Godrej Consumer Products Ltd.'s share price was up nearly 6% after it reported an over 13% year-on-year uptick in its second quarter profit. The profit met analysts' estimates.

Consolidated net profit increased 13.4% over the year earlier to Rs 491 crore in the quarter-ended Sept. 30, 2024, according to an exchange filing. That compares with the Rs 499-crore consensus forecast of analysts tracked by Bloomberg.

Its revenue declined 1.77% to Rs 3,666 crore, as against an estimate of Rs 3,631 crore.

"Our standalone Ebitda margin at 24.3% is at the lower end of our targeted band and is caused entirely by high inflation on palm oil. The already high prices were further exacerbated by the import duty on oil.

"We think this is a short-term hit and we will recover the margins through judicious price increase and stabilising of costs," said Sudhir Sitapati, managing director and chief executive officer of the company.

Godrej Consumer Products also announced a third interim dividend for the fiscal at Rs 5 per share via exchanges. The record date for the payment of dividend is Nov. 1.

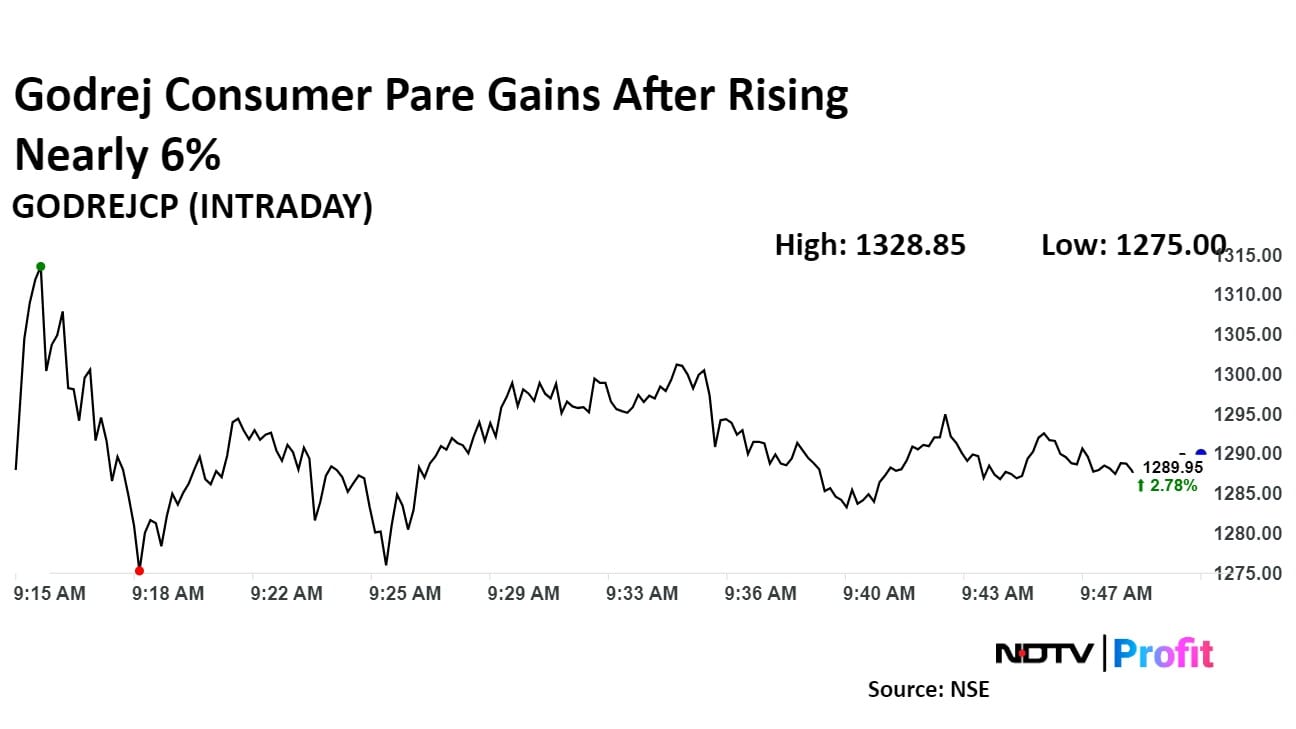

Godrej Consumer Products Share Price Today

Godrej Consumer's stock rose as much as 5.88% during the day before paring gains to trade 2.70% higher at Rs 1,289.05 apiece as of 9:48 a.m., compared to a 0.37% decline in the benchmark Nifty 50.

It has risen 32.45% in the last 12 months and 14.26% on a year-to-date basis. Total traded volume so far in the day stood at 8.3 times its 30-day average. The relative strength index was at 37.31.

Twenty six out of 35 analysts tracking Godrej Consumer have a 'buy' rating on the stock, seven recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 15.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.