Shares of General Insurance Corp. of India fell to their lowest level in over two weeks on Wednesday as the government began the process of selling a 6.78% stake in the company at Rs 395 each. The offer opened for non-retail investors on Wednesday.

In the offer to sell, the Government of India will offload a total of 11.90 crore shares with a face value of Rs 5 each. On Wednesday, it will make a base offer of 3.39% equity to non-retail investors. For retail investors and employees, the offer will open on Thursday with an additional 3.39% equity option to subscribe, the company said in an exchange filing.

Additional 50,000 equity shares will be offered for the company's employees, the exchange filing said.

As of June 30, the Government of India owns 150.5 crore shares, or 85.78% of its total equity. The rest, 14.22%, is public owned. General Insurance Corp of India has 175.44 crore shares.

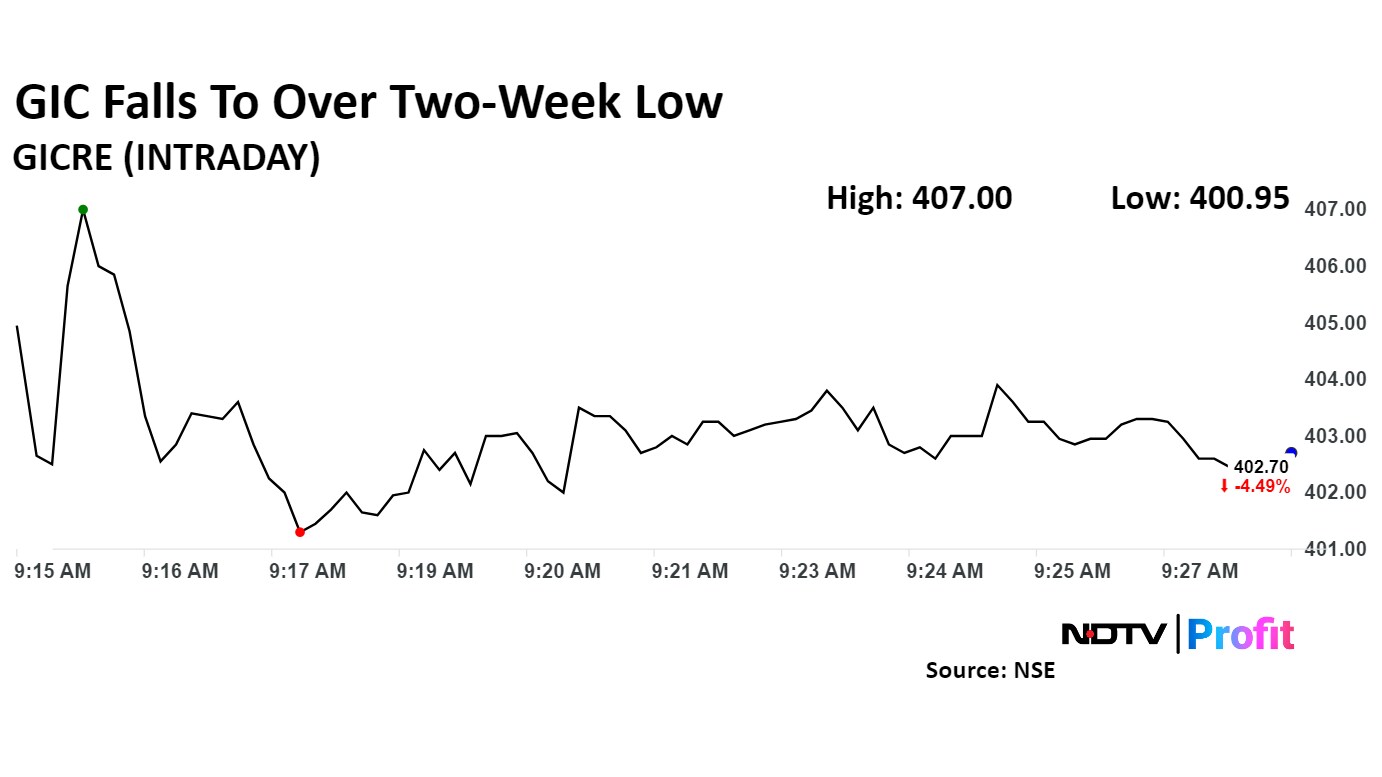

General Insurance Corp of India fell 4.91% to Rs 400.91, the lowest level since Aug 19. It was trading 4.51% lower at Rs 402.65 apiece, compared with 0.67% decline in the benchmark Nifty 50.

The scrip gained 78.50% in 12 months, and 30.76% on year to date basis. Total traded volume so far in the day stood at 15 times its 30-day average. The relative strength index was at 49.58.

Out of four analysts tracking the company, one maintain a 'buy' rating, X recommend a 'hold,' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 15.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.