Shares of small-cap auto components maker Fiem Industries Ltd. gained on Tuesday after Kotak Securities Ltd. initiated coverage with a 'buy' call and a price target of Rs 2,140, representing 39% potential upside.

Fiem's product portfolio is engine technology agnostic, and thereby the rise in electric vehicle share does not pose any threat to the company's business, the brokerage said in a note on Tuesday. The company's top clients include Honda Motorcycle and Scooter India, TVS Motors Co., Yamaha Motor India, and Suzuki Motorcycle.

It manufactures automotive lighting, rear view mirrors, sheet metal parts, and plastic components.

Healthy volume growth in the two-wheeler industry over the next three years will trickle down to the company. Increasing LED adoption in the automotive industry would further add to earnings and revenue growth for Fiem, Kotak Securities said.

"The company's entry in the four-wheeler LED lighting segment provides new growth opportunity. The company has a strong balance sheet and healthy return ratios," the brokerage said.

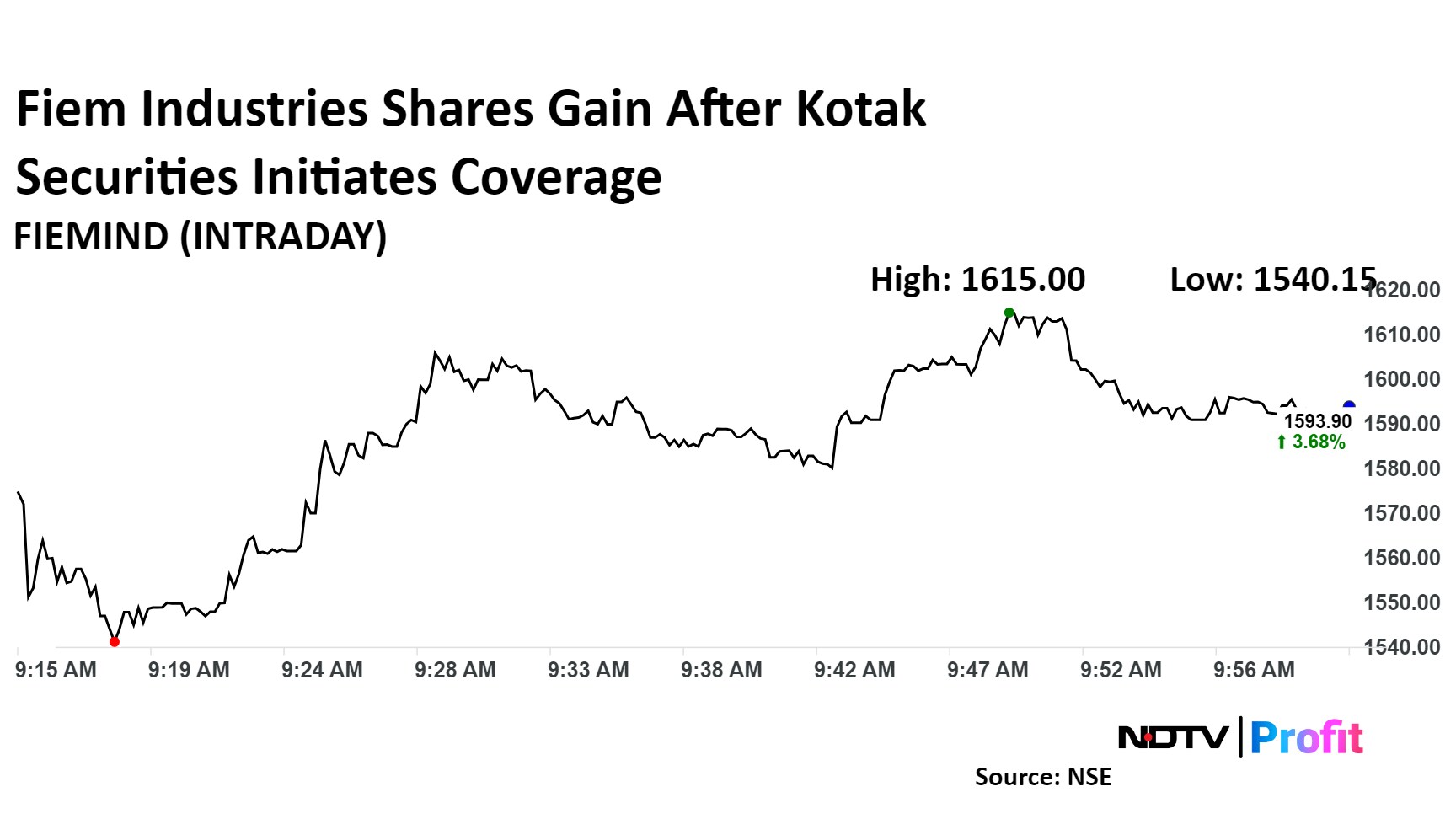

Shares of Fiem Industries advanced 5% to an intraday high of Rs 1,615 apiece. The scrip was trading 3.7% higher at Rs 1,593 by 9:58 a.m. The benchmark NSE Nifty 50 was trading 0.17% higher.

It has risen 59% in the last 12 months and 52% on a year-to-date basis. The total traded volume so far in the day stood at 2.6 times its 30-day average. The relative strength index was at 72.

Three out of the six analysts tracking Fiem Industries have a 'buy' rating on the stock and three recommend a 'hold', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 2.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.