A more active market for first-time share sales will lead to a pickup in technology firms going public, according to a senior Goldman Sachs Group Inc. banker.

The number of tech initial public offerings will “likely more than double” in 2025, with the rate of companies debuting by the end of the year getting more in line with an annual average of about 34, said Will Connolly, the Wall Street bank's head of technology equity capital markets.

“There's a massive population of big, scaled companies in tech that are IPO candidates and there's a lot of demand to put money to work,” said Connolly, speaking on the sidelines of Goldman Sachs' Private Innovative Company Conference in Las Vegas last week.

“The question is how quickly can people recalibrate to a more active IPO market,” Connolly said.

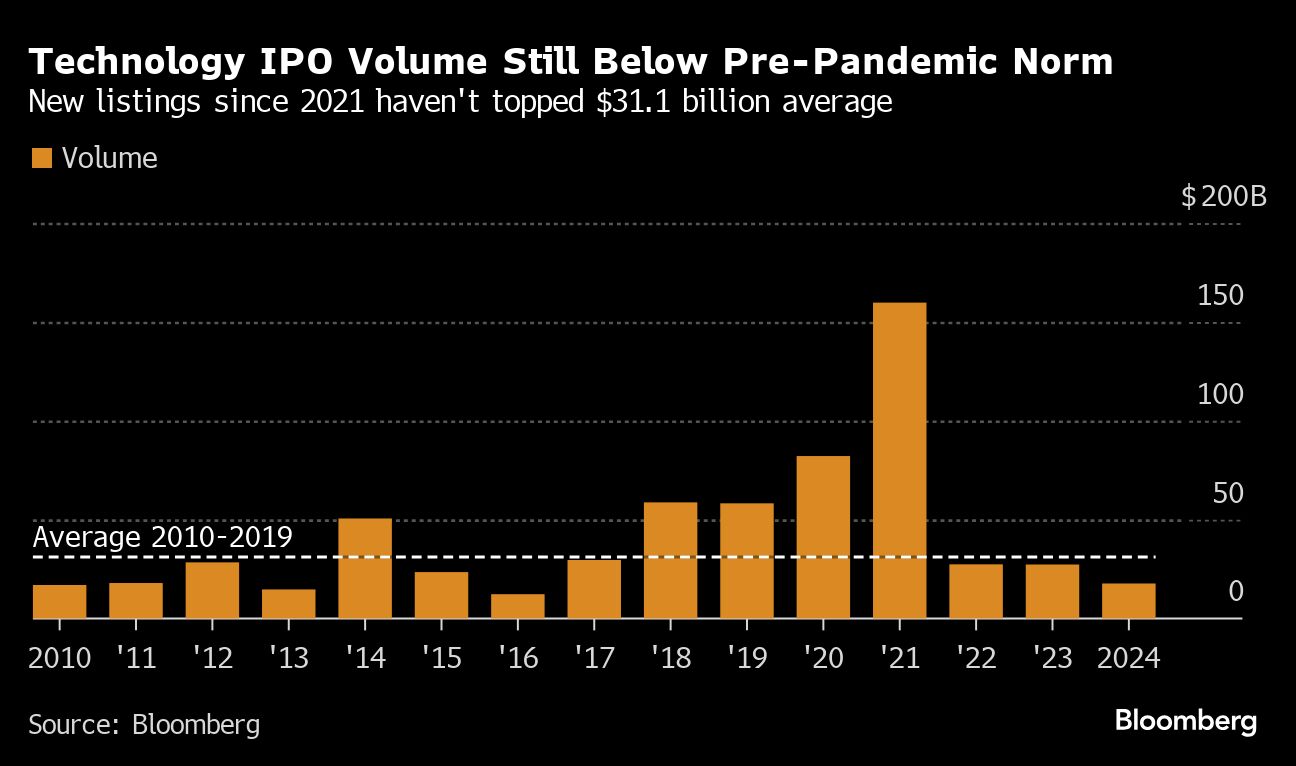

Technology IPOs have been slow to return to health since the pandemic, amid a slump in startup valuations. The record $160 billion raised in 2021 gave way to totals below the $31.1 billion annual average in the decade before Covid, data compiled by Bloomberg show.

The performance of sizable tech listings since 2022, however, indicates that there's an appetite for quality names. Shares in the seven companies raising more than $1 billion in that period, including UK-based chip infrastructure firm Arm Holdings Plc, Indian food delivery startup Swiggy Ltd. and Kazakh fintech Kaspi.JZ JSC, are up a weighted average of 92%, the data show.

The market is nearing an “inflection point where companies will line up to go” public, Connolly said. “We've seen an acceleration of companies getting ready.”

One area of the market that has been vocal about getting deals done has been private equity, which has been a consistent acquirer of tech firms. Blackstone Inc. President Jon Gray talked up expectations for IPOs on the firm's latest earnings call while a top executive at Carlyle Group Inc. told Bloomberg News earlier this month it has three or four firms it'd like to take public in 2025.

“Private equity will play a meaningful role in IPOs next year, they have an incentive to return capital,” Connolly said. “But we will also see some more traditional venture capital-backed companies come to market.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.