Dr. Reddy's Laboratories Ltd. will underperform in the coming quarters due to its exposure to a vulnerable macro environment, according to brokerages.

The pharmaceutical giant has witnessed competition in its top products in the US, and therefore the impact of the pricing environment turning unfavorable may be higher, Citi said in a June 17 note. The brokerage has opened a downside 90-day catalyst watch on the company.

If the current trends hold, there is a possibility that even gRevlimid may not be able to mask the impact of weakness in the erosion of baseline product prices, the brokerage said.

Data from industry watcher IQVIA for the month of April–May 2024 suggests Dr. Reddy's losing market share in its top US products, Jefferies said in a note. This comes at a time when its fiscal 2025 launch pipeline for the US is weak, and its spend on research and development could remain elevated, it said.

Jefferies believes that the first half of fiscal 2025 results will reflect the impact of a market share loss, unless trends in June differ from previous months. "Our analysis of its launch pipeline suggests that new launches may be enough to offset the price erosion in the base business but not drive any meaningful growth for the company."

Citi has maintained its 'sell' call with a target price of Rs 5,200 per share, implying an downside of 14.5% from the previous close. Jefferies has reiterated its 'underperform' rating with a target price of Rs 5,010 apiece, a downside of 18%.

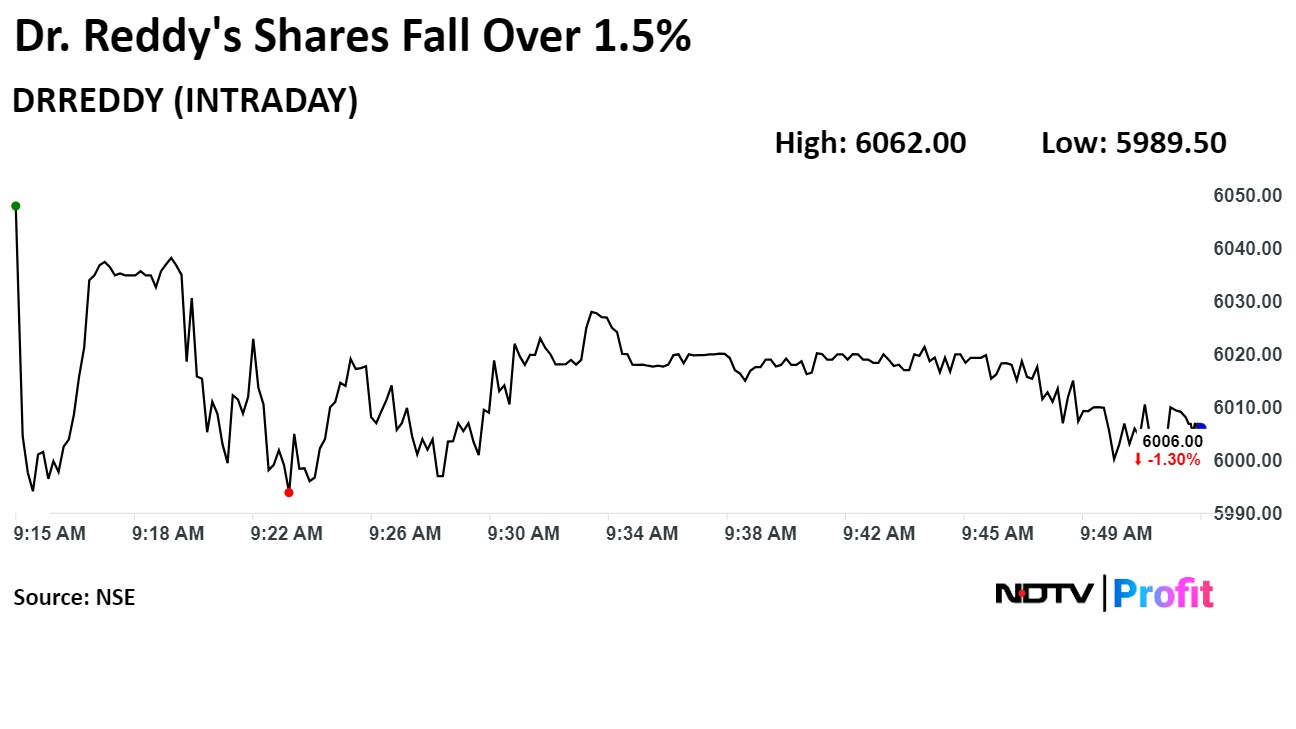

Shares of Dr Reddy's fell 1.57% to Rs 5,989.5 apiece on the NSE. It was trading 1.25% lower at Rs 6,009.3 apiece, compared to a 0.43% advance in the benchmark Nifty 50 as of 9:50 a.m.

The shares have risen 23.1% in the last 12 months and 3.6% on a year-to-date basis. The total traded volume so far in the day stood at 2.4 times its 30-day average. The relative strength index was at 51.

Fourteen out of the 39 analysts tracking the company have a 'buy' rating on the stock, 11 recommend a 'hold' and another 14 suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 2.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.