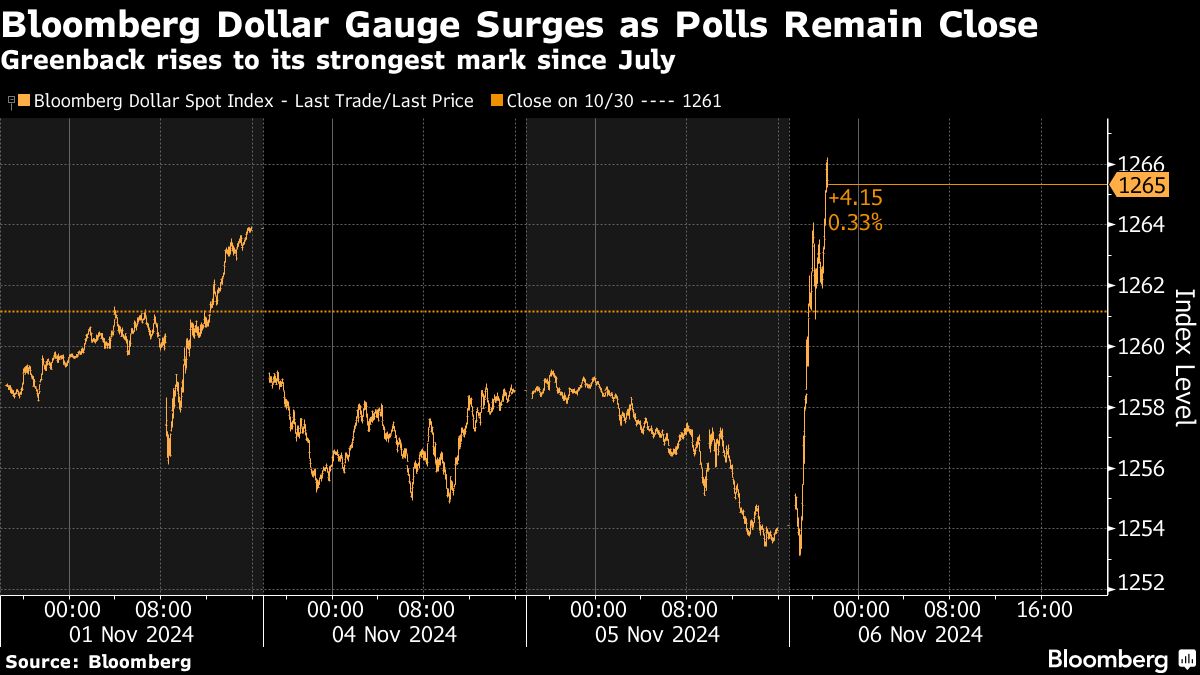

The dollar rose to its highest since July as early results of the US presidential vote indicated that Donald Trump had an edge in certain key states, boosting demand for trades that hinge on the former president's protectionist policy vows.

The Bloomberg Dollar Spot Index rallied more than 1% amid haven demand and as traders returned to wagers seen as benefiting from low-tax and high-tariff policies under a potential Trump administration. The Republican had taken preliminary leads against Vice President Kamala Harris in Georgia and North Carolina, two key swing states, while vote counting in others was in its early stages.

The surge in the greenback sent currency peers around the world sliding, with the euro weaker by more than 1%. The yen, Australian dollar and Swiss franc also fell more than 1%, while losses in the Mexican peso hit the 2% mark.

“Dollar strength on the back of Trump odds improving in the early vote count is really hitting the Mexican peso, euro and yen,” said Charu Chanana, chief investment strategist at Saxo Markets in Singapore. “Thin early Asia market liquidity and excitement from early results has amplified market moves of pricing in higher Trump odds.”

The close contest has elevated volatility in markets as traders tried to gauge the potential fallout of a victory by Trump, whose tariff and tax-cut plans would roil global trade and potentially fan inflation pressures in the US.

That drove hedge funds and other traders to prepare by plowing into so-called Trump trades for much of October, elevating the dollar and dragging down others like the Mexican peso, before Harris's strong showing in certain polls reversed some of that this week.

As of Oct. 29, hedge funds and other speculative traders positioned for a further rally in the greenback, also spurred by a demand for haven assets of the election outcome. These funds, asset managers and other speculators held some $17.8 billion in bullish dollar positions, according to Commodity Futures Trading Commission data compiled by Bloomberg.

(Updates with detail, comments, charts and prices.)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.