Shares of GE Power India Ltd. hit a four-year high on Thursday after its board approved plans to sell its hydro and gas power businesses through a slump sale as part of a business restructuring.

GE Power India plans to sell its hydro business units to GE Power Electronics at a premium of Rs 100.19 crore by the last quarter of the fiscal year, reducing its non-fund credit line exposure to Rs 698.8 crore.

By September, the company plans to sell its gas power business units to GE Renewable Energy Technologies for Rs 43.86 crore, excluding taxes, to address outstanding current liabilities and improve the company's net worth.

Both GE Power India and GE Power Electronics are subsidiaries of the holding company, GE Vernova. GE Renewable Energy Technologies is an indirect, wholly owned subsidiary of GE Vernova, the holding company.

Separately, the company said it won an order from Mangalore Refinery and Petrochemicals Ltd. with a base value of Rs 7.67 crore.

The company will supply main turbine spares to Mangalore Refinery and Petrochemicals. The order is to be executed within 18 months, according to an exchange filing.

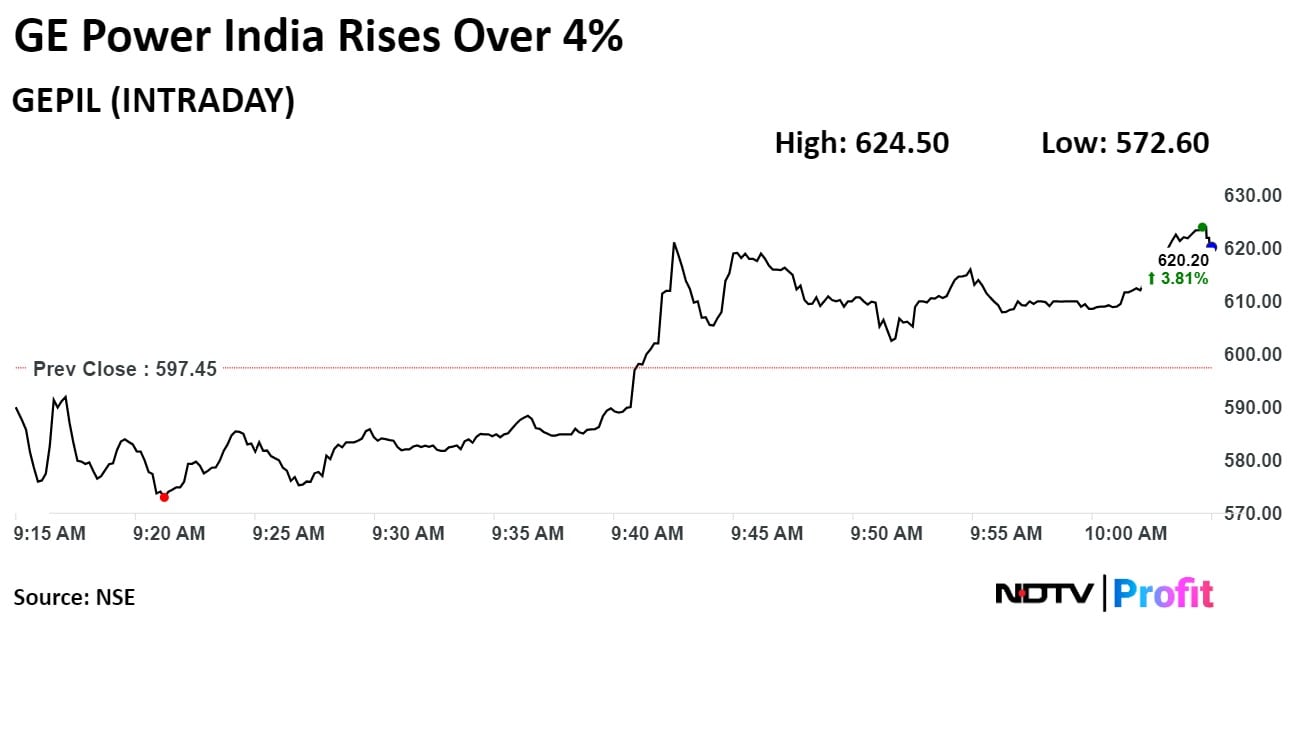

Shares of GE Power rose as much as 4.28% during the day to Rs 623 apiece on the NSE. It was trading 1.87% higher at Rs 608.60 apiece, compared to a 0.08% advance in the benchmark NSE Nifty 50 as of 10:02 a.m.

The stock has risen 283.85% in the last 12 months and 169.8% on a year-to-date basis. The relative strength index was at 88.40 indicating that the stock may be overbought.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.