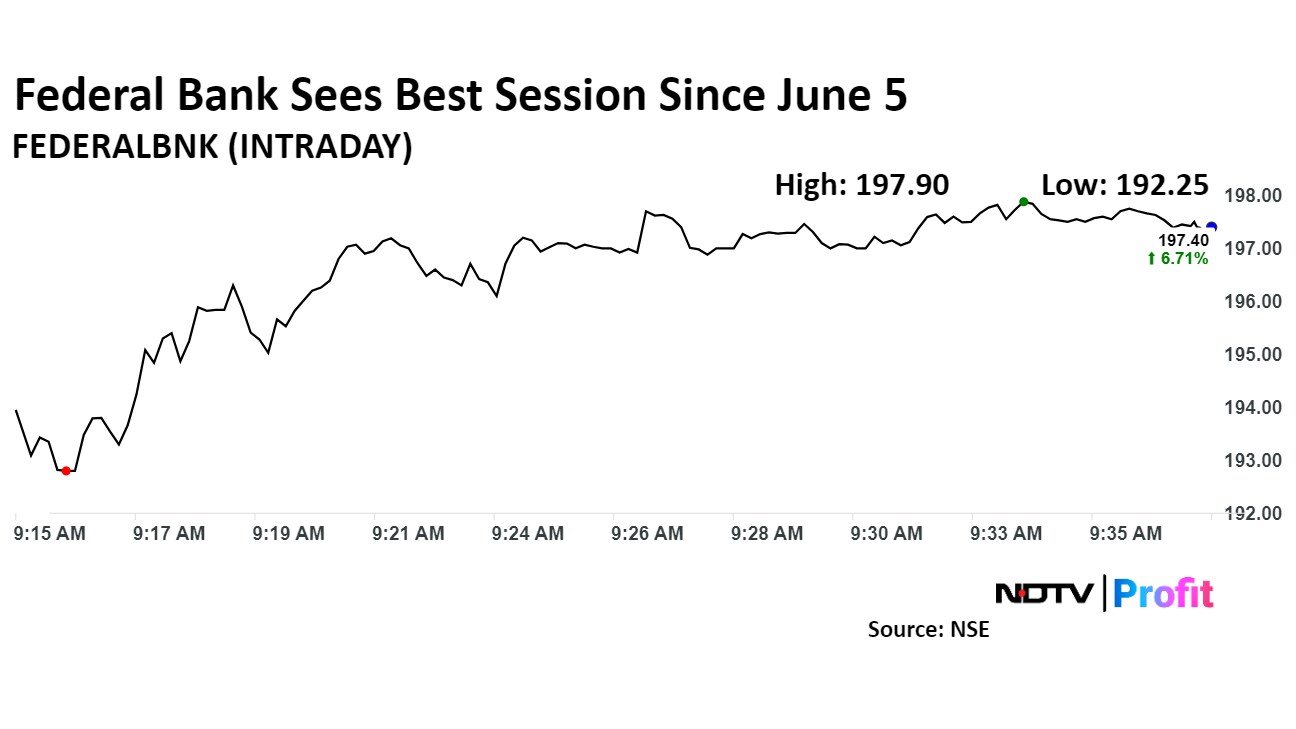

Federal Bank Ltd.'s share price surged over 6% on Tuesday—the best session since June 5—after the lender reported a 11% increase in the net profit to Rs 1,057 crore for the September quarter.

The total income increased to Rs 7,541 crore during the quarter under review against Rs 6,186 crore in the same quarter last year, Federal Bank said in a regulatory filing. The bank reported an interest income of Rs 6,577 crore during the quarter, higher than Rs 5,455 crore in the same period a year earlier.

The bank witnessed improvement with gross non-performing assets declining to 2.09% of the gross loans by the end of September 2024 from 2.26% a year ago. Net NPAs moderated to 0.57% from 0.64% at the end of the second quarter of the previous fiscal year.

In its second-quarter operational update, the lender's CASA ratio—the proportion of deposits that come from low-cost current and savings accounts—decreased by 110 basis points to 30.07% from 31.17% in the year-ago period.

A lower CASA ratio indicates that the bank relies on costlier wholesale funding, which can hurt its margin.

Citi Research maintained a 'buy' with a target price of Rs 231 per share, a 23% upside from the previous close. Citi said that a secured lending dominance helped curtail slippages and credit costs and noted that the asset quality remained intact.

The brokerage estimates about 1.2-1.3% return on assets and 13-14% return on equity over fiscal 2025-27 with a 15-17% credit growth.

Federal Bank's share price rose as much as 6.92% during the day to Rs 197.8 apiece on the NSE. It was trading 6.94% higher at Rs 197.4 apiece, compared to a 0.4% decline in the benchmark Nifty 50 as of 09:35 a.m.

It has risen 40% during the last 12 months and has advanced by 26% on a year-to-date basis. The total traded volume so far in the day stood at 14 times its 30-day average. The relative strength index was at 58.

Thirty-six out of the 42 analysts tracking the company have a 'buy' rating on the stock, five suggest a 'hold' and one has a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 15%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.