Shares of Glenmark Pharmaceuticals surged on Monday on the back of positive commentary by management in the earnings call. The company is targeting a revenue of Rs 13,500–14,000 crore in the financial year 2025.

The company is expecting an Ebitda margin of 19% in comparison to 10% in the last fiscal. It is also expecting double-digit growth in net profit, according to the earnings call.

Glenmark has guided a research and development investment of 7–7.25% of the sales. The overall consolidated capital expenditure would be approximately Rs 700 crore.

The management said fiscal 2026 would be a big year for the company in terms of overall growth.

The company said that it is in talks with the US Food and Drug Administration for a meeting and re-inspection of its Monroe facility. The drug regulator received a warning letter last June.

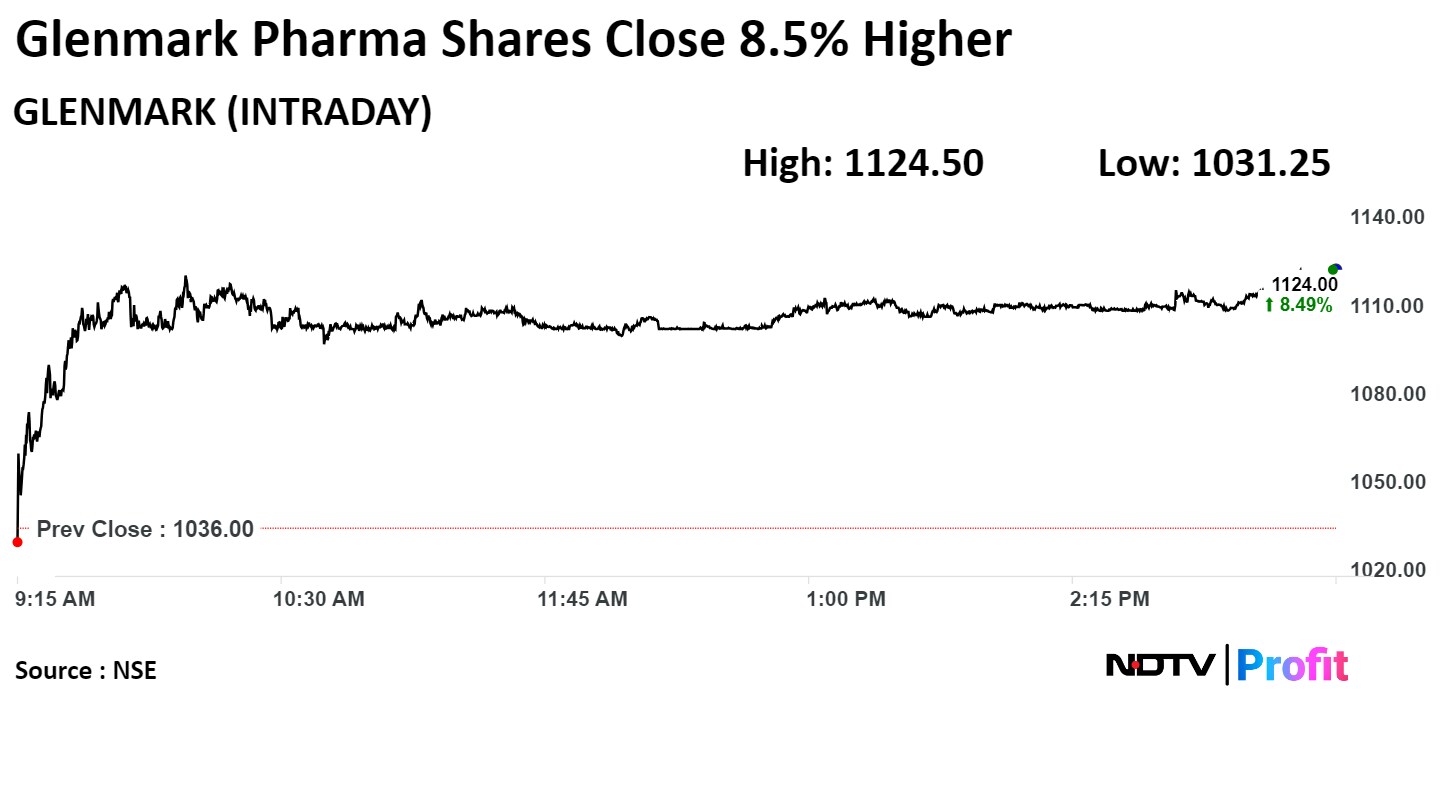

Shares of the company were trading 8.49% higher at Rs 1,124 apiece on the NSE at 3.30 p.m., compared to a 0.11% decline in the benchmark Nifty.

The share price has risen 88% in the last 12 months. The relative strength index was at 70.

Six out of the 14 analysts tracking the company have a 'buy' rating on the stock, five recommend a 'hold' and three suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 10%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.