributed this to a beat on both AUM growth and yield expectations. "Yields expanded by 1 bps QoQ, driven by a higher share of equity mix and rationalisation of brokerages," it said. "AUM growth of 46% YoY was very strong driven by 64% YoY growth in the equity segment."

Nuvama has built in improved inflows and AUMs and accordingly increased net operating profit less adjusted taxes estimates for FY25/26/27 by 7.2%/6.7%/5.8%. Consequently, it has raised its target price to Rs 5,240 from Rs 4,910 per share earlier, while retaining a 'buy'. The new target implies upside of 15%.

Citi Research, the only brokerage with a 'sell' rating, has justified its rating as the company's "richness ignores industry headwinds and stabilising operational trends".

"While market momentum and robust operational performance has supported earnings over the past few quarters, we expect stabilisation in earnings trajectory over medium-term," it said. Industry headwinds include market fragmentation in equities, increasing direct mix for retail flows reducing proprietary distribution moats and increasing bargaining power of large and dominant distributors, Citi said.

However, it has raised its target price as it raised core profit before tax estimates by 9-10% over medium-term, largely capturing strong equity mark to market in base. The new target price is at Rs 3,600 per share from Rs 3,125 apiece.

Going ahead, CLSA said SIPs and NFOs dominate net inflows for HDFC AMC, with very strong growth in SIP inflows. "We are optimistic about the company delivering 29% AUM growth in FY25," it said.

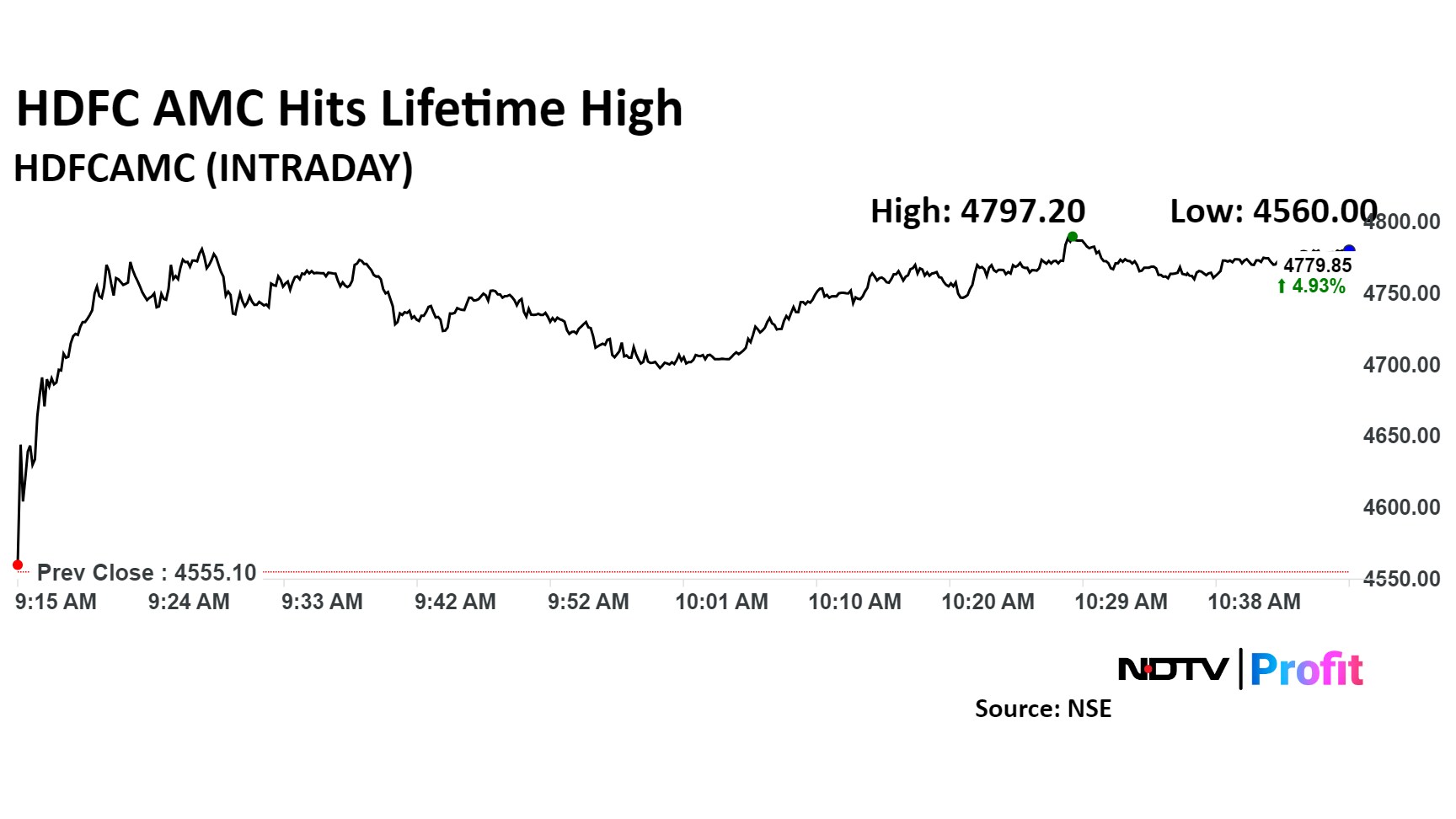

Shares of the company rose as much as 5.3% to hit a lifetime high of Rs 4,797.20 apiece. The stock gave up gains to trade 4.94% higher at Rs 4,779.90 apiece as of 10:51 a.m. This compares to a 0.12% decline in the NSE Nifty 50 index.

The stock has risen 49% on a year-to-date basis and 74.8% in the last 12 months. Total traded volume so far in the day stood at 3.03 times its 30-day average. The relative strength index was at 55.

Out of the 25 analysts tracking the company, 16 maintain a 'buy' rating, six recommend a 'hold,' and three suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 1.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.