Eicher Motors Ltd.'s share price jumped nearly 8% on Thursday as brokerages largely retained their optimistic view on the stock. However, they expressed caution that the Ebitda margin might come under pressure due to higher spend on marketing.

Analysts expect the higher spend in marketing and advertising will drive volume growth for the Royal Enfield maker. They expressed their view after Eicher Motors reported a record revenue during July–September.

Citi Research and Nuvama Institutional Equities retained their 'buy' rating on shares of Eicher Motors. Meanwhile, Emkay Global Research upgraded the stock rating to 'buy', and Nomura upgraded the rating to 'neutral'.

Eicher Motors Q2 FY25 Earnings Highlights (Consolidated, YoY)

Revenue up 3.6% at Rs 4,263 crore versus Rs 4,115 crore (Estimate Rs 4,414 crore).

Ebitda at Rs 1,088 crore versus Rs 1,088 crore (Estimate: Rs 1,158 crore).

Ebitda margins down 90 bps at 25.5% versus 26.4% (Estimate: 26.2%).

Net profit up 8.3% at Rs 1,100 crore versus Rs 1,016 crore (Estimate: Rs 1,086 crore).

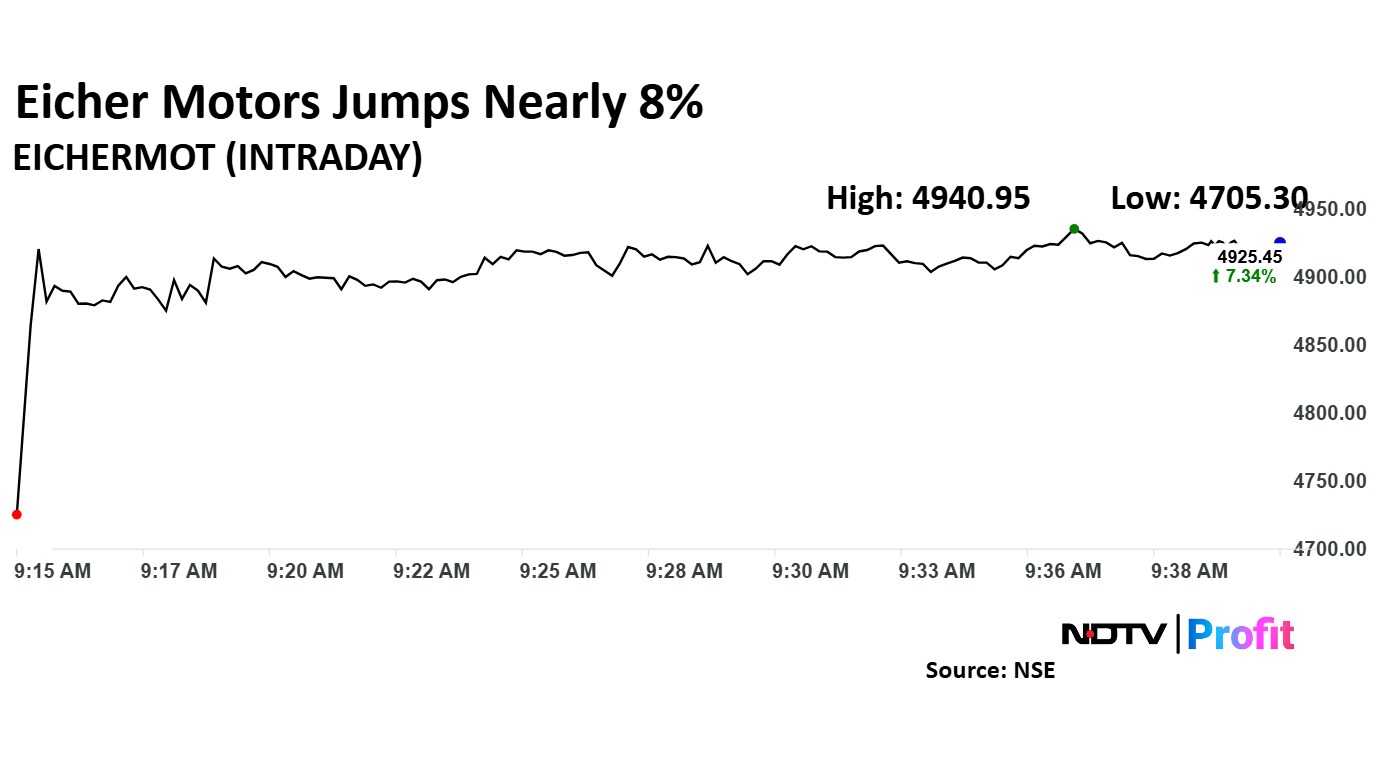

Eicher Motors Share Price Today

Eicher Motors Ltd.'s share price rose 7.68% to Rs 4,940.95 apiece, the highest level since Nov. 6. It was trading 7.05% higher at Rs 4,910.35 apiece as of 09:59 a.m., as compared to 0.16% advance in the NSE Nifty 50.

The stock gained 27.51% in 12 months, and 18.69% on year-to-date basis. Total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 55.57.

Out of 40 analysts tracking the company, 21 maintain a 'buy' rating, 10 recommend a 'hold' and nine suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 1.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.