Godrej Properties Ltd.'s rating was upgraded from 'hold' to 'buy' by Nuvama, after its July-September quarter pre-sales grew 3% to Rs 5,200 crore, the best-ever in a second quarter.

The company has achieved half of its annual sales guidance of Rs 27,000 crore for the current financial year, according to the brokerage. Godrej Properties' pre-sales in the first half of the year has also surpassed the bookings in fiscal 2023.

"Over the past five financial years, GPL has averaged just 37% of its full year sales in the first half," the firm said.

Besides, operating cash flows for the September quarter reached Rs 1,800 crore, marking a 120% year-on-year increase, while the first half totaled Rs 2,800 crore, up 200%.

The improvement in cash flows could help alleviate investor concerns regarding GPL's historically weaker cash flow performance compared to its peers, Nuvama said.

Sales momentum will stay healthy with the housing cycle turning, it said. The brokerage also factored in improvement in cash flows and the recent correction in stock price for the upgrade.

It has set a target price of Rs 3,415 per share, implying an upside potential of 18% over the previous close.

Jefferies also said a strong launch pipeline in the second half of the year can help Godrej Properties beat its annual guidance for pre-sales.

It has a 'buy' rating on the stock with a price target of Rs 3,725 per share, implying an upside potential of 29%.

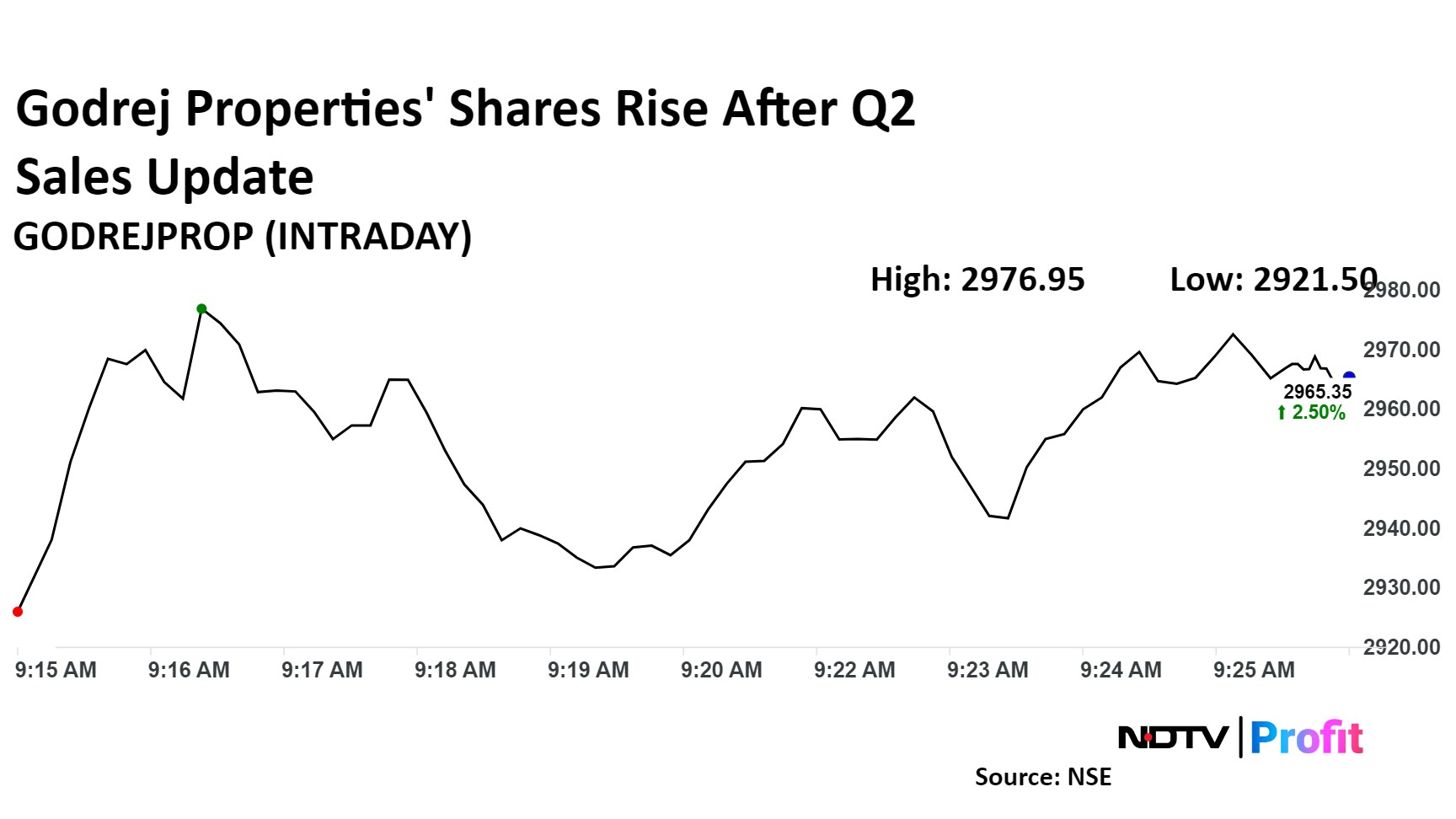

Godrej Properties Share Price

Shares of Godrej Properties rose as much as 2.7% after market open at Rs 2,977 apiece, compared to a 0.34% advance in the benchmark NSE Nifty.

Shares of Godrej Properties rose as much as 2.7% to Rs 2,977 apiece at market open, compared to a 0.34% advance in the benchmark NSE Nifty.

The stock has risen 77% in the last 12 months and 48% year-to-date. The relative strength index was 40.54.

Out of 20 analysts tracking the company, 14 maintain a 'buy' rating, one recommends a 'hold' and five suggest a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 12%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.