Shares of Garden Reach Shipbuilders & Engineers Ltd. were up over 6% on Thursday, following the company's strong financial performance in the quarter ended Sept. 30, 2024, surpassing street expectations.

The defence aerospace company posted a profit of Rs 97.8 crore in the July–September quarter of the current financial year, up 21% compared to Rs 80.7 crore in the year-ago period, according to an exchange filing on Wednesday. Analysts tracked by Bloomberg had a consensus estimate of Rs 87 crore.

The company marked a 28% growth in revenue at Rs 1,152.9 crore year-on-year, as compared to Rs 897.9 crore. Analyst estimates had pegged the revenue to be around Rs 915 crore.

GRSE Q2 FY25 Earnings' Highlights (Consolidated, YoY)

Revenue up 28% to Rs 1,152.9 crore versus Rs 897.9 crore (Bloomberg estimate: Rs 915 crore).

Ebitda up 41% to Rs 68.7 crore versus Rs 48.8 crore (Estimate: Rs 60 crore).

Margin expanded 60 basis points to 6% versus 5.4% (Estimate: 6.5%).

Net profit up 21% to Rs 97.8 crore versus Rs 80.7 crore (Estimate: Rs 87 crore).

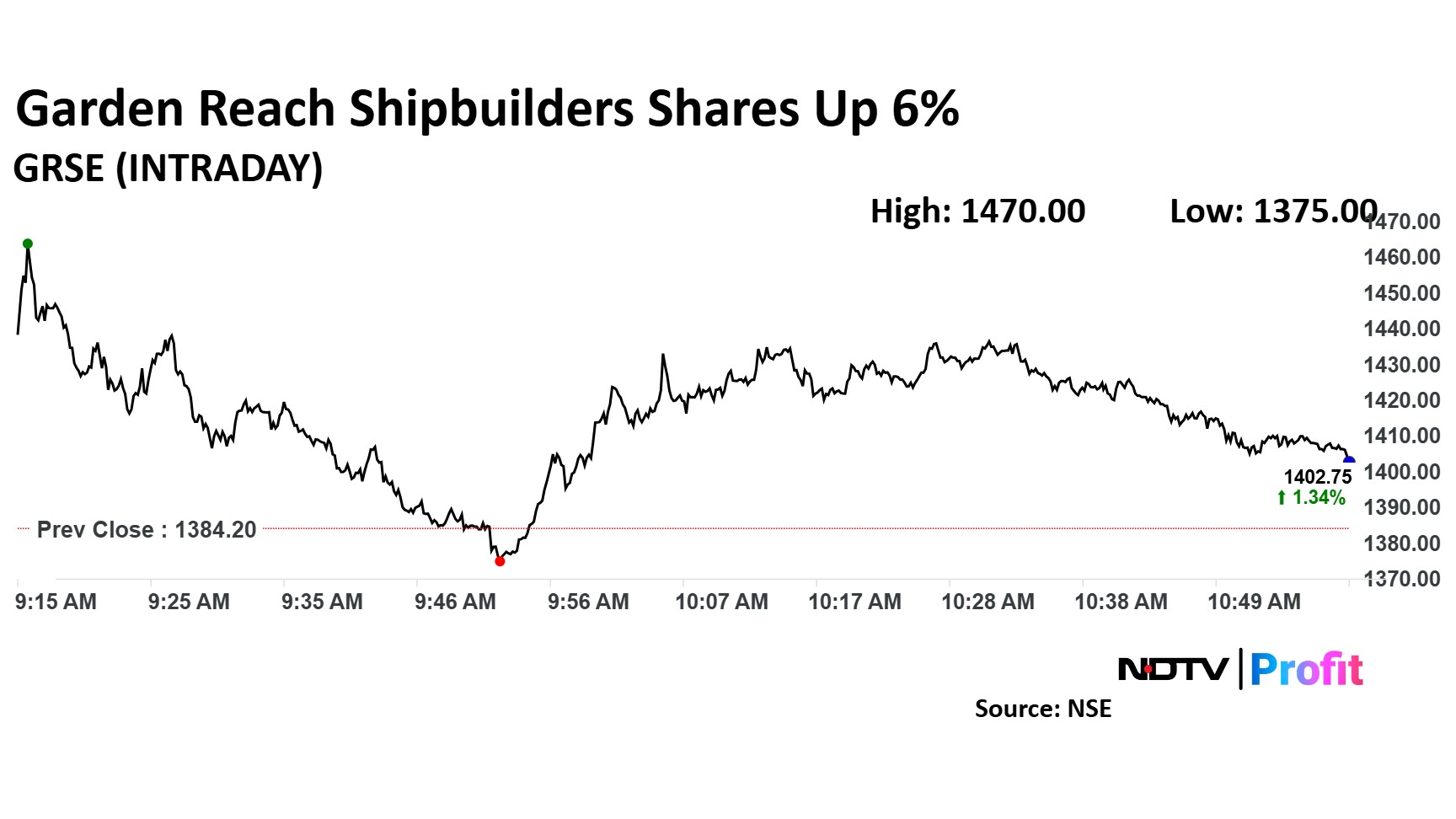

Garden Reach Shipbuilders Share Price Today

Share price of Garden Reach Shipbuilders rose as much as 6.20% to Rs 1,470 apiece. It pared gains to trade 1.29% higher at Rs 1,402 apiece, as of 11:00 a.m., compared to a 0.01% decline in the NSE Nifty 50.

The stock has risen 61.64% on a year-to-date basis. Total traded volume so far in the day stood at 1.2 times its 30-day average. The relative strength index was at 32.83.

Out of four analysts tracking the company, two maintain a 'buy' rating and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 12.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.