Godrej Properties Ltd. got a 'buy' upgrade from Bank of America, as it sees risk-reward turning attractive after the recent correction in the share price. The brokerage had a 'neutral' rating earlier.

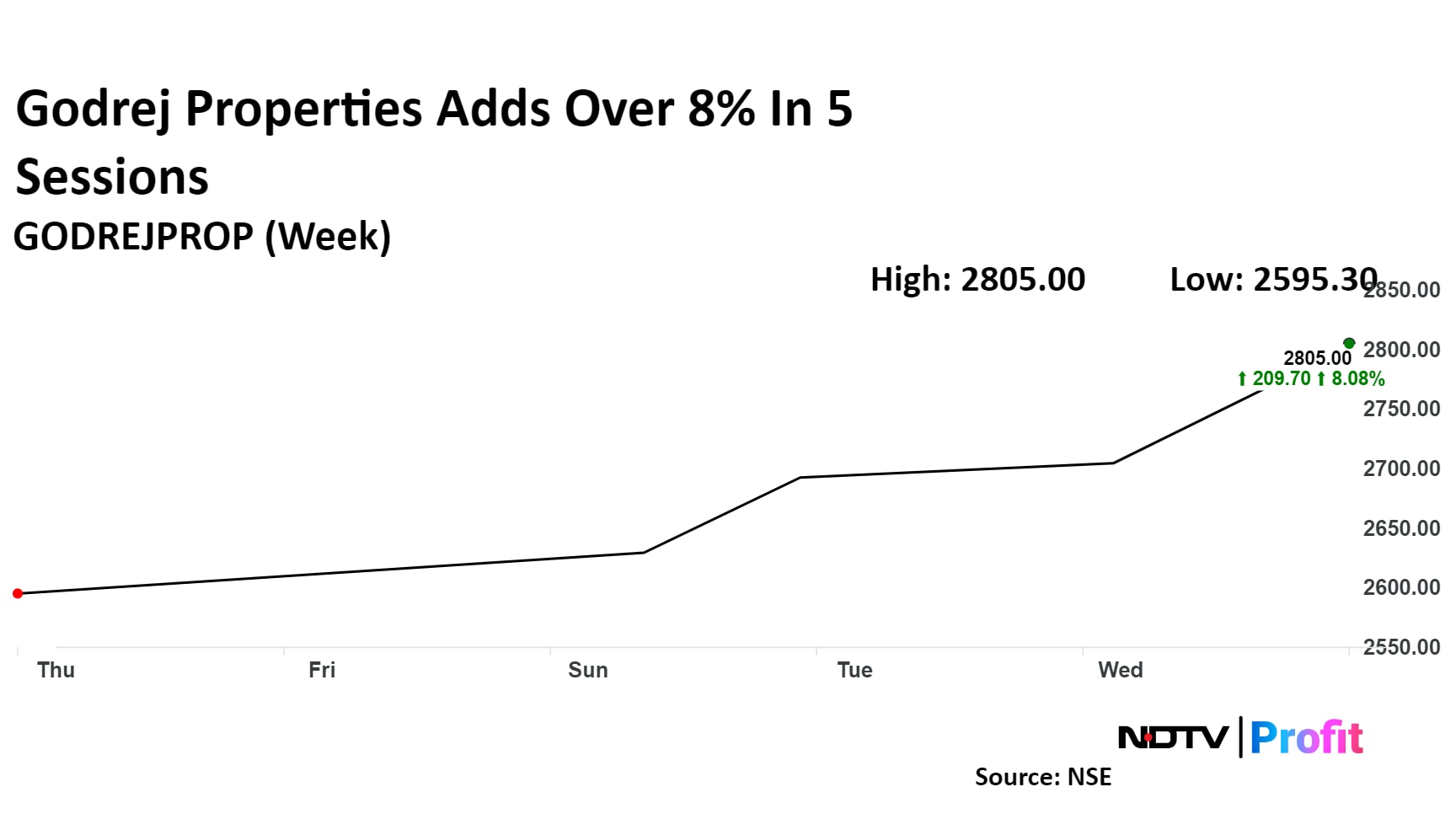

The stock has gained around 9% in its consecutive gains for the last five sessions, but on a two-month basis it is still trading nearly 12% lower.

BofA has also raised its price outlook for the stock to Rs 3,600 from Rs 3,500 earlier, implying 33% upside. According to the brokerage, the stock price has corrected 18% (before Friday's rise) over the last two months, amid a correction in broader Indian market and increased concerns around strength of the residential cycle in the country.

In its assessment, residential cycle remains strong with legs for 15% year-on-year bookings CAGR over FY25-FY27. "We think GPL is well stocked to exceed industry growth with its land paced business development trajectory that could drive a 22% booking CAGR over the same time frame."

The brokerage thinks that sequential dip in bookings seen at an industry level over the past two quarters have been on account of launch constraints. "We expect such constraints to start easing starting Q3/Q4, bringing the bookings trajectory back into growth mode."

BofA's analysis, based on correlation between bookings and collections, suggests that collections could grow at 40% CAGR and thus drive a similar healthy operating cash flow growth of 40% CAGR over FY25-FY27.

"In our view, this is an important parameter of focus for investors in GPL and comfort on these two parameters is likely to boost stock valuation," it said.

Godrej Properties Share Price Today

Continuing its gains for a fifth consecutive session, the stock rose as much as 4.7% on Friday to hit Rs 2,832.70, its highest level since Nov. 8. It pared gains to trade 3.7% higher at Rs 2,806 apiece, as of 12:10 p.m., compared to a 1.24% advance in the NSE Nifty 50.

It has risen 39.3% year-to-date and 49% in the last 12 months. Total traded volume so far in the day stood at 1.3 times its 30-day average. The relative strength index was at 49.3.

Of the 20 analysts tracking the company, 16 maintain a 'buy' rating, one recommends a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 21.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.