.png?downsize=773:435)

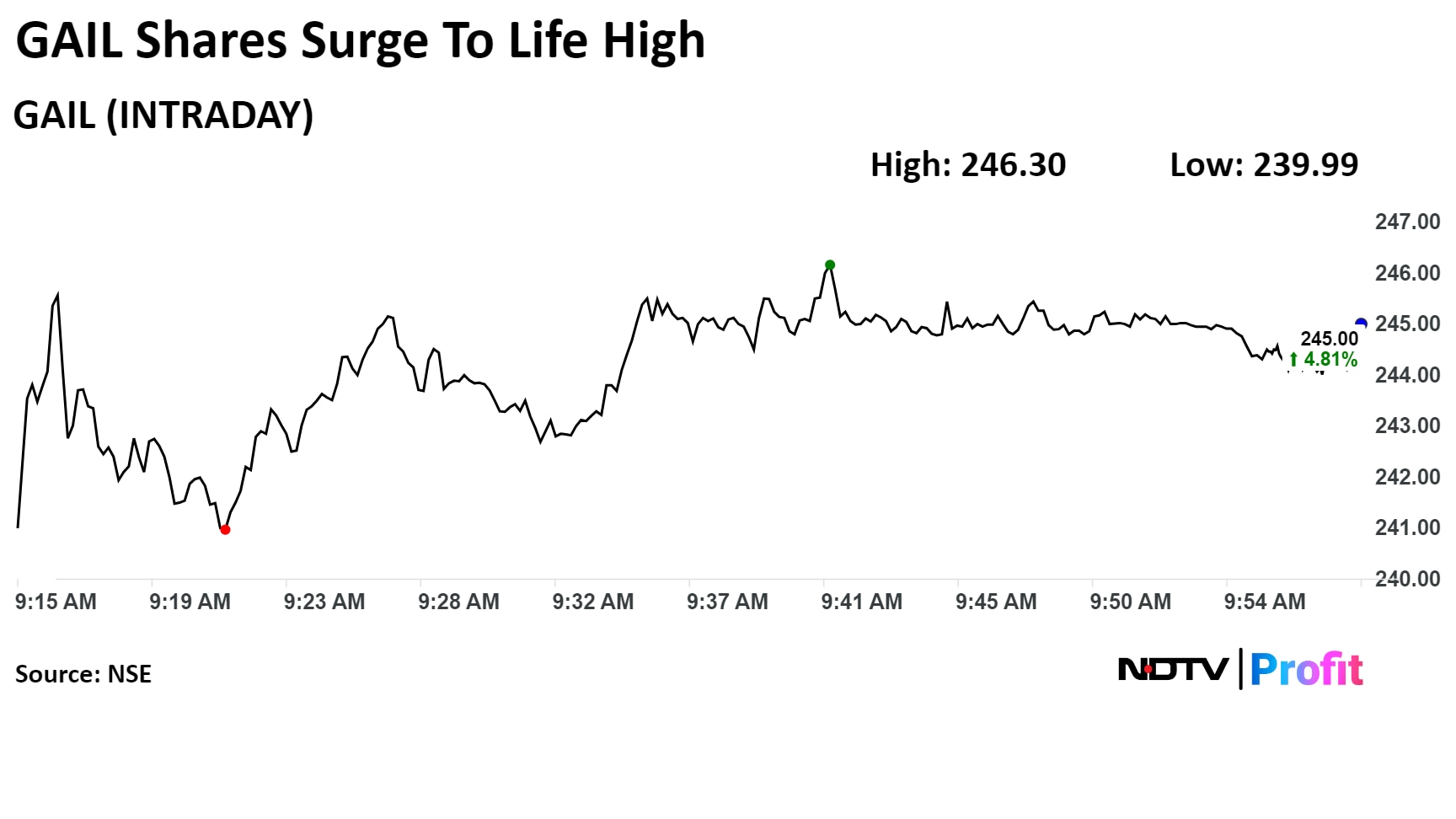

Shares of GAIL (India) Ltd. surged over 5% to an all-time high on Tuesday as its consolidated net profit jumped 78% in the first quarter of the current financial year, beating analysts' estimates.

The company had two block deals during the market pre-open, with 1.4 million and 1.14 million shares changing hands, according to Bloomberg. The buyers and sellers were not known immediately.

The rise in profit was mainly on account of increased gas-transmission volume, domestic natural gas marketing volume, and improved natural gas marketing margin, it said.

The company has incurred a capital expenditure of Rs 1,659 crore during the quarter, which is about 21% of the target of Rs 8,044 crore for the current fiscal. The capex was mainly spent on pipelines, petrochemicals, and equity to joint ventures, according to Chairperson Sandeep Gupta.

GAIL has advanced its net-zero-carbon target for Scope-1 and Scope-2 emissions to 2035 from 2040, he said. Scope 1 emissions are direct greenhouse gas emissions from controlled or owned sources, while Scope 2 emissions are indirect GHG emissions from electricity, steam, heat or cooling purchases.

GAIL Q1 FY25 Earnings Highlights (Consolidated, QoQ)

Revenue up 6% to Rs 34,738 crore versus Rs 32,789 crore (Bloomberg estimate: Rs 32,892.7 crore).

Ebitda up 80% to Rs 4,790 crore versus Rs 2,660 crore.

Margin expands to 13.8% versus 8.1%.

Net profit up 77.5% to Rs 3,183 crore versus Rs 1,793 crore (Estimate: Rs 2,148.5 crore)

Citi Research On GAIL

The brokerage maintained a 'buy' rating on the stock and a target price of Rs 250 apiece, implying a potential upside of 7.3% from the previous close.

GAIL recorded solid first-quarter performance, with Ebitda coming 33% ahead of the brokerage's estimate.

The estimate beat was driven by stronger-than-expected performance in the gas-transmission and gas-trading segments.

Petrochemical and liquefied-petroleum-gas segment performance was weaker than expectations.

GAIL's stock rose as much as 5.37% during the day to Rs 246.30 apiece on the NSE. It was trading 4.77% higher at Rs 244.91 per share, compared to a 0.15% advance in the benchmark Nifty as of 9:54 a.m.

The share price has risen 105.23% in the last 12 months and 50.85% on a year-to-date basis. The total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 67.98.

Twenty out of the 35 analysts tracking GAIL have a 'buy' rating on the stock, six recommend 'hold' and nine suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 15.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.