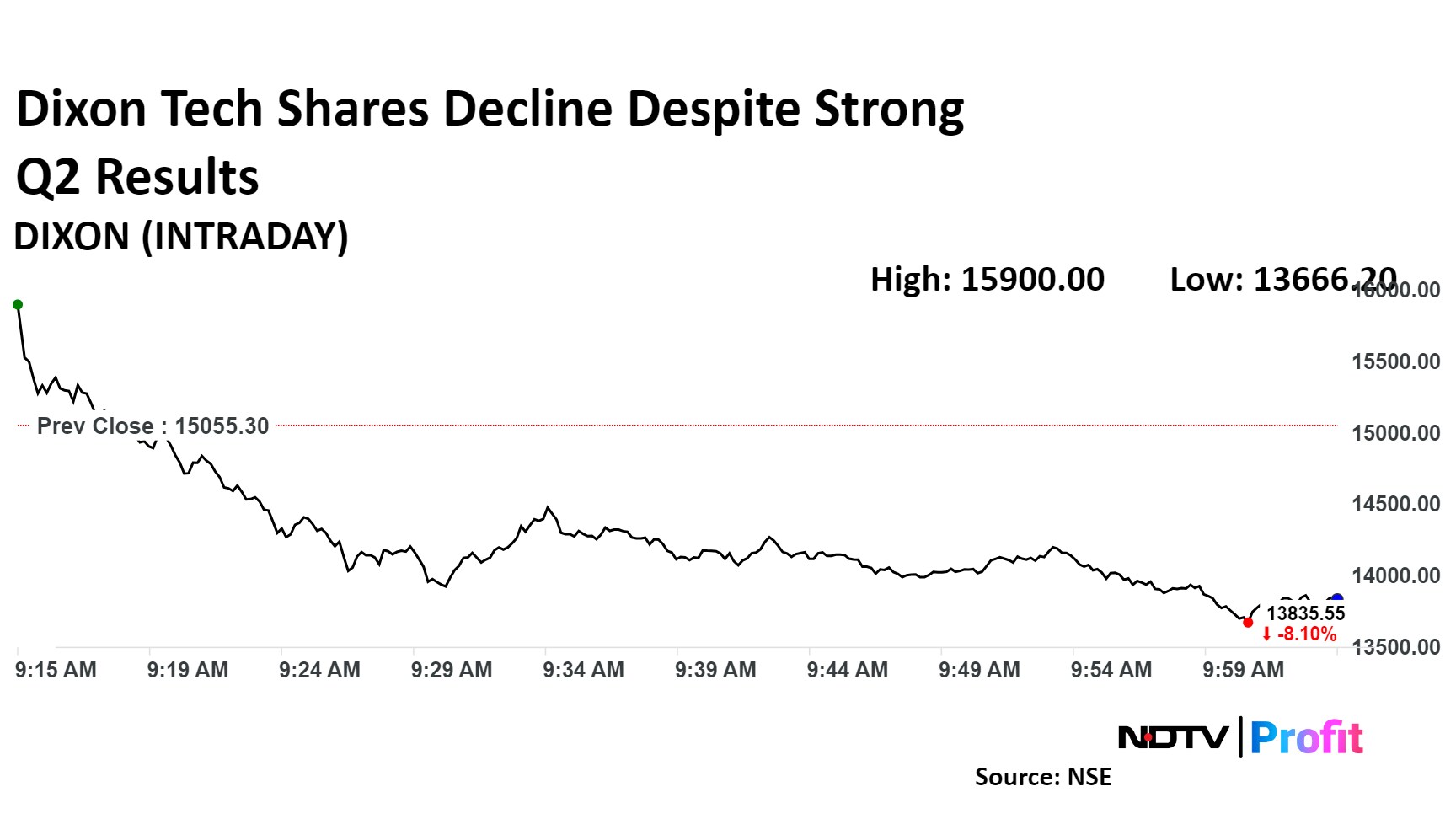

Dixon Technologies Ltd.'s share price declined over 9% in early trade on Friday despite impressive second quarter earnings.

Consolidated net profit in the quarter ended September jumped over 3.5 times, as per the financial results declared by the company on Thursday. Dixon Tech clocked a net profit of Rs 412 crore, which is 265% higher as compared to Rs 113 crore in the corresponding quarter of the previous fiscal.

The revenue from operations more than doubled to Rs 11,534 crore, as it accelerated by 133% as against Rs 4,943 crore in the year-ago quarter.

The earnings before interest, taxes, depreciation, and amortisation in the July-September period came in at Rs 426 crore, marking a jump of 114% from Rs 199 crore in the same quarter of the last fiscal. The Ebitda margin, however, declined to 3.7% from 4% in the year-ago period.

Chief Financial Officer Saurabh Gupta said Dixon Tech is sitting on a good balance sheet, while ramping up its client base of brands this year. He said the company is targeting to add mobile display manufacturing and non-semiconductor portion of mobiles capacities.

"Margins will be around 3.7-3.8%. We will see significant margin expansion with entry into components," he told NDTV Profit.

Analyst Views

Investec said IT hardware can be an attractive growth opportunity for Dixon and foray into components manufacturing can further improve competitive strength and earnings. It raised its three-year forward revenue estimates by 8-10%, and also hiked target price on the stock from Rs 12,700 to Rs 15,900.

Nomura expects Dixon Tech to be a key beneficiary of strong traction from its mobile customers and addition of new clients and produce 4.7 crore smartphones by fiscal 2027. The brokerage also raised its earnings projections, and maintained 'buy' rating on the stock with a target price of Rs 18,654.

Dixon Tech share price fell as much as 9.2% to Rs 13,666 apiece by 10:05 a.m.

Dixon Tech share price fell as much as 9.2% to Rs 13,666 apiece by 10:05 a.m., compared to a 0.5% decline in the benchmark Nifty 50.

The stock is up 110% on a year-to-date basis and by 152% over the past 12 months. The total traded volume stood at 12 times its 30-day average. The relative strength index was 55.

Out of 32 analysts tracking the company, 15 have a 'buy' rating on the stock, seven suggest a 'hold', and 10 recommend a 'sell'. The average of 12-month analysts' price target implies a potential downside of 3.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.