DOMS Industries Ltd.'s stock jumped over 4% on Tuesday to hit an all-time high after the company's net profit rose in the first quarter of fiscal 2025.

Net profit of the stationery and art materials manufacturer rose 49.5% year-on-year to Rs 54.3 crore in the quarter ended June 30, 2024. This compares to Rs 36.3 crore in the same period last year.

The company's consolidated revenue from operations was up 17.3% year-on-year at Rs 445 crore in Q1, against Rs 379.4 crore reported a year ago. Sequentially, the revenue from operations was up by over 10% from Rs 403.7 crore reported in the last quarter of FY24.

Doms Industries Q1 FY25 Highlights (Consolidated, YoY)

Net profit up by 49.5% at Rs 54.3 crore against Rs 36.3 crore.

Ebitda rose 17.3% to Rs 445 crore from Rs 379.4 crore.

Ebitda margin at 19.4% versus 16.4%.

Scholastic stationery remained the largest product category of the company contributing 43% to its revenue in Q1. It was followed by scholastic art material at 25%, and kits and combos at 8%.

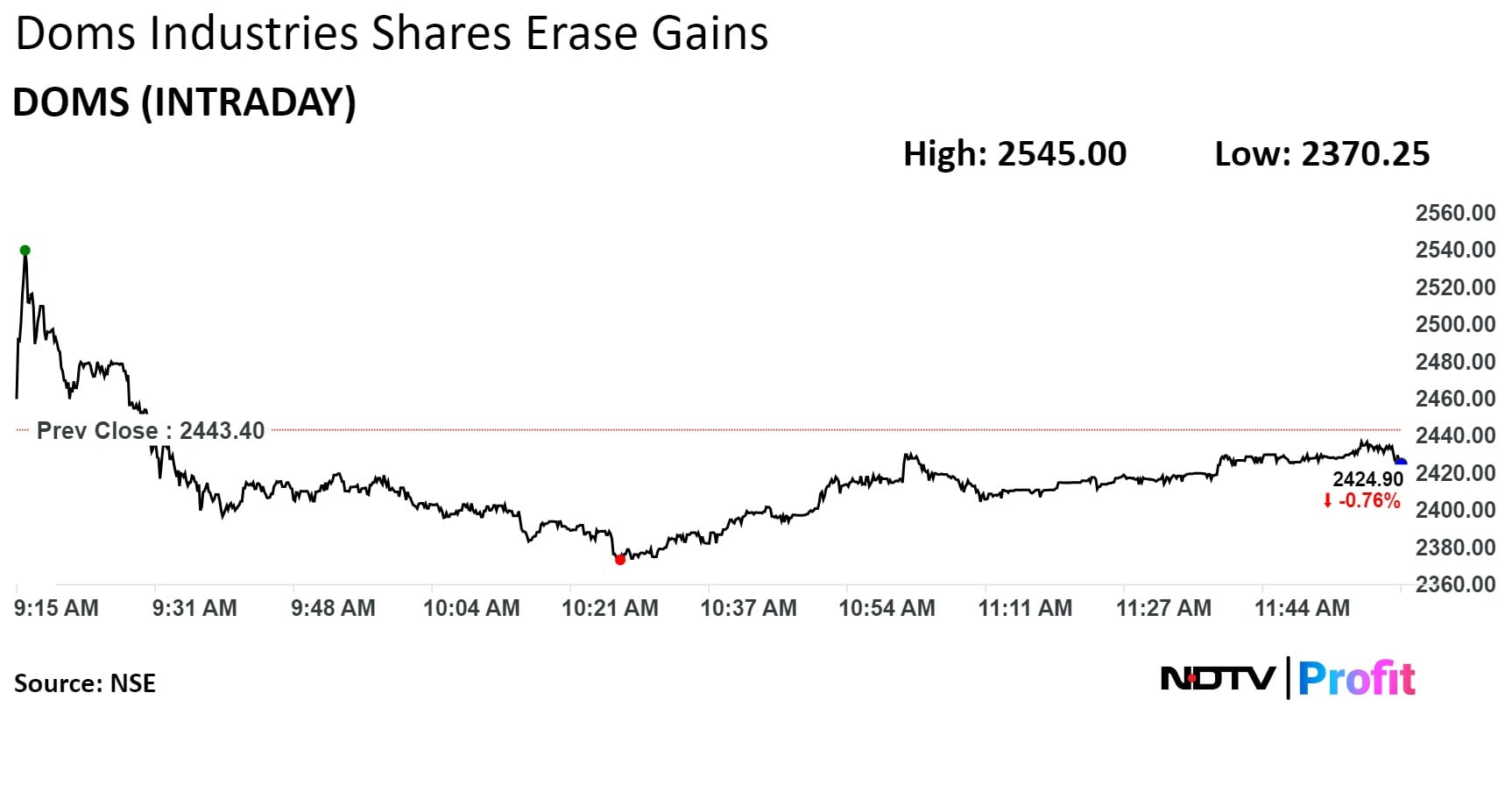

Doms Industries' stock rose as much as 4.16% during the day. It erased gains to trade 0.44% lower at Rs 2,433.1 apiece, compared to a 0.09% advance in the benchmark Nifty 50 as of 11:58 a.m.

It has risen 83% in the last 12 months and 94% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 62.

All six analysts tracking the company have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 14%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.