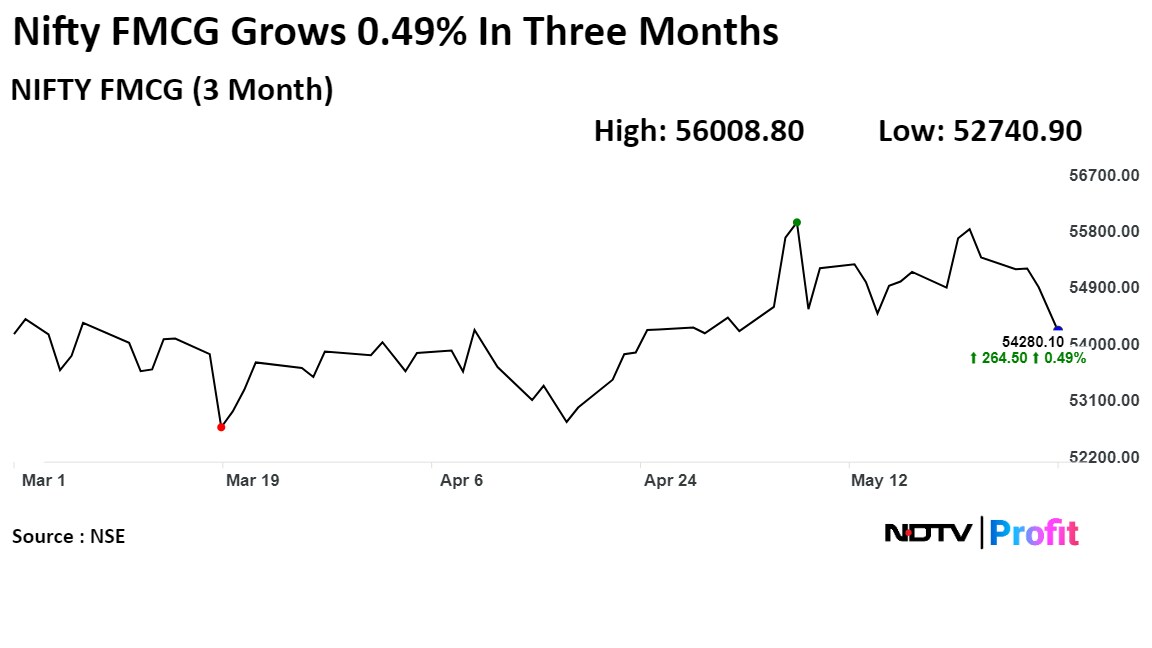

The Nifty Fast-Moving Consumer Goods index closed 1.26% lower on Thursday. However, analysts expect the sector to make a comeback. Theb FMCG space—that has grown only 0.49% in the last three months—has the potential to scale all-time highs, according to them.

"There have been green shoots of recovery in the FMCG sector and that has been reflected, of course, in the performance of Emami Ltd. as well as other stocks like Dabur Ltd. and Marico Ltd. I think the FMCG sector has really been a sort of sector which is on the comeback as far as Q4 is concerned," said Nirav Asher, head-equity research analyst at Latin Manharlal Securities Pvt.

The Emami stock has surged 17.03% since its strong fourth-quarter performance. The growth will likely boost the prospects of the sector, according to Asher.

Jai Bala, founder and chief market technician at Cashthechaos, concurred and said he had predicted that FMCG has potential to scale all-time high. The sector retains the potential to break the 60,000 mark, with Emami and Dabur India in the lead, he said.

However, looking at the current valuation and the risk-reward buying, Emami may not be a profitable move, he said. One might not buy at the current valuations but should have accumulated earlier, Asher said.

The benchmark equity indices fell for the fifth consecutive session on Thursday as heavyweights weighed on them.

The NSE Nifty 50 closed 216.05 points or 0.95%, down at 22,488.65, while the S&P BSE Sensex ended 617.30 points or 0.83%, lower at 73,885.60.

In terms of the decline in Tata Steel shares, Asher said coking coal prices may go up in the near term and this could impact the company's margin. The company's domestic operations and steel operations have been quite strong and in line with the market expectations, he said.

Bala cautioned against Tata Steel, as he expects a larger correction if it closes below Rs 155 levels.

Watch The Full Video Here:

The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.