Shares of Glenmark Pharmaceuticals Ltd. rose to all-time high on Thursday as it is set to exit Glenmark Life Sciences Ltd. through an offer for sale.

The promoter group will divest a 7.85% stake or approximately 96.12 lakh shares of the Glenmark Life Sciences. The offer will be open for institutional investors on Thursday, and for retail investors on Friday, according to an exchange filing.

The floor price is set at Rs 810 per equity share, implying an 8% discount from the closing price on Wednesday, it said.

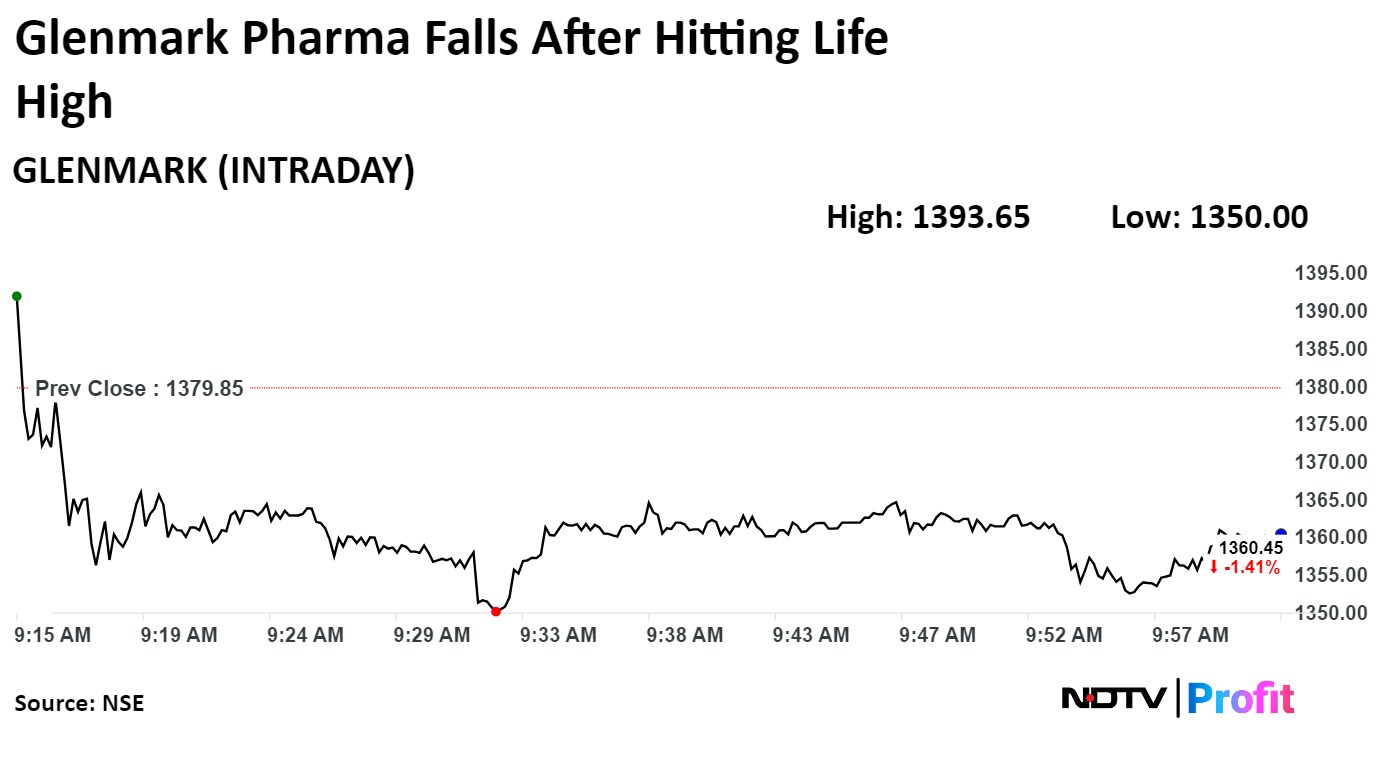

Glenmark Pharma's stock rose 1% in early trade to Rs 1,393 apiece on the NSE. It erased gains to trade 1.34% lower at Rs 1,361 per share, compared to a 0.09% advance in the benchmark Nifty at 9:53 a.m.

The share price has gained 72.17% in the last 12 months and 58.69% on a year-to-date basis. The total traded volume so far in the day stood at 0.97 times its 30-day average on NSE. The relative strength index was at 71.25, implying that the stock is overbought.

Six out of the 14 analysts tracking the company have a 'buy' rating on the stock, five recommend 'hold' and three suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 9.4%

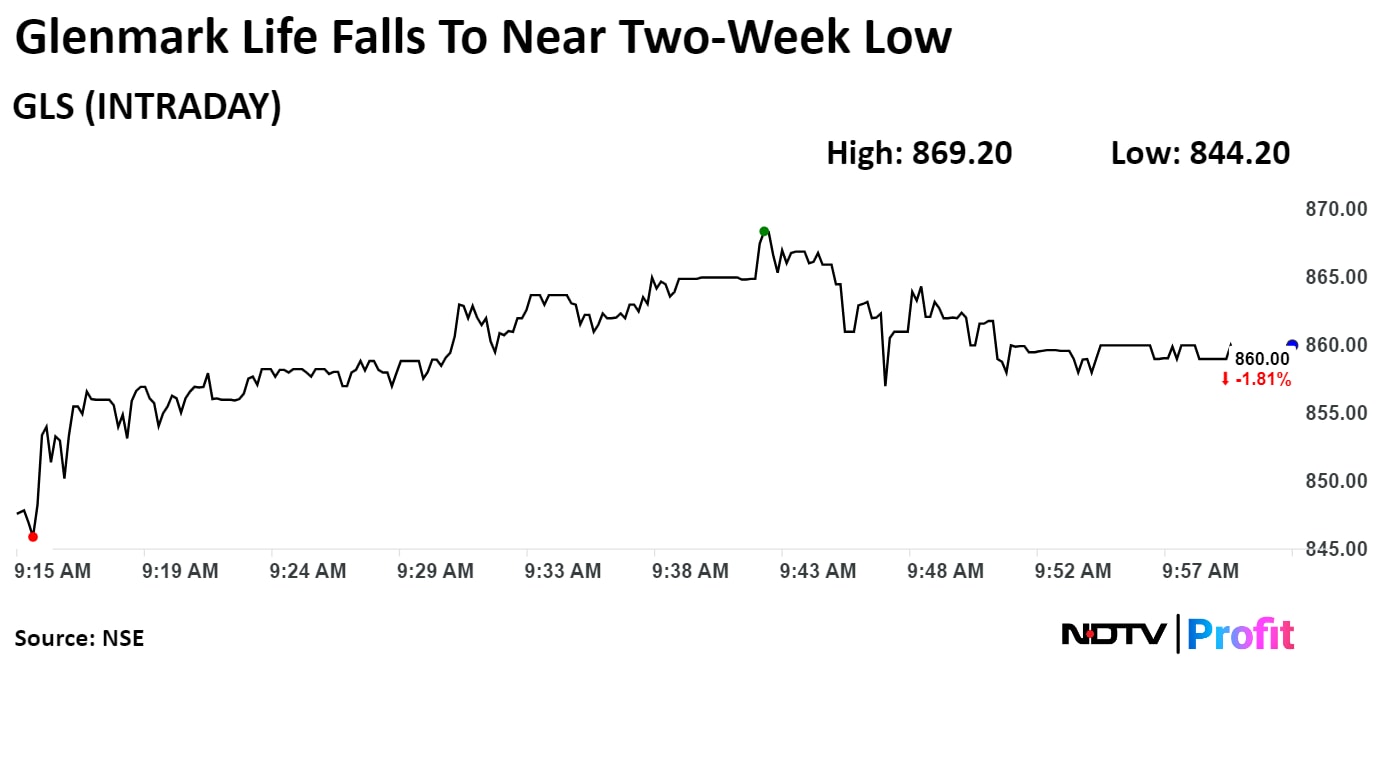

Shares of Glenmark Life declined as much as 3.61% during the day to Rs 844.20, the lowest since June 28. It was trading 1.92% lower at Rs 859 apiece as of 9:59 a.m.

The share price has gained 27.91% in the last 12 months and 30.89% on a year-to-date basis. The Total traded volume so far in the day stood at 1.79 times its 30-day average. The relative strength index was at 48.24.

Six out of the seven analysts tracking the company have a 'buy' rating and one recommends a 'hold', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 6.2%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.