Shares of Devyani International Ltd. fell nearly 4% on Tuesday as investors booked profits after the company reported a profit in the first quarter of fiscal 2025. Citi maintained a 'buy' rating on the stock and raised its target price.

The leading quick service restaurant chain operator's revenue from operations rose 44.3% year-on-year to Rs 1,221.9 crore in the first quarter of fiscal 2025, compared to Rs 846.6 crore in the same period last year.

Devyani International reported net profit of Rs 22.43 crore marking a substantial turnaround from the loss of Rs 1.59 crore in Q1 FY24. The net profit also saw a significant QoQ growth, compared to a loss of Rs 48.95 crore in the previous quarter.

Citi raised the target price to Rs 215 per share from Rs 200 apiece, implying a nearly 19% upside from the previous closing price of the stock.

The company's revenue and Ebitda growth exceeded expectations, the brokerage said. The revenue grew by 44% year-on-year, which was 4% above Citi's estimates and 3% ahead of consensus forecasts.

Its Ebitda growth of 29% YoY surpassed Citi's projections by 8% and outperformed consensus estimates by 15%. This strong performance was partially driven by the company's recent acquisition in Thailand. However, profitability and margins were negatively affected by challenges in the Thailand business, the devaluation of the Nigerian currency, and negative same-store sales growth, Citi said.

In India, the performance remained subdued, with KFC and Pizza Hut reporting SSG declines of 7% and 8.6%, respectively, due to a persistent slowdown in discretionary spending. Despite this, average daily sales for KFC and Pizza Hut showed quarter-on-quarter improvement, rising by 11.8% and 12.5% due to seasonal factors, the brokerage observed.

Management remains optimistic, maintaining their store expansion plans and expecting uplift in demand and consumer sentiment during the upcoming festive season.

Citi made minor adjustments to its Ebitda estimates (1-2%) for FY25-27E.

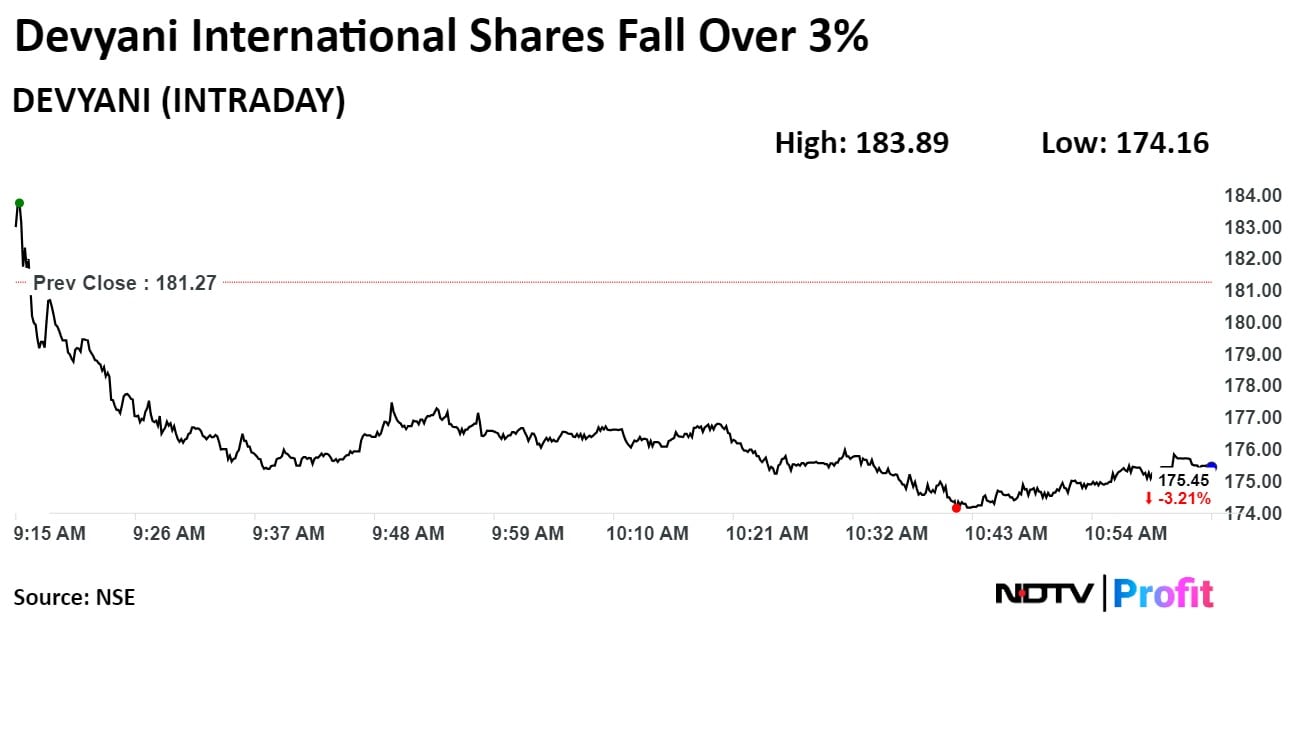

Stock Movement

Devyani International stock fell as much as 3.9% before paring some loss to trade 3.2% lower at Rs 175.4 apiece, compared to a 0.75% decline in the benchmark Nifty 50 as of 11:02 a.m.

The stock has declined 7.8% in the last 12 months and 9.3% year-to-date. Total traded volume so far in the day stood at 3.8 times its 30-day average. The relative strength index was at 52.

Sixteen out of the 24 analysts tracking the company have a 'buy' rating on the stock, three recommend a 'hold' and five suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 6.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.