(Bloomberg) -- Global banks are targeting shorter maturities in their purchases of India's sovereign bonds, tapping improved liquidity amid limited supply, according to Bank of America Corp.'s head of India fixed income.

Foreign banks bought nearly 600 billion rupees ($7.2 billion) in all maturities since the start of June even as state-run banks and mutual funds sold, according to Clearing Corp. of India data. CCIL doesn't break down the data by maturity.

Investors' eagerness for short-term bonds are driven by lower supply of treasury bills, coupled with banking liquidity improvement that was largely triggered by higher government spending and large sizes of bonds that matured, Vikas Jain, Bank of America's head of India fixed income, currencies and commodities trading, said in an interview.

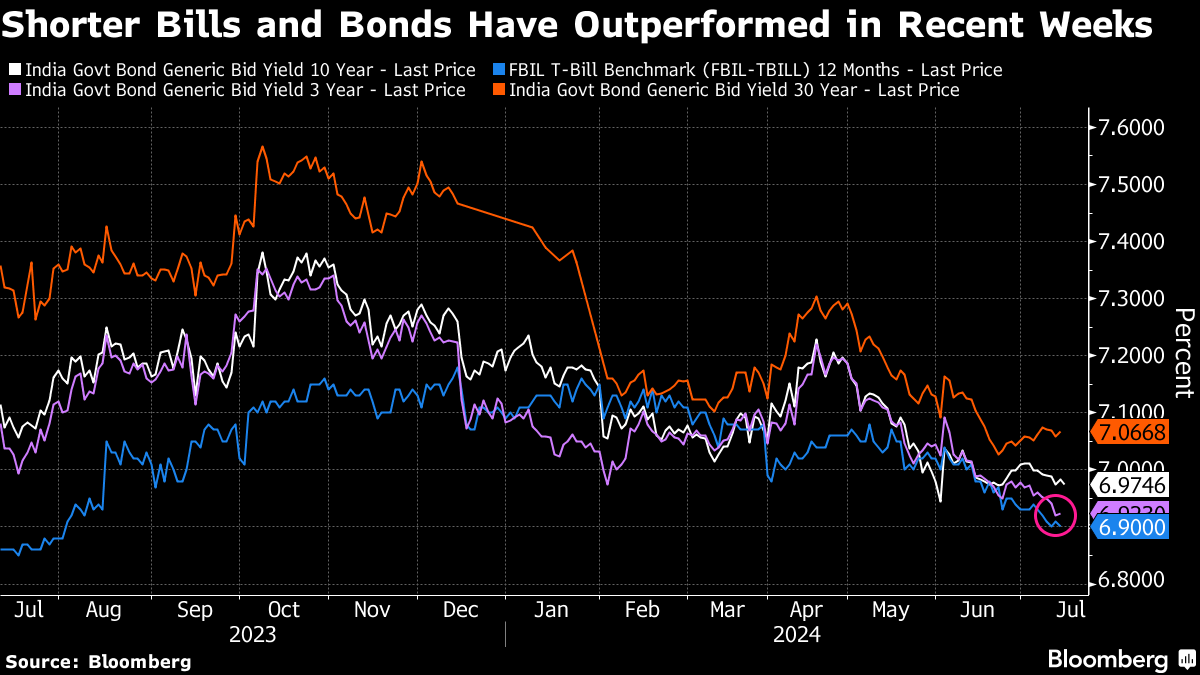

The preference for shorter-dated notes underscores their common tactic of managing balance sheets using such instruments. It also points to the fast-moving gyrations in the nation's fixed income market following JPMorgan Chase & Co.'s inclusion of Indian sovereign bonds last month to its emerging-market index.

The JPMorgan index inclusion has also raised demand for bonds. “Foreign banks have also seen increased demand for government securities from foreign portfolio investors, and hence they have increased their inventory to meet this demand,” he said.

Indian authorities surprised the markets by cutting sales of treasury bills, with maturities up to a year, by 600 billion rupees in the last quarter. That drove yields on the three-year bond lower by seven basis points last month, compared with a rise of three points on the 10-year paper.

Improvement in liquidity has brought down the overnight rates, lowering banks' borrowing costs in buying bonds and driving demand higher for shorter papers, Jain said. Foreign banks that operate in India, which also benefit from better liquidity, often address their asset-liability management with short-term papers, he added.

READ: JPMorgan Says Foreign Holding of Indian Bonds to Almost Double

The yield on the benchmark 10-year bond has yet to fall below the 6.95% level despite the index-inclusion inflows. If the government delivers a lower fiscal deficit in the budget, that may act as a next big trigger for the market, Jain said.

“The only way, it can break that is if the fiscal deficit number comes below 5%,” Jain said. “Then we are definitely moving toward 6.75%-6.80% kind of a yield level.”

The Reserve Bank of India is likely to cut interest rates by 100 basis points in the next 18 months, he said. “There is a much bigger room for the yield curve to move lower” if the repurchase rate goes to 5.5% by March 2026.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.