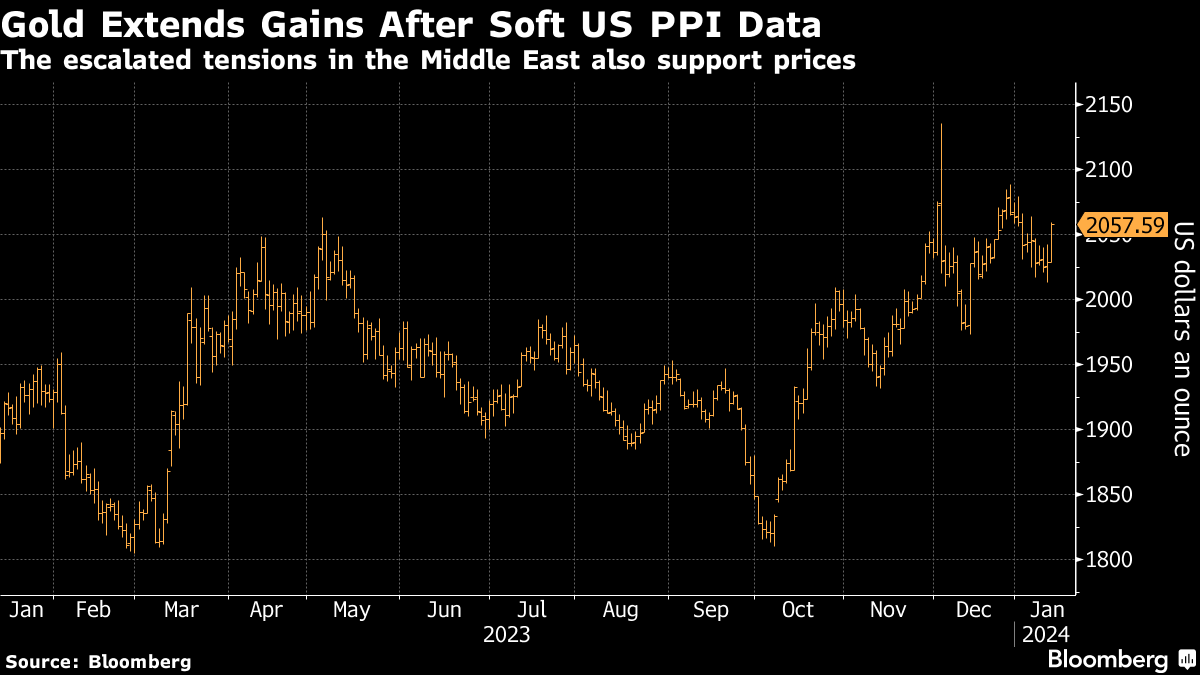

(Bloomberg) -- Gold jumped the most in a month after soft US producer prices data amped up expectations of interest-rate cuts, while US-led airstrikes on Houthi rebel targets in Yemen stoked haven demand.

Prices paid to US producers unexpectedly fell in December for a third straight month, consistent with limited inflation at the wholesale level, Labor Department data showed Friday. The Houthi response to the US and UK airstrikes is “imminent,” a senior political leader and member of ruling party, Mohammed Ali Al-Houthi, said in a public speech.

Treasury yields and the dollar weakened after the PPI report while latest comments from the Houthi leader signaled a potential escalation of the situation in the Middle East. Those developments boosted bullion by as much as 1.6%, the biggest intraday jump in a month.

Investors typically seek haven in gold in times of geopolitical and economic uncertainty. At the same time, they want to own the precious metal in a rate-cutting cycle. Bullion usually has an inverted relationship with rates — the lower rates, the higher it climbs.

While recent US economic data point to a bumpy path ahead for policymakers trying to bring down inflation to a 2% target, traders appear to be focused on the timing and size of the Federal Reserve's shift to lowering borrowing costs. Despite daily price swings, bullion has stayed above the $2,000-an-ounce level since Dec. 13 on expectations of the US central bank's pivot to monetary easing.

Read More: US and UK Strike Yemen's Houthis After Red Sea Ship Attacks

The US and UK launched about 70 airstrikes on Houthi targets in Yemen early Friday in a bid to stop the Iran-backed group's shipping attacks in the Red Sea. The Houthis appeared undeterred, vowing to continue targeting commercial vessels and saying they'd expand their campaign “very soon.” All US and UK interests are now “legitimate targets,” the group said.

“Gold has responded to the increase in tensions, which clearly indicates that the West is slowly being drawn into the Middle East conflict,” said Nicky Shiels, head of metals strategy at Geneva-based MKS PAMP SA. “It's another added support to gold.”

Gold rose 1.3% to $2,055.49 an ounce as of 10:36 a.m. in New York.

--With assistance from Sybilla Gross, Swansy Afonso and Mia Dawkins.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.