(Bloomberg) -- It's bad timing for chocolate lovers with cocoa prices soaring to the highest ever. Meanwhile, record warm temperatures look set to continue, posing an ongoing threat to crops, energy supplies and transportation. The Organization of Petroleum Exporting Countries and the International Energy Agency publish their respective monthly oil market reports. And more earnings are on tap, including from mining behemoth Barrick Gold Corp., machinery maker Deere & Co. and oil companies Eni SpA and Occidental Petroleum Corp.

Here are five notable charts to consider in global commodity markets as the week gets underway.

Soft Commodities

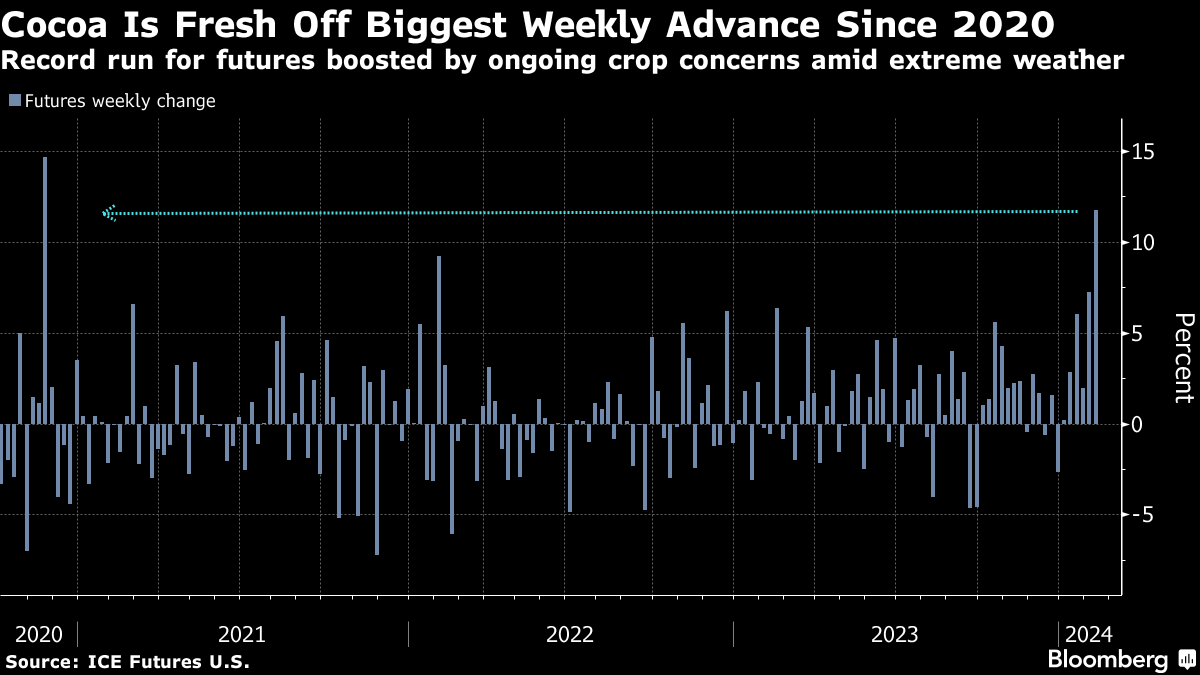

With Valentine's Day approaching, it's a good time to check in on cocoa, the main ingredient in chocolate. Futures traded in New York are fresh off a record high and biggest weekly advance in more than three years, as extreme weather in West Africa ravages crops. That — coupled with rising sugar futures — has increased input costs for candy and chocolate makers. Low cocoa supplies from Ivory Coast and Ghana, the world's two biggest producers, will continue to pressure prices and in turn add to elevated costs for consumers, Hershey Co. has warned. In the US, candy — which includes chocolate — is expected to be the top gift category as Americans lavish their loved ones on Wednesday, according to the annual survey by the National Retail Federation and Prosper Insights & Analytics.

Climate

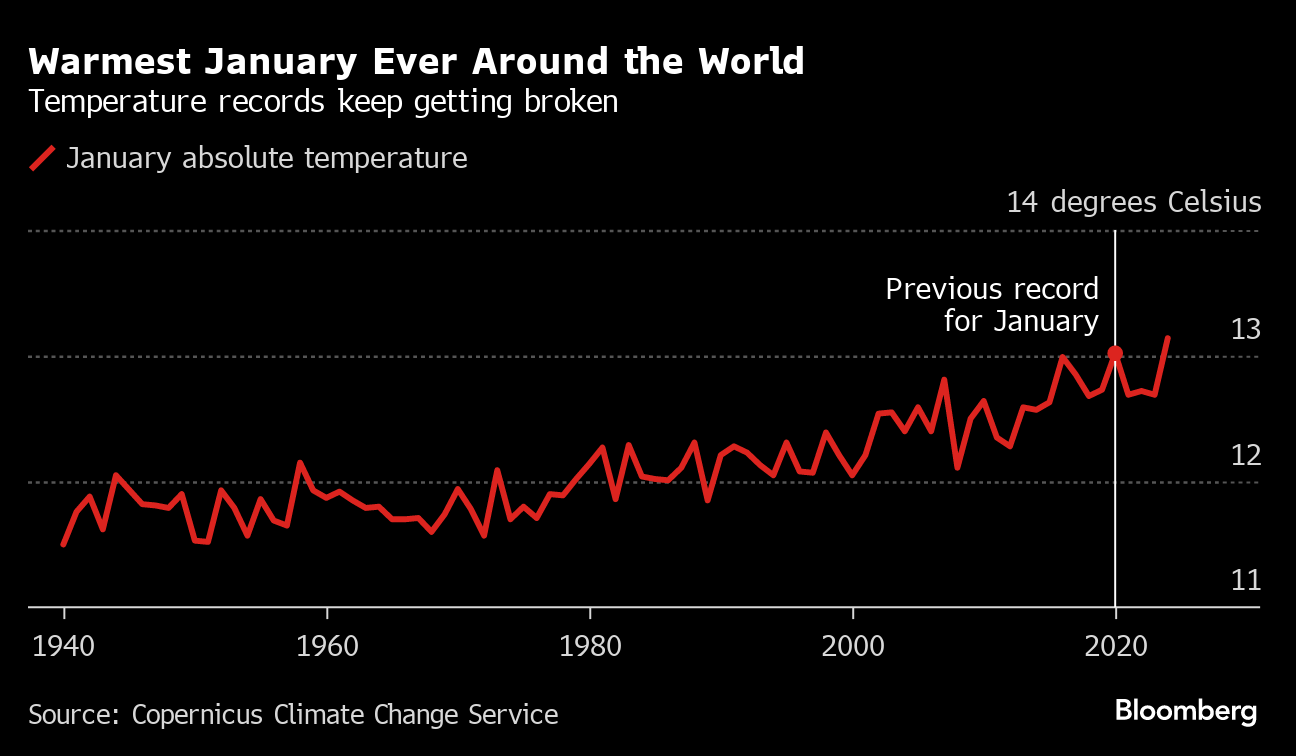

Yet another temperature milestone is in the books, and it's not necessarily good news. Last month was officially the Earth's warmest January on record, according to the European Union's Copernicus Climate Change Service. And it also marked the eighth straight month with a fresh peak for the period. The warm weather has curbed demand for natural gas during the Northern Hemisphere winter when it normally peaks. And scientists are already bracing for what may be the hottest year ever, topping last year's extremes. That's due to a combination of more planet-warming greenhouse gas emissions in the atmosphere and El Niño, a cyclical phenomenon that alters ocean circulation and weather patterns, leading to more heat and drought in many latitudes.

Oil

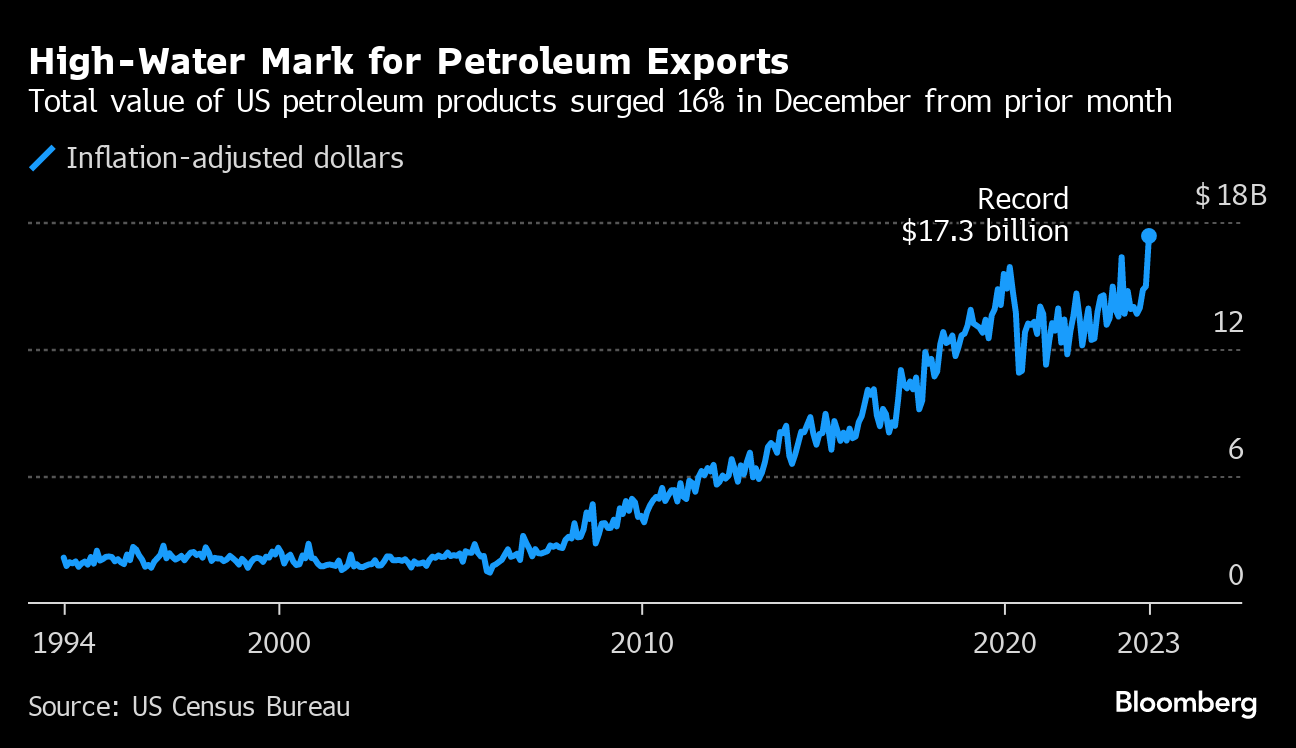

It wasn't just US oil production that hit a record in 2023 — the total value of exported petroleum products also peaked, surging in December to $17.3 billion, according to Census Bureau data. For all of 2023, shipments totaled $175 billion, an 8% increase from the prior year. The US had been running a deficit in the petroleum import-export balance up until 2020 when it changed to a surplus — $16.6 billion — for the first time, data going back to 1994 show. Last year, the overall total trade balance for petroleum rose to $18.3 billion, also a record. And with another bumper year ahead expected for oil production, these figures may keep rising.

Metals

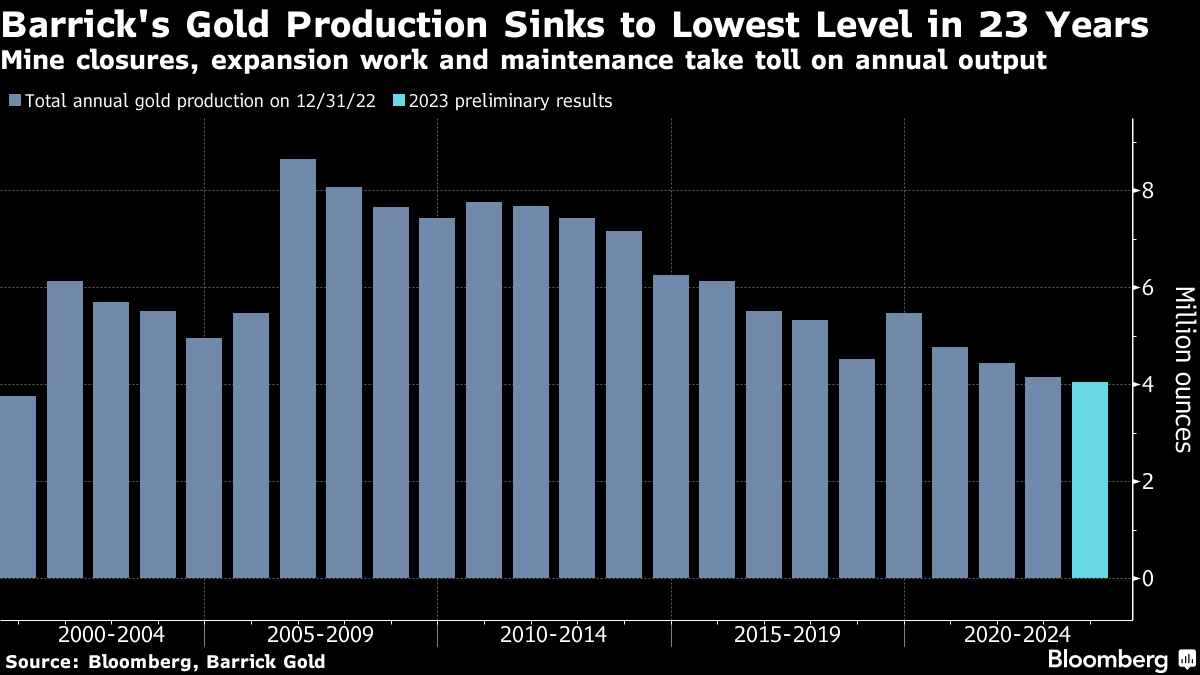

Barrick's gold output hit its lowest level since 2000 last year following a series of setbacks across its operations. Maintenance and repair work at its Nevada mines, an expansion at Pueblo Viejo in the Dominican Republic and a prolonged shutdown at a major asset in Papua New Guinea all contributed to a 23-year low in total bullion ounces for the world's second-largest gold miner. Investors will be seeking insight into this year's production outlook when the Canadian metals producer reports fourth-quarter earnings on Wednesday. The company posted preliminary results last month.

Agriculture

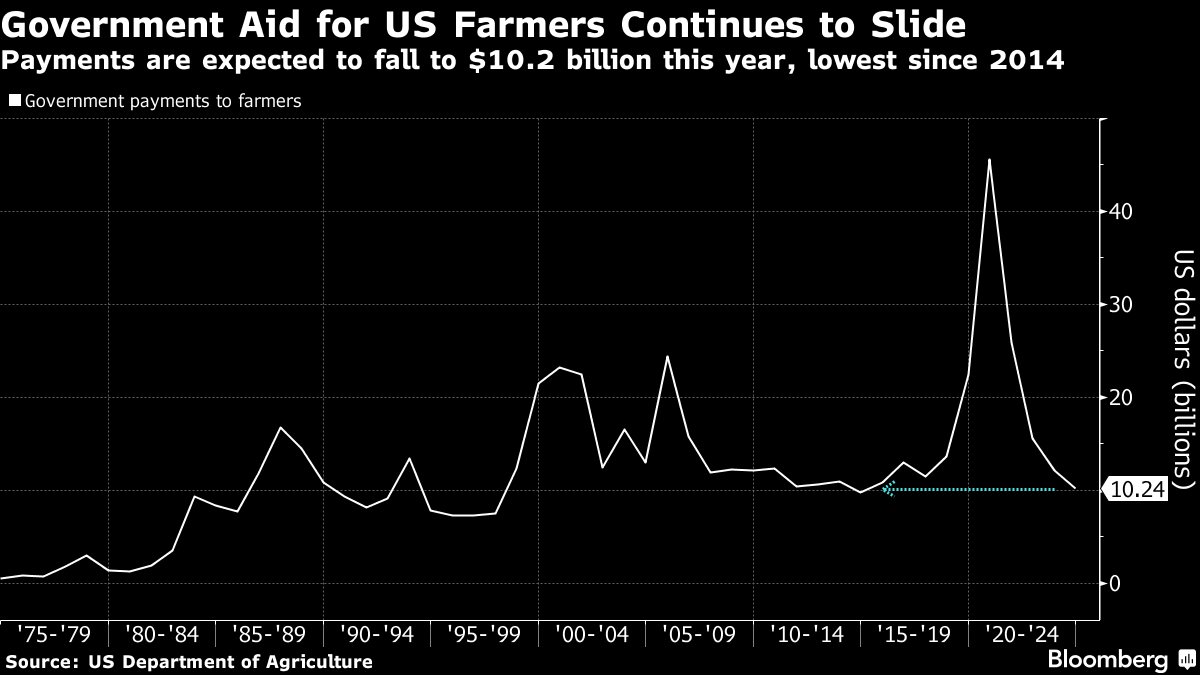

Direct government payments to US farmers are forecast to decline to $10.2 billion on expectations for less supplemental and disaster assistance in 2024, according to US Department of Agriculture data released last week. If realized, that would be the lowest since 2014 and mark less than a quarter of the record amount that was doled out in 2020 amid the Covid-19 pandemic and trade disputes. Former President Donald Trump has previously touted that assistance, intended to offset losses linked to trade spats, when appealing to rural voters.

--With assistance from Alex Tanzi, Jacob Lorinc, Ilena Peng and Michael Hirtzer.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.