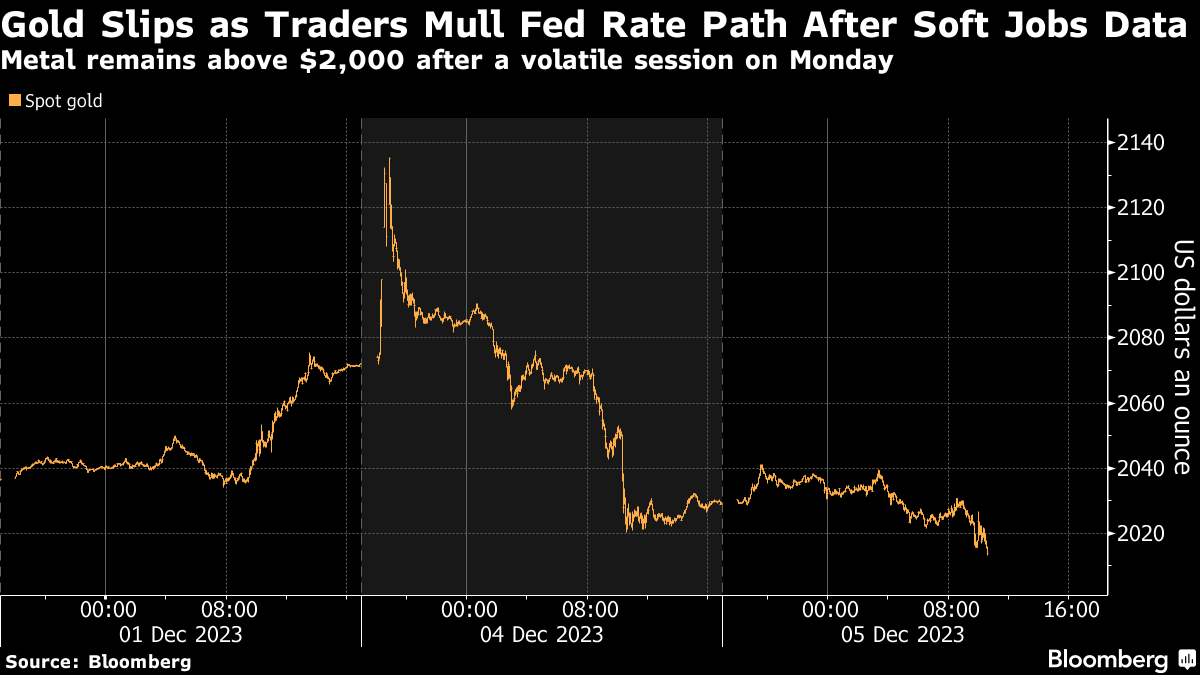

(Bloomberg) -- Spot gold edged lower as traders mulled the Federal Reserve's interest-rate path after data showed the US labor market is cooling.

Job openings fell in October to the lowest level since March 2021, with available positions decreasing to 8.7 million from a downwardly revised 9.4 million in the prior month, according to a Bureau of Labor Statistics report released Tuesday. The openings figure was below all estimates in a Bloomberg survey of economists.

Treasury yields pared gains after the print before recouping some of the advance, keeping bullion under pressure. The swaps market is pricing in a more than 50% chance of the Fed lower borrowing costs in March.

The precious metal still traded near $2,015 an ounce Tuesday after a volatile session the prior day that saw it reach a record high before pulling back as traders reined in bets that the Fed was nearing a pivot to rate cuts. Investors will be closely monitoring more jobs readings over the next few days for clues on the central bank's next steps.

Bullion is up about 10% since early October, with the rally initially driven by haven buying following the Hamas attack on Israel before rising further on the prospect of looser monetary policy in the US. While a wave of purchases by central banks has also underpinned gold's strength this year, there has been a decline in the holdings of exchange-traded funds.

“The fundamentals themselves are just not there yet to keep the rally going,” said Michael Widmer, head of metals research at Bank of America Merrill Lynch. “The big problem is ETFs where we continue to see a lack of inflows – there is a reluctance to get long gold until the Fed actually cuts rates.”

Spot gold fell to $ an ounce as of in New York after slipping as much as 0.7% earlier.

--With assistance from Swansy Afonso, Andrew Janes and Archie Hunter.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.