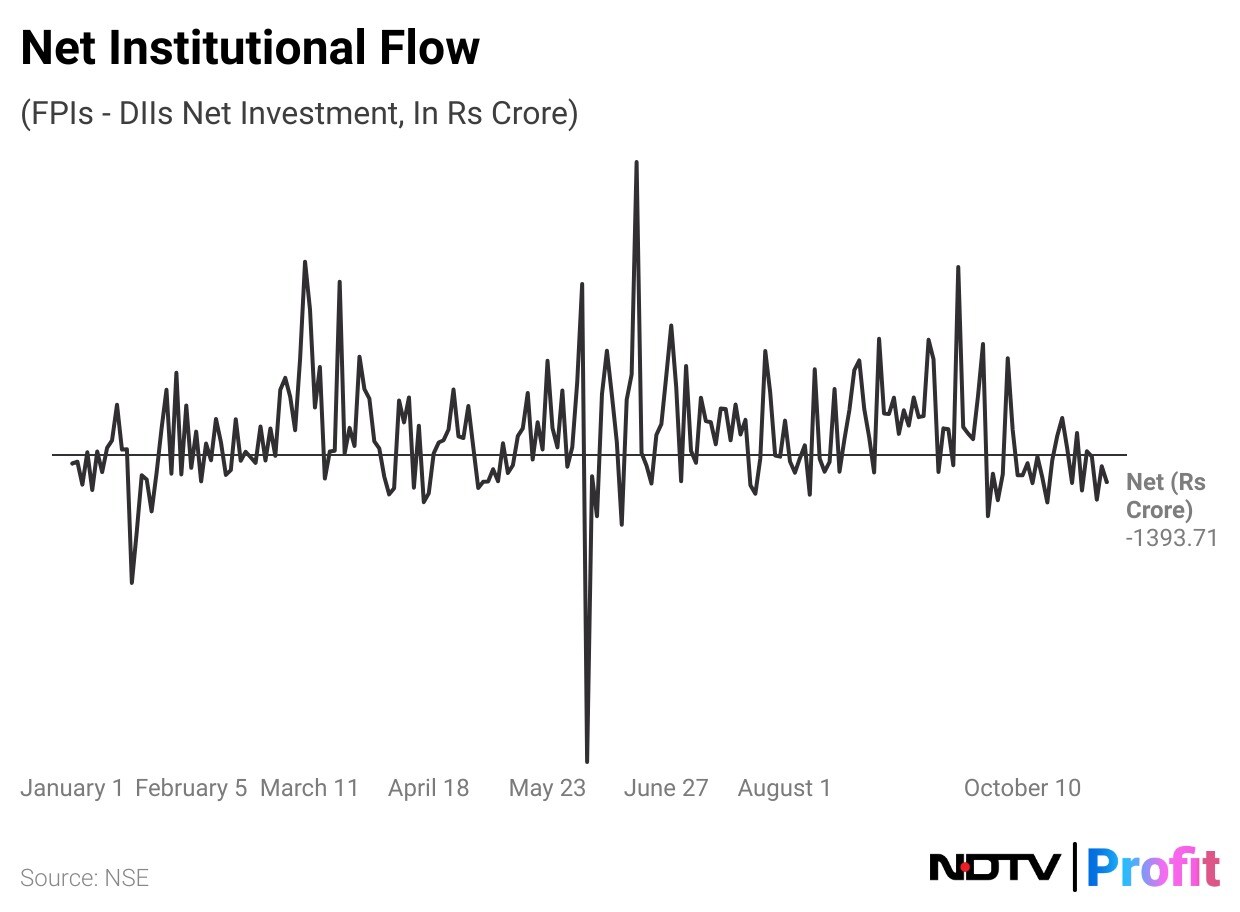

Overseas investors remained net sellers of Indian equities for the 26th consecutive session on Monday, while domestic institutional investors turned net buyers after a session of selling.

Foreign portfolio investors offloaded stocks with an approximate value of Rs 4,329.8 crore, according to provisional data from the National Stock Exchange. The DIIs bought stocks worth Rs 2,936.1 crore.

In the last five sessions, the FPIs have sold equities valued at Rs 15,517.4 crore, while the DIIs have purchased shares worth Rs 11,321.8 crore.

In October, the FPIs offloaded stocks with a value of Rs 1.14 lakh crore, while the DIIs mopped up stocks worth Rs 1.07 lakh crore. While, in September, the FPIs had bought stocks valued at Rs 15,423.4 crore, while the DIIs purchased stocks worth Rs 31,860.3 crore.

Foreign institutions have been net buyers of Rs 2,249 crore worth of Indian equities so far in 2024, according to data from the National Securities Depository Ltd., updated till the previous trading day.

Market sentiment remained highly pessimistic, with all sector indices closing in the red, according to Ameya Ranadive, a chartered market technician at StoxBox.

"We have identified the most immediate support level for the Nifty 50 near 23,900. Should this level be breached, there is a potential for further exacerbation of the current market weakness,” he said.

India's benchmark stock indices, NSE Nifty 50 and BSE Sensex, closed at their lowest levels in over a month on Monday, led by declines in Reliance Industries Ltd. and HDFC Bank Ltd.

The Nifty 50 settled 309.00 points, or 1.27%, lower at 23,995.35, and the Sensex fell 941.88 points, or 1.18%, to end at 78,782.24.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.