(Bloomberg) -- Earnings season continues for the world's largest oil and gas producers, with Chevron Corp. and Exxon Mobil Corp. capping the reporting period on Friday. A crop tour in top US wheat-growing state North Dakota is yielding some promising results for global grain supplies. And the world just keeps getting warmer.

Here are five notable charts to consider in global commodity markets as the week gets underway.

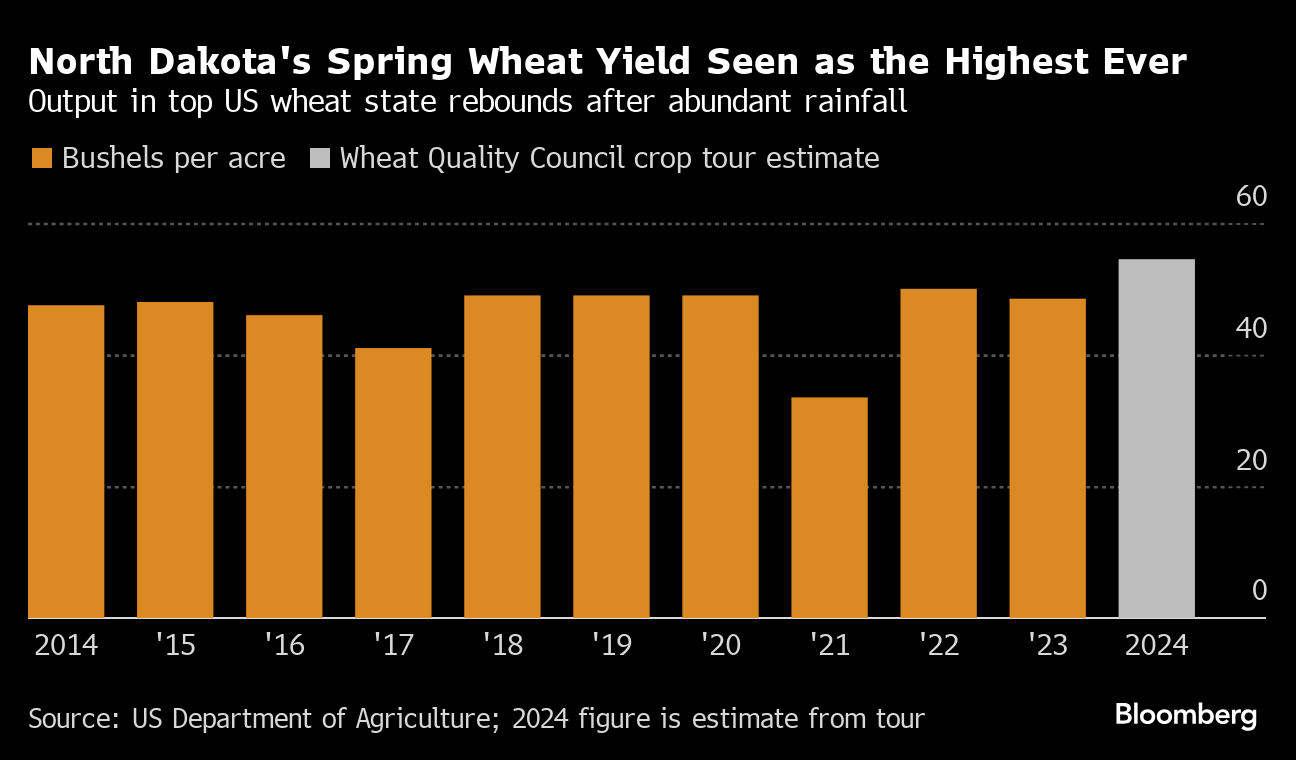

Wheat

Record-high wheat yields in the US Plains state of North Dakota are set to further expand American grain supplies. Dozens of wheat traders, millers and bakers who traveled across the state in an annual crop tour last week found lush wheat fields thick with tall, green plants — a good sign for US exports. American farmers have been reaping bumper grain crops, helping to bolster global output.

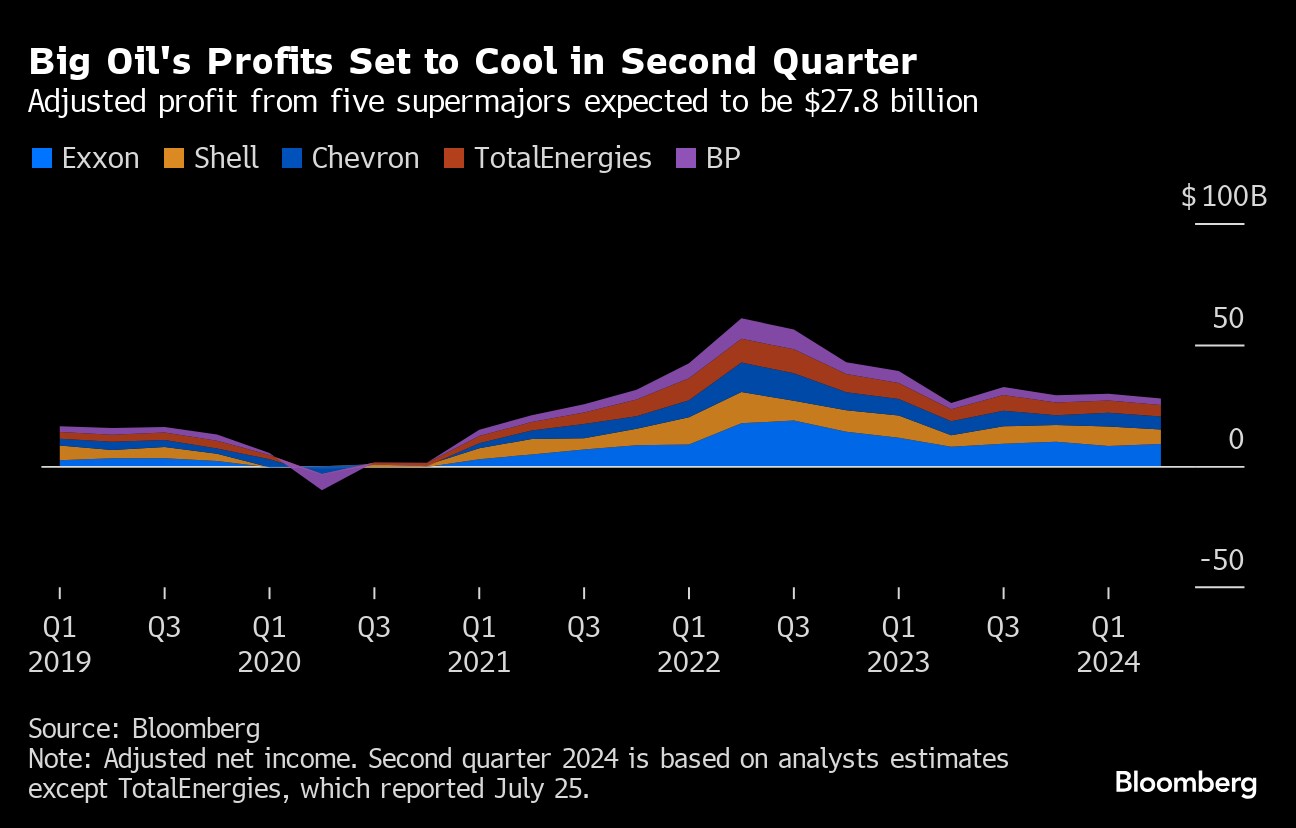

Oil

Big Oil's quarterly earnings season continues with four supermajors reporting second-quarter results this week. TotalEnergies SE has already given a hint of what's to come, after posting a bigger-than-expected profit drop last Thursday due in part to weaker refining margins in Europe and the Middle East. BP Plc and Shell Plc release results Tuesday followed by Chevron and Exxon on Friday. The five energy giants are collectively forecast to report $27.8 billion in adjusted net income for the period, 6.6% lower than the first quarter, with refining margins expected to be a drag on results.

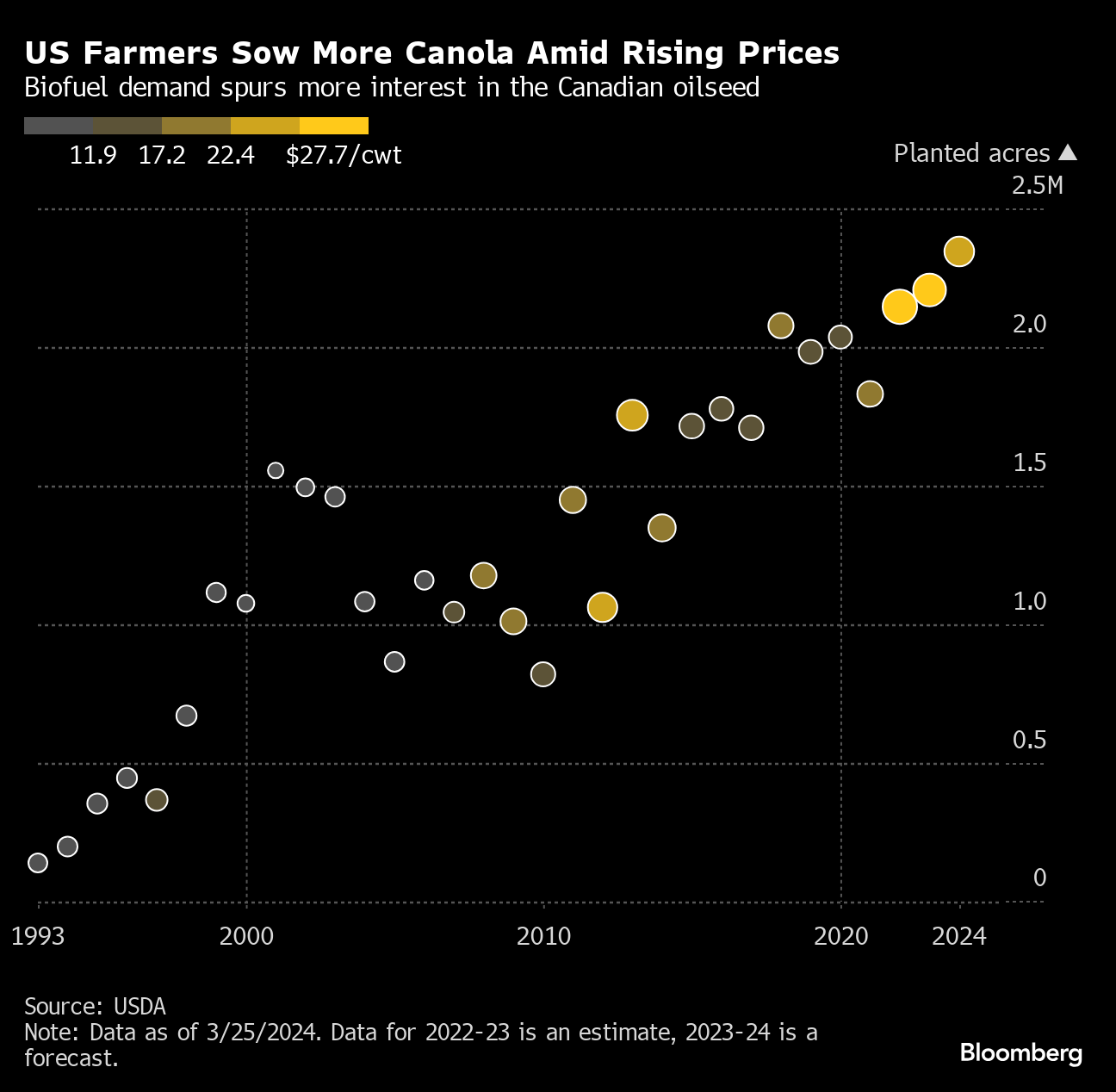

Canola

After decades of slow progress, winter canola is getting a new chance to take off in the US, thanks to the crop's potential as a source of renewable diesel and jet fuel. Canola has a much higher oil content than soy, which under the right growing conditions, makes it an ideal raw material for biofuels. Along with states like Kentucky, Tennessee and Kansas, there is an attempt underway to plant winter canola in Illinois, the biggest US grower of soybeans — which yields about half the oil as canola.

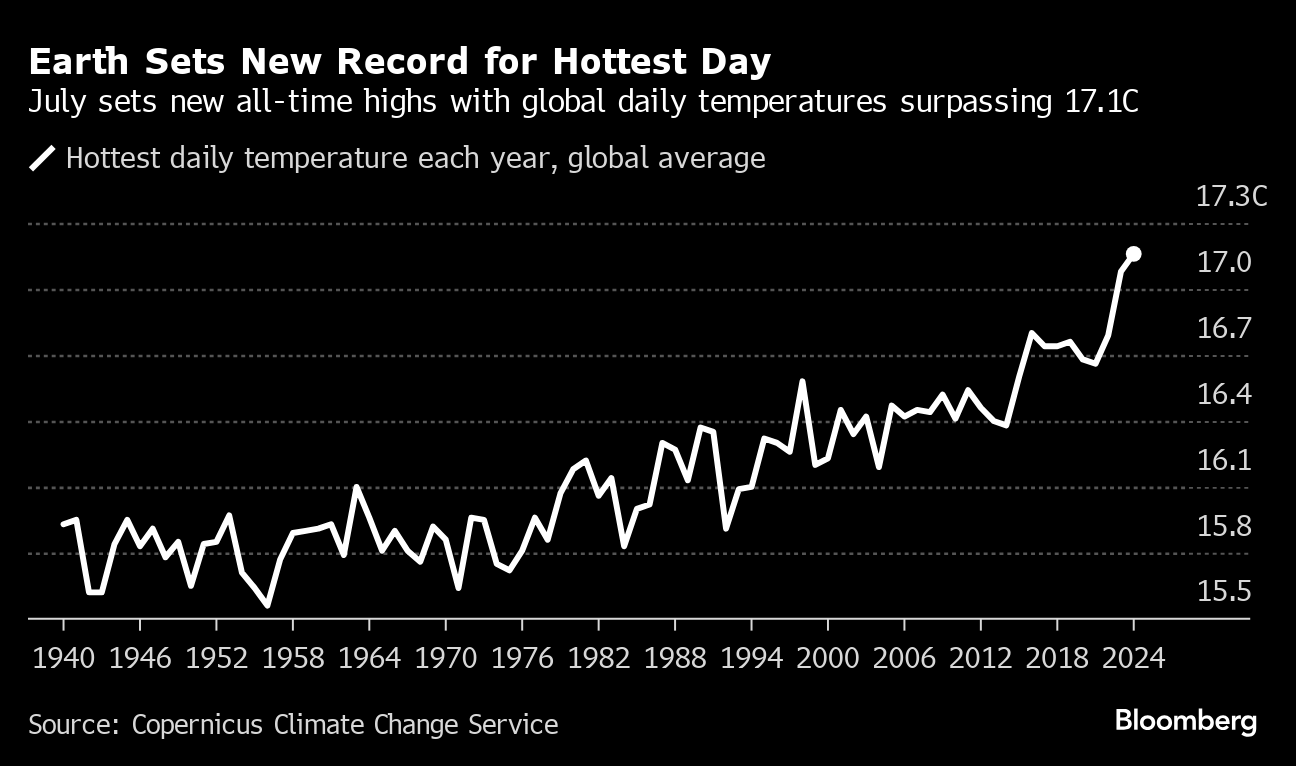

Climate

The world keeps heating up, with global average temperatures already hitting or exceeding a key climate threshold for 12 months — highlighting the challenge of limiting global warming to below 1.5C above the pre-industrial era. The highest average daily temperature on Earth keeps setting new records, at one point rising above 17.1, according to provisional data from the European Union's Copernicus Climate Change Service. Climate change is increasing the frequency and intensity of heat waves, bringing extreme weather events from flooding to wildfires and causing havoc to commodities markets such as agriculture and energy.

Lithium

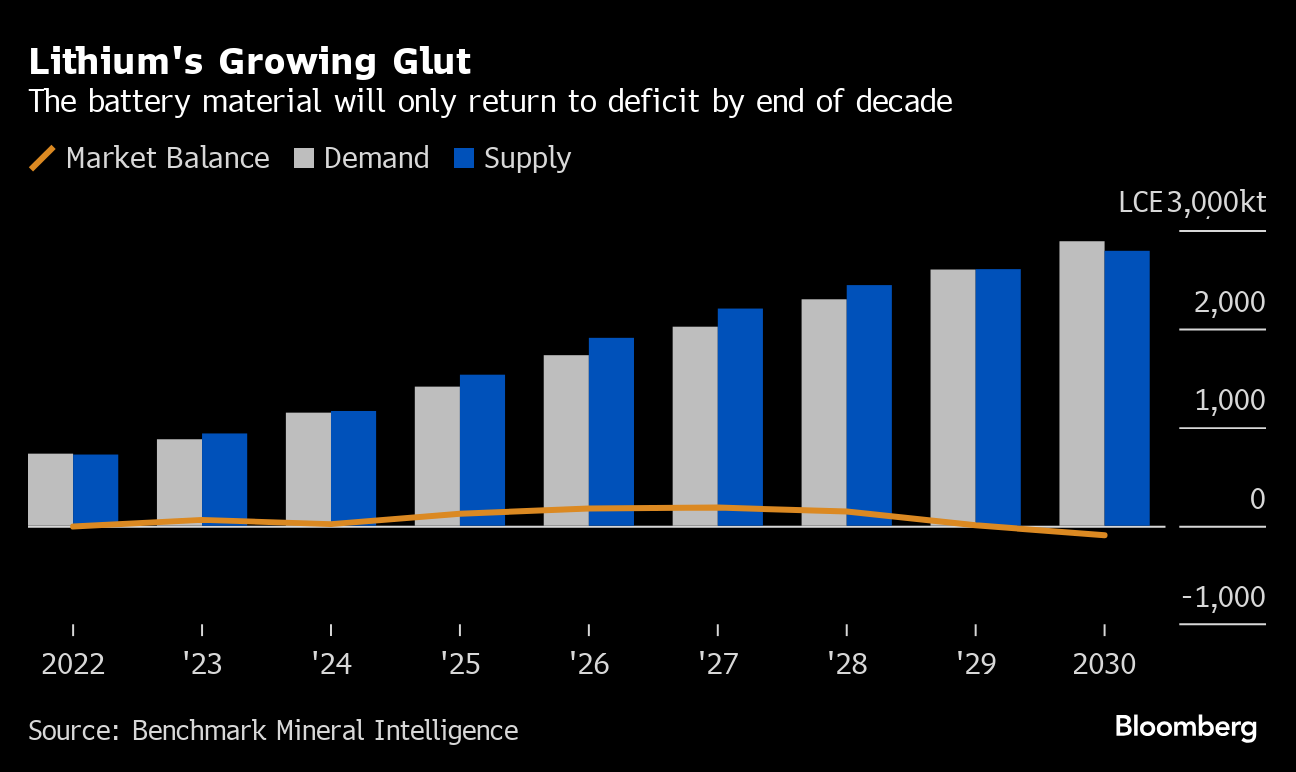

With lithium prices near three-year lows and showing no signs of a recovery, attention is turning to whether miners will be forced to rein in supply of the battery metal. The price of the metal vital to the energy transition has plunged 86% since November 2022, and Benchmark Mineral Intelligence sees the current glut deepening through 2027. Lithium remains in the doldrums due to slowing growth in electric-vehicle adoption and increased supply.

--With assistance from Kim Chipman, Kevin Crowley and Doug Alexander.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.