Godrej Properties Ltd.'s share price rose over 4% after JPMorgan raised its target price to Rs 3,580 per share, on the back of ongoing project additions and favourable market conditions. The brokerage maintained an 'overweight' rating on the stock.

The firm reported strong pre-sales for the second quarter, totaling Rs 5,200 crore, reflecting a 3% year-on-year increase. This brought the total pre-sales to Rs 13,800 crore, representing 51% of the annual target of Rs 27,000 crore.

The note highlighted GPL's consolidation of economic interests, increasing to 93% in key areas, which is expected to enhance future margins. Despite higher land acquisition costs impacting free cash flow, the company's operating cash flow improved significantly, showing a 68% growth year-on-year.

Godrej Properties Ltd., headquartered in Mumbai, India, is a leading real estate developer, ranking among the top three firms in Delhi-NCR, Bangalore, Mumbai, and Pune. Founded in 1990, it operates as a subsidiary of Godrej Industries Ltd. The company has a patronage of 1.1 billion consumers globally, across consumer goods, appliances, real estate, agriculture and many other businesses.

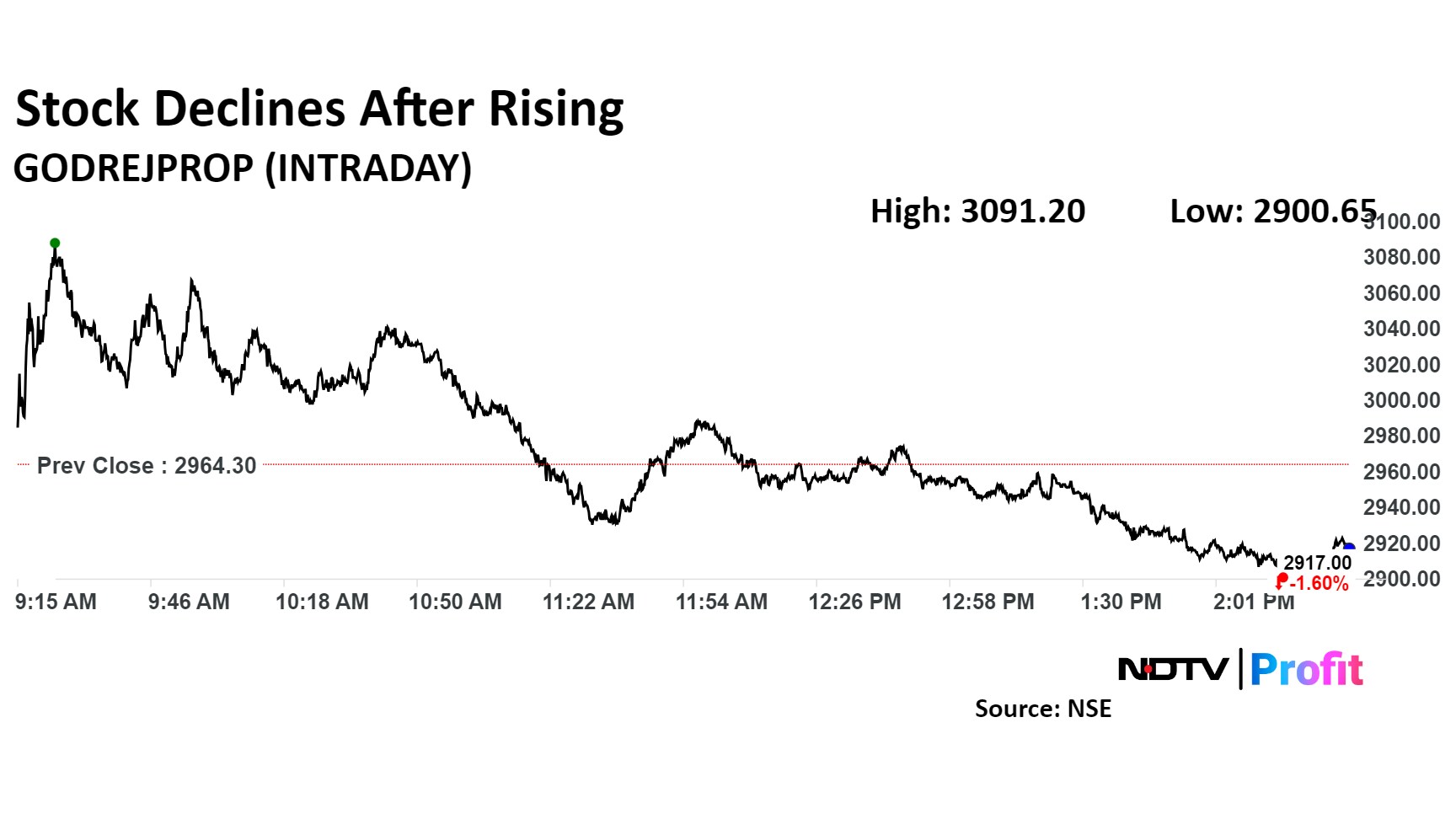

Godrej Properties Share Price

The scrip rose as much as 4.28% to Rs 3,091.20 apiece. However, it erased gains to trade 1.66% lower at Rs 2,915.20 per share as of 02:22 p.m. This compares to a 0.22% decline in the NSE Nifty 50.

The stock has risen 84.27% in the last 12 months. Total traded volume so far in the day stood at 2.0 times its 30-day average. The relative strength index was at 40.

Out of 20 analysts tracking the company, 15 maintain a 'buy' rating, two recommend a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 16.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.