Dilip Buildcon Ltd., along with its consortium partner STL Tech, has been selected as the lowest bidder for a major broadband connectivity project under BharatNet Phase III initiative of the Bharat Sanchar Nigam Ltd., an exchange filing stated on Tuesday.

The project, valued at Rs 1,625.36 crore, will provide middle-mile and last-mile connectivity in the Jammu & Kashmir and Ladakh regions.

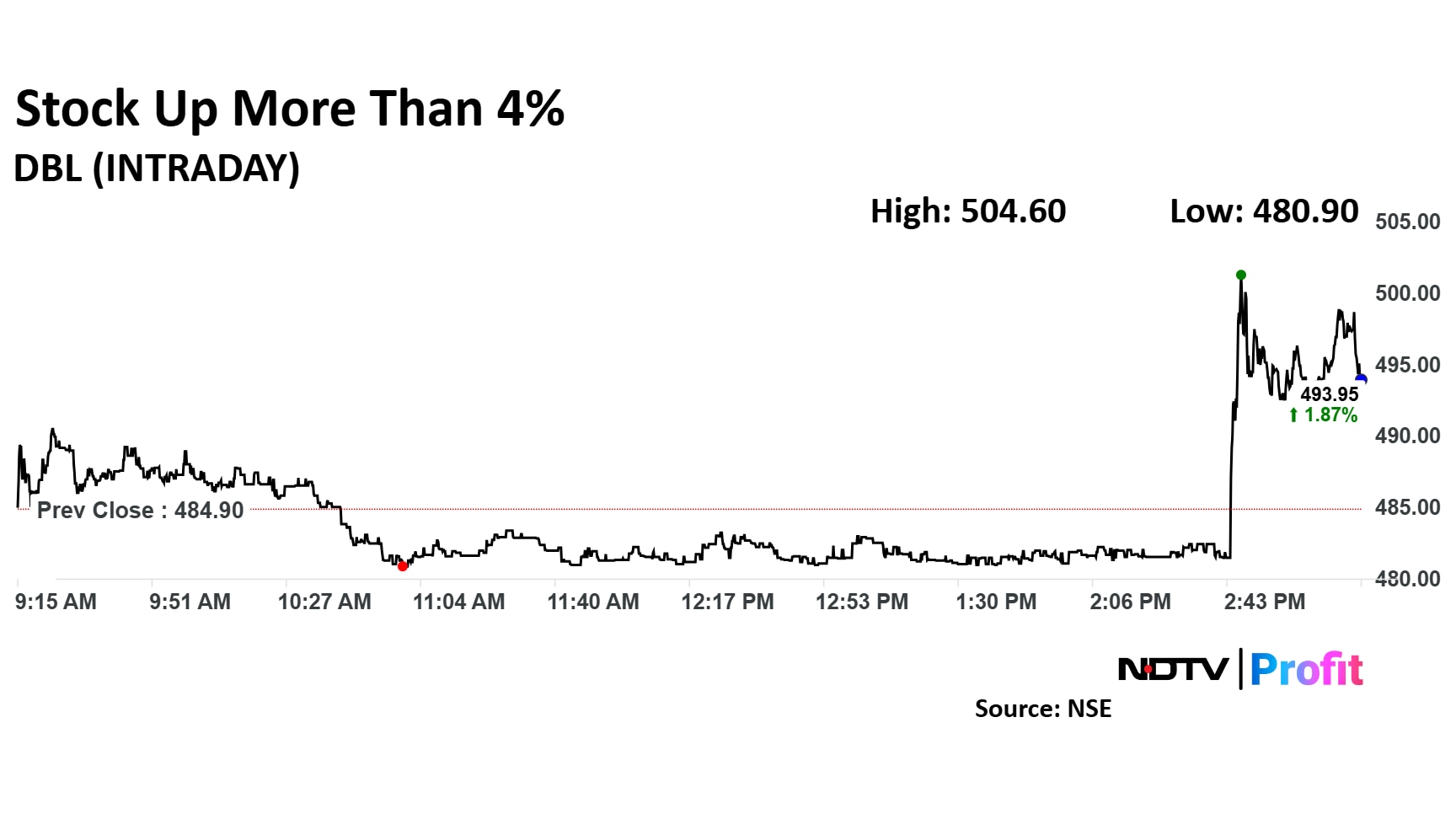

Dilip Buildcon's stock reacted positively to the development, jumping over 4% in the final hour of trading.

The BharatNet project, funded by the Universal Service Obligation Fund, aims to enhance broadband infrastructure across rural and remote areas of India. As part of the project, Dilip Buildcon will be responsible for 70.23% of the execution, focusing on the design, development, operation, and maintenance of the connectivity network.

The contract is structured under the design, build, operate, and maintain model, and spans a period of three years for construction and an additional 10 years for ongoing maintenance. The project will significantly improve internet access in the two regions, which have historically faced challenges in connectivity.

Dilip Buildcon's stock rose as much as 4.06% to Rs 504.6 apiece on the NSE, the highest level since Nov 8. However, it pared half of the gains to trade 2.01% higher at Rs 494.65 apiece, as of 03:14 p.m. This compares to a 1.12% decline in the benchmark Nifty 50 Index.

Shares of Dilip Buildcon have risen by 31.64% in the last 12 months. The stock's total traded volume on the NSE stood at 2.29 times its 30-day average so far in the day. The relative strength index was at 49.46.

Out of six analysts tracking the company, two maintain a 'buy' rating, three recommend a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average of 12-month consensus price target implies a potential upside of 14.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.