(Bloomberg) -- European equities were little changed as investors processed a steady stream of earnings and messaging from central bank officials keen to temper hopes of early interest-rate cuts.

The Stoxx 600 Index was 0.1% higher by 8:04 a.m. in London, with the food and beverage and auto sectors leading gains. Real estate stocks were the biggest laggards.

Among individual stocks, Orsted AS climbed after it said it will pause dividend payments until at least 2025 to help cut spiraling costs, while TotalEnergies SE slipped as it reported a drop in profit. Carlsberg AS rallied after it increased its long-term outlook. Barratt Developments Plc slumped after agreeing to buy rival Redrow Plc.

Investors continue to look for clues on when interest-rate cuts will start following recent pushback from central banks about too much optimism around policy easing. European Central Bank executive board member Isabel Schnabel said Wednesday that the latest economic data and aggressive market bets on rapid interest-rate cuts mean the ECB should be patient. Federal Reserve officials also made cautious remarks.

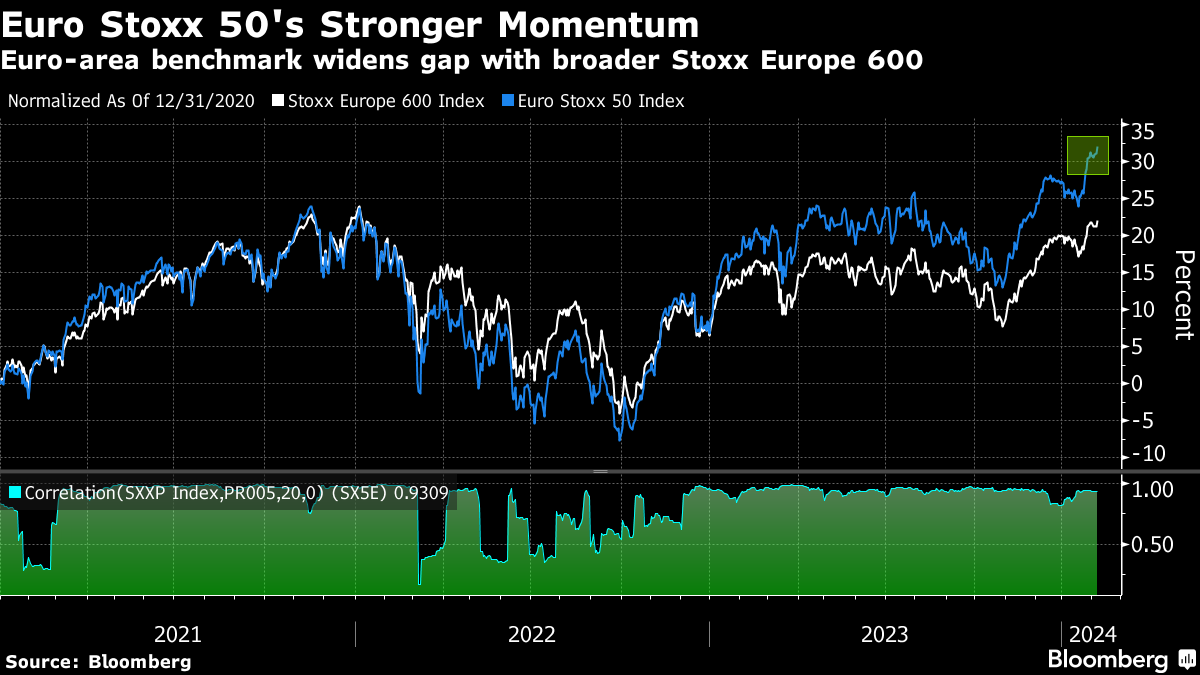

Stocks in the region are making a positive start of the year, building on the end-of-2023 rally. That's taken the main regional benchmark to about 1.4% from a fresh record high.

“The micro — with positive earnings for tech companies especially — is supporting equity markets against the message from central banks,” said Alfonso Benito, chief investment officer at Dunas Capital. “Markets are only wanting to focus on the positives. We remain very, very cautious on stocks as we see risks that aren't priced in.”

SECTORS TO WATCH

- European advertising stocks may be in focus after US peer Omnicom reported revenue for the fourth quarter that beat the average analyst estimate.

For more on equity markets:

- Europe's Market Also Has Big Concentration Factor: Taking Stock

- M&A Watch Europe: Barratt, Redrow, MorphoSys, Amundi, Holcim

- Athens Airport, Theon to Test European IPO Appetite: ECM Watch

- US Stock Futures Unchanged; Snap, Mercury Systems Fall

- BP, Buyback Plenty: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Michael Msika.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.

.jpg?im=FeatureCrop,algorithm=dnn,width=350)