Volatility in fertiliser stocks will remain in the lead up to the Union budget, according to an analyst, as sector outlook remains unclear over government policy and valuations stretch.

"It's not clear whether any of the fertiliser companies would have the ability to have the alpha gain from policy decisions," Deven Choksey, managing director of DRChoksey Investment Managers Pvt., told NDTV Profit.

"We don't have complete clarity on sustainability part of the current pricing front, with respect to input costs," he said.

Expectation mismatch takes place around government policy, Choksey said, and sectors that are predominantly dependant on government policy are used largely for short-term trading to take advantage of price volatility.

Shares of fertiliser companies tumbled on Monday on likely profit-booking, following a strong rally the previous week. Leading the decline was Fertilizers and Chemicals Travancore Ltd., which fell over 9% during the day.

Despite the GST Council's proposal for an exemption of fertiliser from GST, market participants booked profit, even as the parliamentary panel recommendations for exempting fertilisers from GST was forwarded to the Group of Ministers on rate rationalisation.

"These businesses are difficult to make money from if you are a long-term investor," Choksey said.

The elevated levels in benchmark equity gauges discourage index positions and investors should be prudent in approach and stock-specific, said Hemen Kapadia, senior-VP of institutional equity at KR Choksey Stocks and Securities.

The Nifty 50 moved up nearly 2,400 points since hitting its low on June 4, he said, adding that he doesn't see legroom for upward move in the last week of monthly contract expiry.

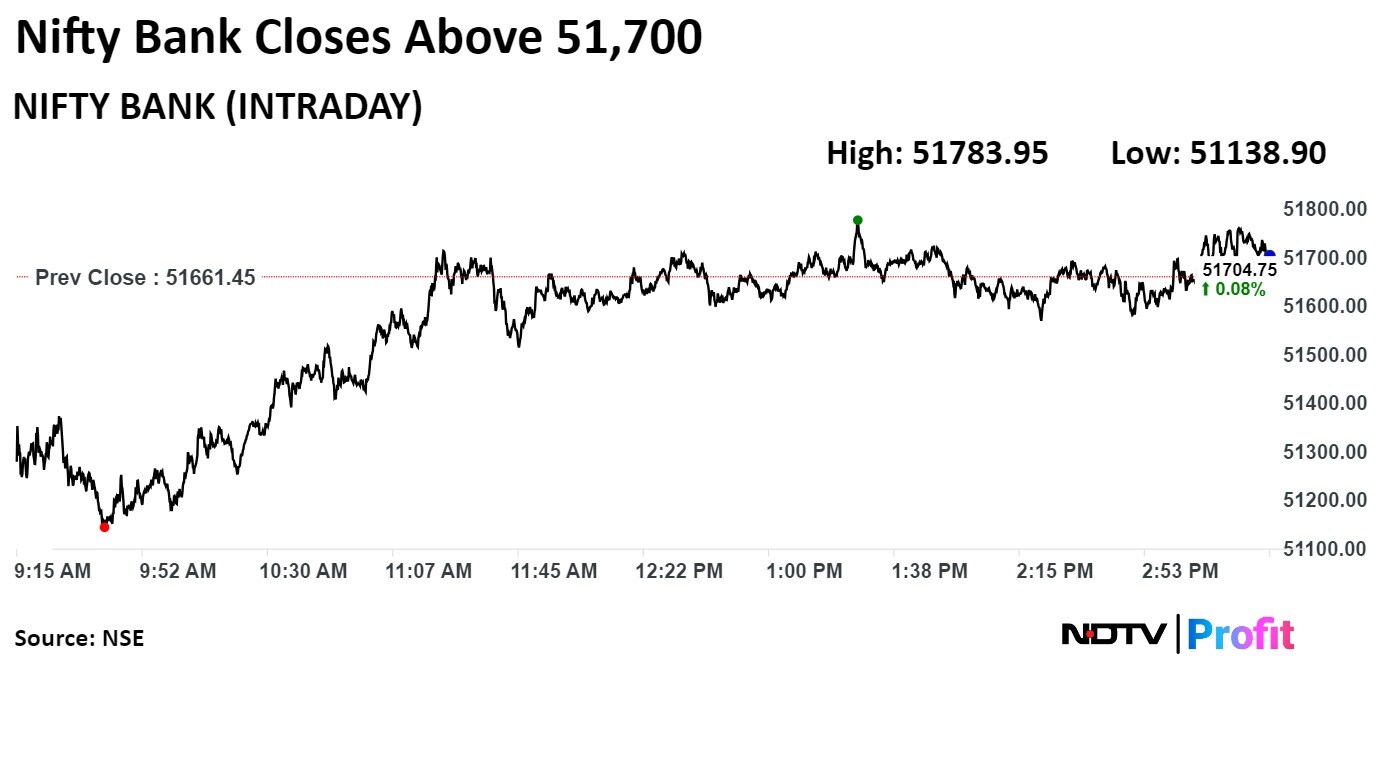

For the Bank Nifty, 51,955 is the breakout level, according to Kapadia. He said PSU banks are taking a breather after the multifold rally since 2020.

Benchmark equity indices ended on a positive note after opening lower as shares of private banks and Mahindra & Mahindra Ltd. gained.

The NSE Nifty 50 closed 36.75 points, or 0.16%, up at 23,537.85, while the S&P BSE Sensex ended 131.18 points, or 0.17%, higher at 77,341.08. During the day, both the indices fell as much as 0.6%.

The Nifty reversed from the lower end of the consolidation to form a green candle, with the downside being protected at 23,400, while the higher side is also capped at 23,660, according to Aditya Gaggar, director of Progressive Share Brokers. "A precise close on either side will provide a clear picture."

The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.