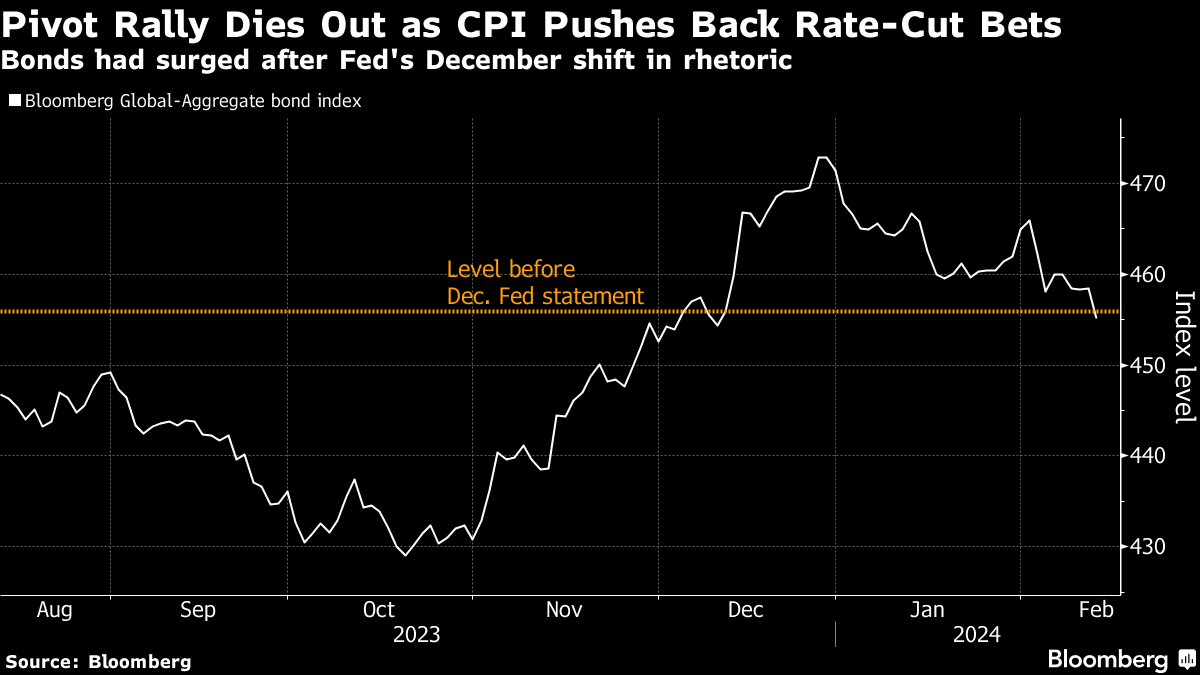

(Bloomberg) -- US inflation data has erased the last remnants of a global bond rally that started in December with the hope that the Federal Reserve had finally pivoted to favor interest-rate cuts.

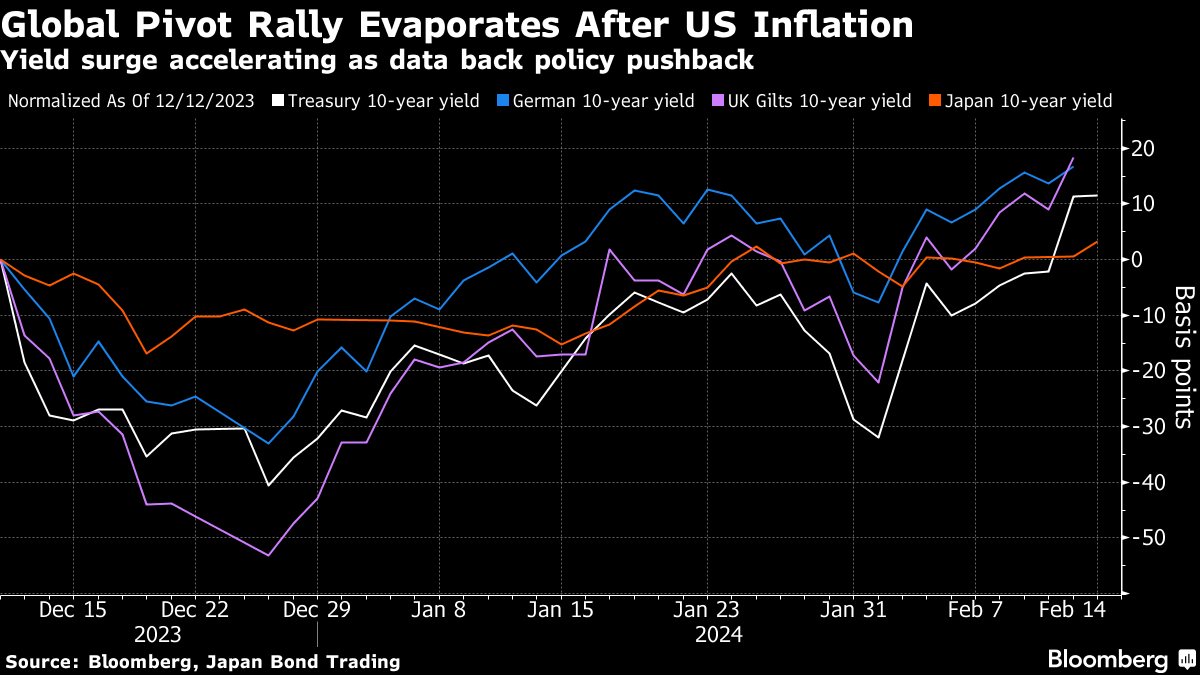

A Bloomberg index of global debt has dropped 3.5% this year, wiping out all of its gains since Dec. 12, the day before the Fed announcement that month. Treasury 10-year yields were at 4.31% in Asia after surging 14 basis points in the previous session, while Japan's 10-year yield climbed as much as four basis points.

Global bonds slumped this year as Fed Chair Jerome Powell led major peers in pushing back strongly against market bets that central banks would start rapid easing moves as early as March. The rout accelerated after data on Tuesday showed US inflation in January was stronger than expected, while prompting traders to push back bets on the first Fed interest rate cut to July.

“January CPI is a game changer — the narrative that Fed disinflation provided scope for insurance cuts is clearly now on the chopping board,” said Prashant Newnaha, Singapore-based senior rates strategist at TD Securities Inc. “There is now a real risk that price pressures begin to shift higher. The Fed can't cut into this. This should provide momentum for further bond declines.”

Traders are now only fully pricing in three Fed rate cuts for this year, with a fourth reduction seen as a coin toss. That lines up with the US central bank's own forecast for three easing moves, though it is a far cry from just a month ago when swaps showed the potential for as many as seven downward shifts in the cash rate.

The strength of the US economy makes Treasuries unattractive at the moment, despite the fact that rate bets are now better aligned with Fed guidance, according to Amy Xie Patrick, head of income strategies at Pendal Group in Sydney. She has pulled back from US government duration, to focus more on corporate notes for now.

“Credit is the easier choice because economic momentum is still strong enough to support risky assets,” Xie Patrick said. The structural disinflation story is “a two steps forward, one step back process,” she said.

Australian 10-year bond yields jumped as much as 12 basis points to 4.29% on Wednesday, right in line with their level before the Fed's December announcement. German bunds and UK gilts had already more than erased their pivot-era rallies.

(Adds investor comment in sixth, seventh paragraphs.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.