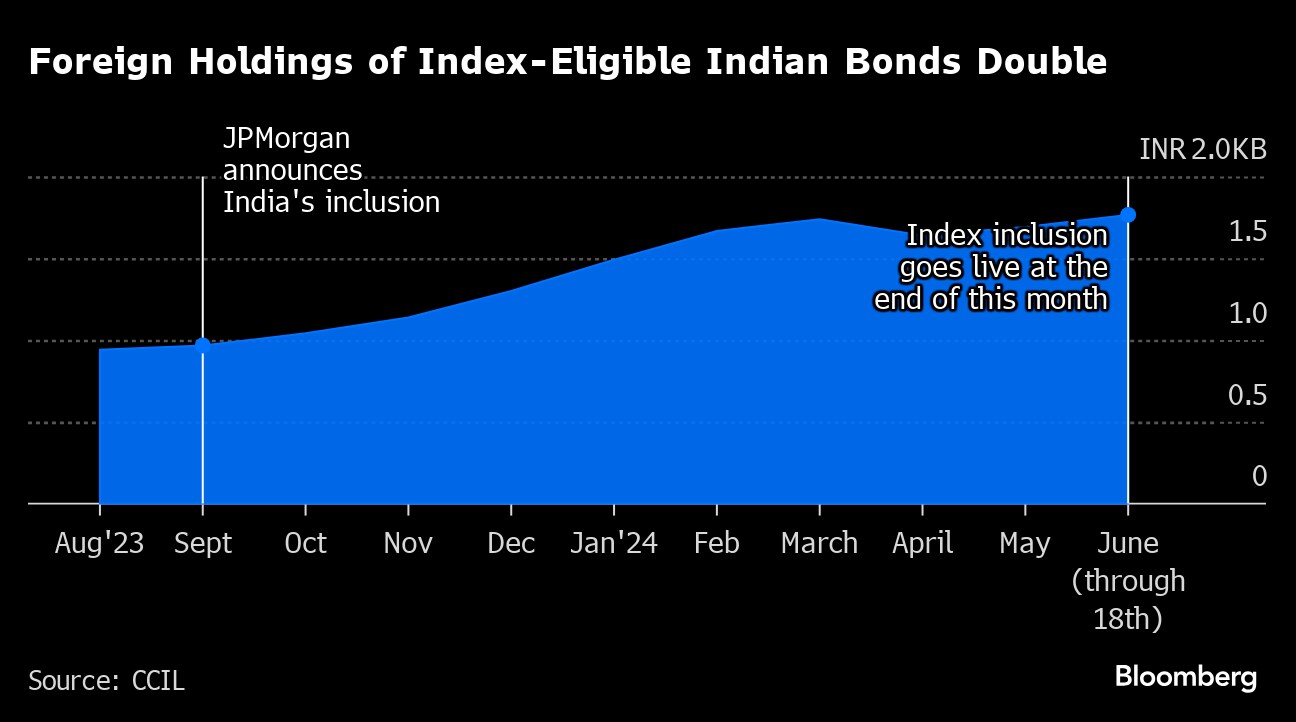

(Bloomberg) -- Foreign investors are returning to Indian bonds after a selloff in April, ahead of the debt's inclusion into a key global index at the month-end.

Net flows have climbed to $10 billion since September when JPMorgan Chase & Co. announced the inclusion starting June 28.

The inflows are helping cool yields after Prime Minister Narendra Modi formed a coalition government following a surprisingly close election contest. The yield on 10-year government bonds has fallen eight basis points to 6.98% from this month's high.

Global funds bought a net 73.5 billion rupees ($881 million) of the nation's index-eligible debt this month through June 18, following purchases of about 52 billion rupees in May. They sold 98.3 billion rupees of the so-called Fully Accessible Route bonds in April, according to data from the Clearing Corp. of India.

The purchases are seen adding to tailwinds such as a robust dividend payment by the central bank to the government ahead of the annual budget.

Bloomberg Index Services Ltd. will also include some India bonds in its emerging market local currency index starting next year. Bloomberg LP is the parent company of Bloomberg Index Services Ltd., which administers indexes that compete with those from other service providers.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.