GAIL (India) Ltd.'s share price recorded its best single-day jump since June on Wednesday after its September quarter profit met analysts' estimates.

The company's net profit fell 16% sequentially to Rs 2,690 crore in the quarter ended September 2024, according to an exchange filing on Tuesday. That compares with Rs 2,616 crore, the consensus analysts' estimate tracked by Bloomberg.

GAIL Q2 Results: Key Highlights (Consolidated, QoQ)

Revenue down 2.4% to Rs 33,889 crore. (Bloomberg estimate: Rs 33,936 crore).

Ebitda down 18% to Rs 3,937 crore. (Bloomberg estimate: Rs 4,018 crore)

Margin narrows 220 basis points to 11.6% (Bloomberg estimate: 11.8%)

Net profit down 16% to Rs 2,690 crore. (Bloomberg estimate: Rs 2,616 crore)

GAIL's consolidated revenue remained flat with a 2.81% growth. The company's earnings before interest, taxes, depreciation and amortisation, and profit both rose 10% on an annual basis.

"The natural gas transmission volume stood at 130.63 million metric standard cubic meters per day in the second quarter and gas marketing volume was 96.60 MMSCMD during the same quarter," the company said in an exchange filing

The liquid hydrocarbon and polymer sale stood at 253 thousand metric tone and 226 TMT respectively in the second quarter as compared to 218 TMT and 169 TMT, respectively, in first quarter of fiscal 2025, it said.

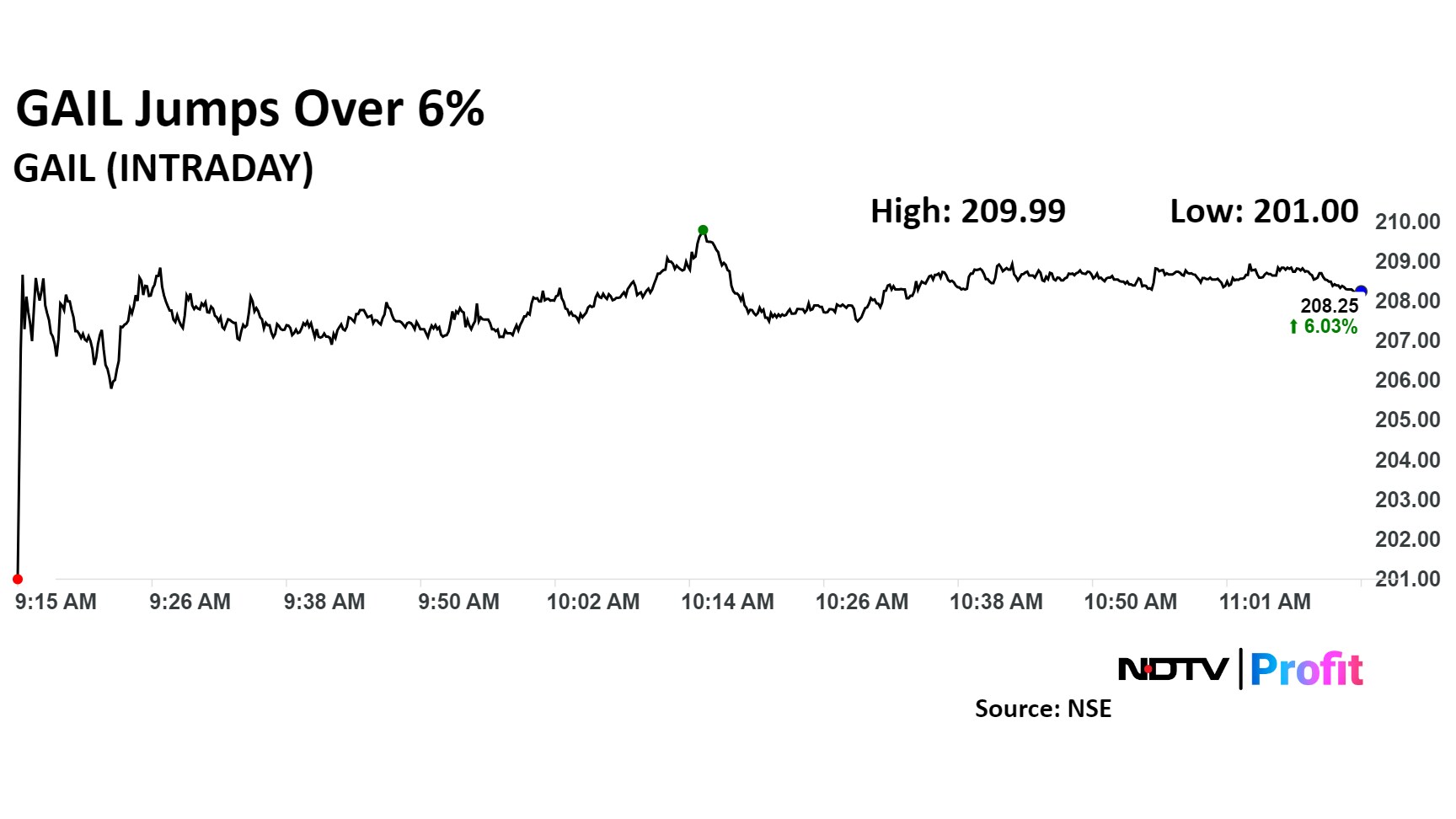

Shares of GAIL (India) rose as much as 6.9% to Rs 209.99 apiece, the highest level since Oct. 25. It pared gains to trade 5.88% higher at Rs 691 apiece as of 11:18 a.m. This compares to a 0.6% advance in the NSE Nifty 50 Index.

The stock has risen 28.25% on a year-to-date basis and 57.5% in the last 12 months. Total traded volume so far in the day stood at 2.38 times its 30-day average. The relative strength index was at 43.9.

Out of the 36 analysts tracking the company, 23 maintain a 'buy' rating, three recommend a 'hold,' and 10 suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 20.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.